New Bitcoin ETF Targets Overnight Returns Amid Record Outflows

TLDR

- Tidal Trust II files for Bitcoin ETFs targeting overnight market returns.

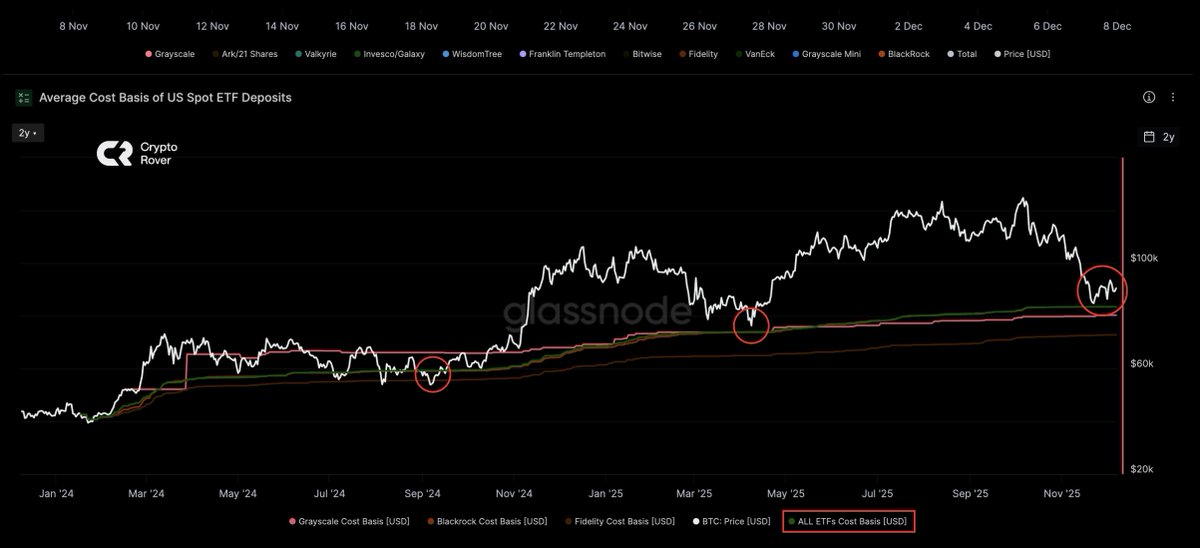

- Bitcoin ETFs saw a record $3.48 billion in outflows in November 2025.

- New ETF strategy focuses on Bitcoin futures and options during after-hours.

- Bitcoin price manipulation concerns coincide with ETF outflows and declines.

A new Bitcoin ETF proposal is targeting overnight market returns as outflows from existing Bitcoin ETFs reach record levels. With Bitcoin prices facing significant volatility and concerns over potential price manipulation during US trading hours, Tidal Trust II’s new strategy aims to capitalize on Bitcoin’s price movements after hours. This innovative approach focuses on Bitcoin futures and options to provide investors with exposure to the digital asset when US markets are closed.

Bitcoin ETF Proposal Targets After-Hours Market Activity

Tidal Trust II has filed a proposal with the US Securities and Exchange Commission (SEC) to launch a new Bitcoin exchange-traded fund (ETF). The fund aims to capitalize on Bitcoin’s price movements during the overnight trading hours when US markets are closed. The filing comes at a time when Bitcoin’s spot ETFs have faced significant pressure, leading to record outflows and concerns over market manipulation.

The new proposal includes two distinct funds: the Nicholas Bitcoin and Treasuries AfterDark ETF and the Nicholas Bitcoin Tail ETF. These funds will target Bitcoin’s returns during after-hours trading, utilizing Bitcoin futures, Bitcoin options, and Bitcoin ETFs or exchange-traded products (ETPs) listed in the US. Unlike traditional Bitcoin ETFs that directly hold the cryptocurrency, this proposal will focus on trading Bitcoin-linked financial instruments outside the US market’s regular trading hours.

Bitcoin Futures and Synthetic Positions

The After Dark ETF will not hold Bitcoin directly but will gain exposure to Bitcoin through futures, options, and ETFs. According to the registration documents, the fund will primarily trade Bitcoin futures and options during the overnight period when US markets are closed. These positions will be closed at the opening of the US market each day.

In the case of Bitcoin options, the fund aims to establish a synthetic long Bitcoin position as US markets close, which will typically be unwound before the next market open. This trading strategy targets Bitcoin’s price movements after the US market closes and is designed to take advantage of specific market trends observed during these hours.

The fund’s strategy also involves holding short-term US Treasury securities and cash equivalents during US trading hours. These investments will be made when Bitcoin-related positions are not active, ensuring liquidity and flexibility for the fund’s portfolio.

Record Outflows and Declining Bitcoin Prices

Bitcoin ETFs have faced considerable pressure in recent months. November 2025 saw record outflows from spot Bitcoin ETFs, with $3.48 billion in withdrawals. The largest portion of these outflows came from BlackRock’s iShares Bitcoin ETF, which accounted for $2.34 billion in withdrawals alone. The heavy outflows coincide with a sharp decline in Bitcoin’s price, which fell by 17.4% in November, marking its worst monthly performance of the year.

This sharp decline in Bitcoin prices has raised concerns about investor confidence, contributing to cautious sentiment in the broader digital asset market. As a result, Bitcoin ETFs have faced challenges, with additional outflows extending into December. Despite this, some signs of stabilization were noted, with Bitcoin ETFs seeing $151.74 million in inflows on December 9.

Concerns Over Market Manipulation

Industry analysts have raised concerns over potential price manipulation during the US market’s open hours. A recurring pattern of Bitcoin price drops around the market’s opening has led to speculation about price manipulation tactics. The new Bitcoin ETF proposal, with its focus on after-hours market movements, aims to sidestep these concerns and offer a more stable trading strategy.

While the proposal’s strategy targets long-term capital appreciation, it also responds to ongoing market dynamics, including the price fluctuations and outflows currently affecting Bitcoin ETFs. The AfterDark ETF may offer an alternative approach for investors looking for exposure to Bitcoin in a market that is experiencing volatility during regular US trading hours.

The post New Bitcoin ETF Targets Overnight Returns Amid Record Outflows appeared first on CoinCentral.

You May Also Like

Tether’s Cash Offer for Juventus Ownership Rejected by Exor

TROLL Price Prediction, Next Crypto To Explode