Australia’s Securities Regulator Eases Crackdown On Stablecoins

ASIC eases rules for stablecoin and wrapped token distribution, removing extra licensing and allowing omnibus accounts for cheaper operations.

Australia’s securities regulator (ASIC) has released new rules that are expected to improve how companies handle stablecoins and wrapped tokens.

ASIC said the decision creates a simpler path for businesses that work with secondary distribution.

The previous rules slowed activity across the sector, and many operators argued that costs rose too quickly while compliance demands blocked new products.

In other words, the latest announcement gives firms room to grow while still keeping user protections intact.

Why ASIC removed separate licensing requirements

ASIC said that intermediaries no longer need separate Australian Financial Services licenses for these products.

The change applies to companies that help distribute stablecoins or wrapped tokens on secondary markets. ASIC explained that the old rules overlapped with existing licenses.

That overlap created delays and frequent costs for operators.

Australia introduces new stablecoin and wrapped token rules.

The new update reduces those barriers. Companies can now add services or support new tokens without going through long approval periods each time.

ASIC noted that this move is part of its plan to guide the sector with clearer rules.

Omnibus accounts now allowed for stablecoin services

ASIC approved the use of omnibus accounts if intermediaries maintain accurate records.

For context, these accounts let companies group customer holdings in a single structure. That design reduces operating costs because firms no longer need individual accounts for each customer.

It also increases the speed of transfers and settlement.

ASIC noted that omnibus accounts are common across global markets. The structure also supports better cybersecurity practices and improved risk management in many cases.

Companies can now manage reserves more efficiently and can also process transfers much faster, without having to build new systems from scratch.

Stablecoin demand rises worldwide

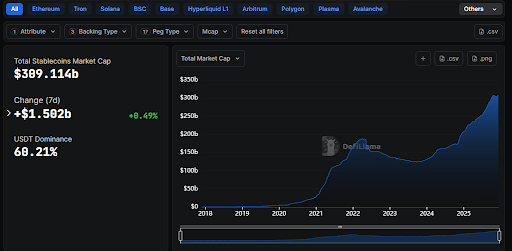

Total global stablecoin supply has passed $300 billion. Data from sources like DefiLlama show that the market has grown by 48% since the start of the year.

There has been massive growth in the stablecoin market so far | source: DefiLlama

There has been massive growth in the stablecoin market so far | source: DefiLlama

Tether continues to be the largest issuer with more than 60% of the market. The continued rise shows that stablecoins now serve a rising number of payment, trading and settlement needs.

Australia’s update arrives at a time when many governments are tightening or clarifying rules. Companies that issue stablecoins now need strong oversight, clear reserve structures and transparent reporting.

ASIC said the new exemptions fit within that goal. It added that the rules have been put in place to support responsible growth while protecting customer funds.

Related Reading: Australia Moves to Require Licenses for Crypto Platforms

How the new bill expands oversight of crypto companies

Australia recently introduced the Corporations Amendment Digital Assets Framework Bill.

The bill sets new standards for digital asset platforms and custody providers and requires platforms that hold customer crypto to obtain an Australian Financial Services License.

ASIC will also oversee these platforms once the bill passes.

The proposal is moving through Parliament now, and includes two new license classes. One applies to digital asset platforms, while the other applies to tokenized custody platforms.

Lawmakers said the move could create billions of dollars in productivity gains each year.

Supporters say this improves trust. They also believe it encourages larger firms to join the sector, and ASIC said these changes link directly to the exemptions for stablecoins.

Together, they combine to form a more complete and modern structure for the country.

The post Australia’s Securities Regulator Eases Crackdown On Stablecoins appeared first on Live Bitcoin News.

You May Also Like

Wormhole Unleashes W 2.0 Tokenomics for a Connected Blockchain Future

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings