Solana Spot Trading Now Live on dYdX Opening Access For U.S. Traders

TLDR

- dYdX has launched Solana spot trading, offering U.S. traders a decentralized experience.

- Solana spot trading on dYdX is free of fees for December 2025, excluding third-party charges.

- The move expands dYdX’s offerings to include Solana alongside perpetuals in a unified interface.

- U.S. traders can now interact with dYdX’s decentralized platform for Solana asset trading.

dYdX has officially launched Solana spot trading, opening up a new opportunity for U.S. traders to engage with decentralized markets. This move not only introduces spot trading alongside perpetual contracts but also provides a zero-fee incentive for December 2025. U.S. traders can now access Solana assets directly, marking a significant shift for the platform and expanding its offerings to a new audience.

Solana Spot Trading Now Live on dYdX

In a major development, dYdX has officially launched Solana spot trading. This new offering enables traders to buy and sell Solana (SOL) native assets directly on the platform, marking a significant expansion for the decentralized exchange (DEX). The feature is available through the dYdX web interface, alongside existing perpetual contracts.

The launch signifies the first-ever opportunity for traders to engage with Solana spot markets in this decentralized manner. This new feature is part of dYdX’s larger initiative to enhance its product offerings, which are traditionally centered around perpetual contracts.

U.S. Traders Gain Access to Solana Spot Trading

For the first time, U.S.-based traders can use dYdX’s platform to trade Solana assets directly. This move marks a major step in expanding the exchange’s reach within the United States. Prior to this launch, U.S. traders were only able to access dYdX’s perpetual contracts.

Eddie Zhang, President of dYdX Labs, commented on the milestone, saying, “We’re excited to bring dYdX to the United States and provide American traders with access to institutional-grade decentralized trading infrastructure.” He added that the expansion is in response to the evolving regulatory landscape and aims to deliver deep liquidity, advanced tools, and transparency to U.S. users.

However, while spot trading is now available for U.S. users, perpetual trading remains unavailable due to ongoing regulatory discussions with the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

Zero Fees for Solana Spot Trading in December

As part of the pilot rollout, dYdX is offering zero fees on Solana spot trading during December 2025. This temporary offer is aimed at attracting users to the platform while the new feature is in its early stages. It should be noted, however, that third-party fees may still apply, such as charges from Solana’s network or liquidity providers.

Looking ahead, dYdX plans to introduce additional features, including advanced order types like limit orders, stop-loss, and take-profit options. These updates will provide more flexibility and control for traders as they engage with the Solana spot markets.

Future Expansion and Community Governance

Solana spot trading is expected to become a core offering on dYdX, with the potential for further improvements and new tools. The platform is also focused on expanding its community governance, which plays a key role in shaping its development. The introduction of Solana trading was made possible through the dYdX community’s input and decisions.

Moreover, dYdX plans to enhance its mobile experience and introduce social trading features. This will include tools for following other traders, monitoring performance, and even copying successful strategies, providing a more social and interactive trading environment.

The post Solana Spot Trading Now Live on dYdX Opening Access For U.S. Traders appeared first on CoinCentral.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

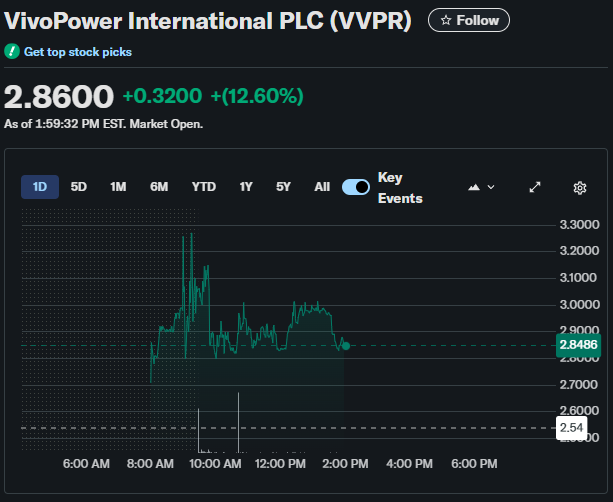

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally