Zcash (ZEC) Rockets Up 14%: Is Crucial Resistance Lurking Ahead?

- Zcash is currently trading around $408, marking a 14% jump.

- ZEC’s daily trading volume has surged by more than 88%.

The bearish wind across the crypto assets has resulted in a loss of momentum, and the prices have been in the red zone. The broader market sentiment still lingers in fear, with the value holding at 25. All the major assets have difficulty surviving in the bear’s grip, including BTC and ETH. Meanwhile, Zcash (ZEC) has secured a spot among the trending coins.

ZEC opened the day trading at a bottom level of $355.08, and with the bullish shift, the price has been sent to a high range of $423.28. The asset has broken the crucial resistance between $359.82 and $419.85 zones. At the time of writing, the asset has registered a jump of over 14.64%, and Zcash trades at around the $408.47 mark.

As the market cap is resting at $6.58 billion, the daily trading volume of ZEC has exploded by over 88.66%, reaching $1.38 billion. In addition, the Coinglass data has exhibited that the market has experienced an event of liquidation of $15.18 million worth of Zcash during the last 24 hours.

Green Signals for Zcash: Are the Bulls Warming Up?

The ZEC/USDT trading pair’s positive outlook might push the price up to test the crucial resistance at $428.47. With the prolonged bullish pressure, the golden cross could emerge, which would drive the price above $438.73. Upon a bearish reversal, the Zcash price could fall to the immediate support at $398.47. Further downside correction might initiate the death cross formation and push the asset’s price down below $388.19.

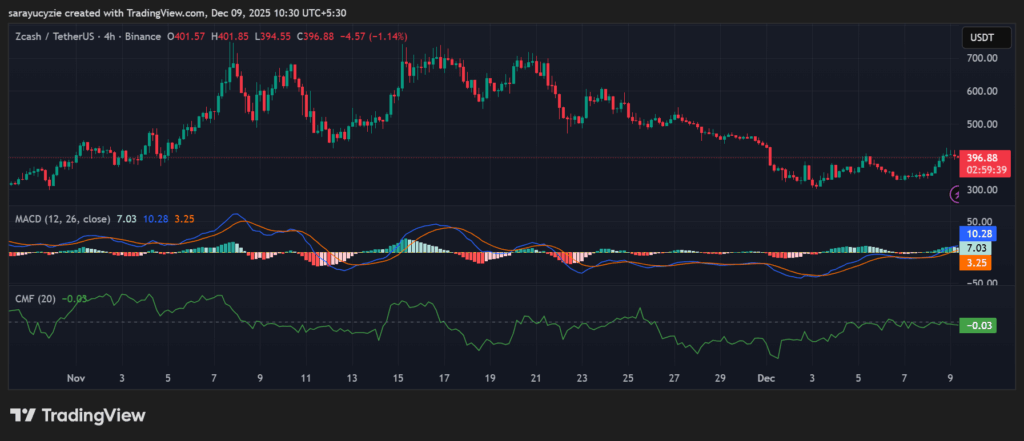

ZEC chart (Source: TradingView)

ZEC chart (Source: TradingView)

Besides, Zcash’s technical indicator analysis reports that the MACD line is above the signal line, indicating bullish momentum. The buying strength is increasing, and the asset may be gearing up for an upward move. ZEC’s CMF indicator found at -0.03 is slightly negative, close to zero, so momentum could shift either way. Notably, it suggests a mild selling pressure, not strongly bearish, and the money flows into the asset weakly.

The daily RSI of Zcash staying at 61.52 signals a significant bullish sentiment. The asset is not overbought, but it is in a healthy uptrend, and there is still enough room for more upward movement. Furthermore, the BBP reading settled at 35.11, implying a strong bullish dominance in the ZEC market. As the bulls have a solid advantage, the upward momentum is intact, and the price is holding above.

Top Updated Crypto News

Is the $124 Support Critical as Solana (SOL) Bulls Fight to Maintain Control?

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

OCC Findings Suggest Major U.S. Banks Restricted Access for Digital Asset Firms Amid Debanking Probe