Bitcoin Price Aims For $99k as Fed Initiates 25 Bps Rate Cut Amid Onset of QE

The post Bitcoin Price Aims For $99k as Fed Initiates 25 Bps Rate Cut Amid Onset of QE appeared first on Coinpedia Fintech News

Bitcoin (BTC) price rallied above $94k after the Federal Reserve initiated a 25 bps rate cut on Wednesday, December 10, 2025. The flagship coin signaled midterm bullish sentiment after the Fed’s Chair Jerome Powell stated that the agency will begin injecting liquidity in the coming months.

According to the Fed’s statement, it will purchase $40 billion in short-term treasury securities for the next 30 days beginning on December 12, 2025. As such, capital flow is expected to favor Bitcoin as investors turn risk-on fueled by a supportive macroeconomic backdrop and clear regulatory frameworks.

Bitcoin Price Aims for $99k Amid Low Selling Pressures

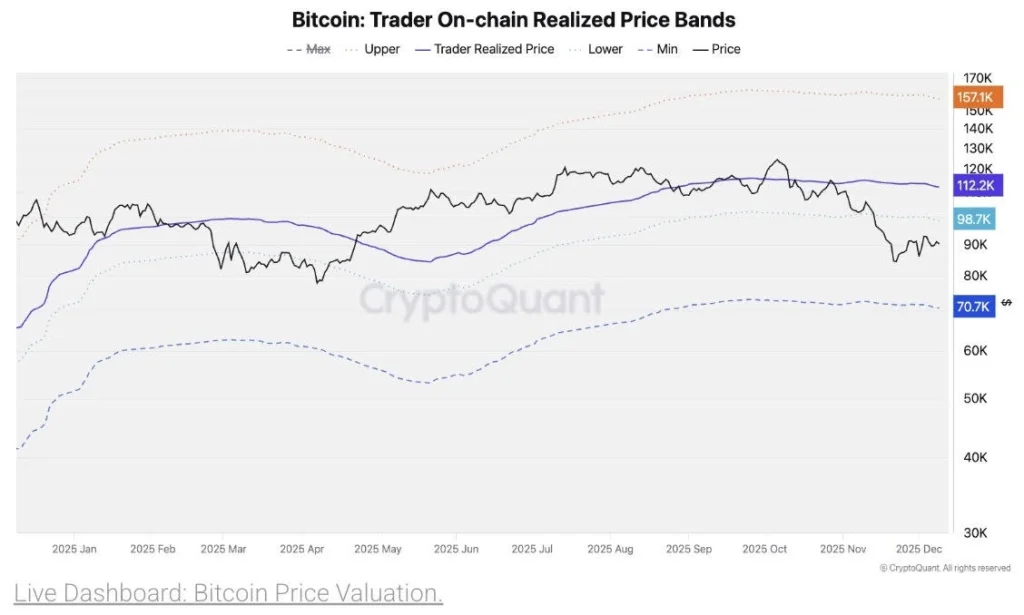

According to onchain data analysis from CryptoQuant, Bitcoin has experienced low selling pressure in the recent past. As such, CryptoQuant noted that the BTC price could climb towards $99k, which coincides with the lower band of the Trader Realized Price.

The $99k resistance level is also a major psychological pivot, where most retail traders are expected to turn bullish. On the upper side, CryptoQuant highlighted that Bitcoin price must consistently close above the resistance range between $102k and $112k to confirm its rally towards a new all-time high (ATH).

According to crypto analyst @PrecisionTrade3, the BTC/USD pair is well-positioned to rally above $100k soon based on the Elliott wave principle. The crypto analyst noted that the Bitcoin price has established a strong support level above $84k, thus signaling a renewed bullish momentum ahead.

Although macro-bearish supporters have argued that Bitcoin price may be trapped in a falling trend in 2026, Cathie Wood stated that the four-year crypto cycle has weakened due to significant institutional adoption.

You May Also Like

VivoPower Ripple deal opens South Korean investor access to $300 million in Ripple Labs shares

Will XRP Price Increase In September 2025?