Bitcoin Price Drops 2.5% Despite Federal Reserve’s 25bp Interest Rate Cut

The Bitcoin price tumbled 2.5% in the past 24 hours to trade at $90,185 as of 2:32 a.m. EST on trading volume that rose 9% to $58.3 billion.

This comes despite the US Federal Reserve announcing its third benchmark interest rate cut this year. It sliced 25 basis points (0.25%) off its federal funds rate as Fed Chair Jay Powell forecast one more cut in 2026.

After the announcement, Bitcoin attempted a short-term rebound to around $94,000, but was pushed back. Prices later recovered somewhat, but volatility widened, and the $90,000 level did not hold.

Fed Chair Jerome Powell reaffirmed the Fed’s price stability goal but maintained a cautious stance on further easing. The market reacted positively to the rate cut itself, but it was not enough to trigger a strong rotation into risk assets.

Bitcoin Price On A Consolidation Phase, Poised For A Breakout

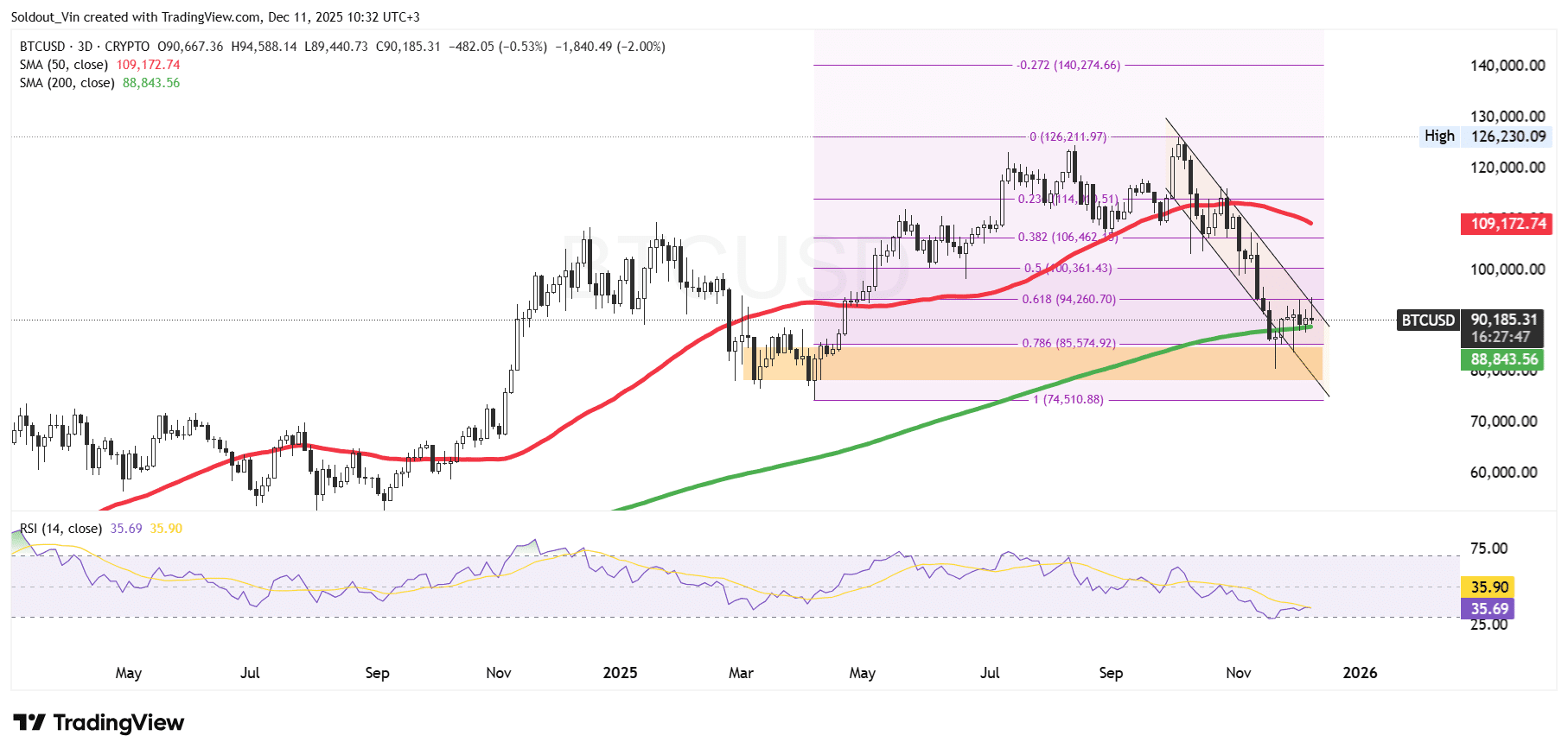

After plunging slightly to the $75,000 support level in April, the BTC price recovered to an all-time high (ATH) of around $126,230, according to the TradingView 3-day chart.

This dramatic surge allowed sellers to book profits, pushing the Bitcoin price back into a falling channel pattern and overcoming key support levels on the Fibonacci Retracement chart.

With the drop, the price of BTC crossed below both the 50-day and 200-day Simple Moving Averages (SMAs), further cementing the overall bearish stance.

However, support around $82,000 allowed the Bitcoin price to stage a recovery attempt. Still, it has since been capped below the $94,000 resistance, leaving BTC to hover in a sideways pattern between the 0.786 and 0.618 Fib levels, $85,574 and $94,260, respectively.

BTC is currently trading at the upper boundary of the falling channel pattern, attempting a breakout above it, as the price has recently crossed above the 200-day SMA ($88,843).

Meanwhile, the Relative Strength Index (RSI) seems to be consolidating within the $34 zone, currently at 35, which suggests a recovery, but buyers are still encountering some resistance.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Price Prediction

Based on the current chart structure, the BTC price appears to be stabilising near the confluence of the 200-day SMA and the 0.786 -0.618 Fibonacci retracement zone, which often acts as a final support region during deeper corrections.

If the Bitcoin price holds above this area and breaks out of the falling channel pattern, a relief rally toward the mid-Fibonacci levels, around $94,000–$100,000, becomes probable. A stronger breakout could then target the 0.382 and 0.236 retracements near $106,000–$114,000.

However, if BTC loses the 200-day SMA and closes below the highlighted support box, momentum could shift toward a retest of the deeper Fibonacci extension around $74,500, which represents the full retracement from the prior swing.

Michaël van de Poppe, the founder of MN Fund and a popular market analyst with over 815k followers on X, says that if BTC holds around the $91,800 level, the next key resistance will be the $100,000 zone.

Overall, the price of BTC is at a critical juncture, with the future price direction hinging on whether this support cluster holds.

Related News:

You May Also Like

Pepe Could 30x Again, But Ozak AI Prediction Dominates Analyst Reports for 2025

Nexo Agrees to Buy Argentina’s Buenbit to Expand Crypto Services Across Latin America

Copy linkX (Twitter)LinkedInFacebookEmail