Shiba Inu Coin rebound looms as whales suddenly buy amid reserves drain

Shiba Inu Coin price has been in a freefall this year as demand for meme coins waned. This rebound could be about to end as key fundamentals and technicals align.

- Shiba Inu Coin price has dropped and is now in a technical bear market.

- Whales have started buying SHIB as the supply in exchanges has tumbled.

- Technical analysis suggests that the token has more upside in the near term.

Shiba Inu (SHIB) token was trading at $0.00000841 today, Dec. 12, a few points above the year-to-date low of $0.00000753. It remains ~75% below its highest point in November last year.

Shiba Inu Coin fundamentals are improving

Shiba Inu token has dropped this year as demand for meme coins has waned, with the market capitalization of all these tokens falling to $46 billion from the year-to-date high of nearly $100 billion.

There are signs that Shiba Inu’s fundamentals are improving, which might lead to more upside in the near term.

One fundamental is that token burn has rebounded in recent days. The daily rate rose by 170% on Friday, bringing the total token burns since inception to over 410.75 billion.

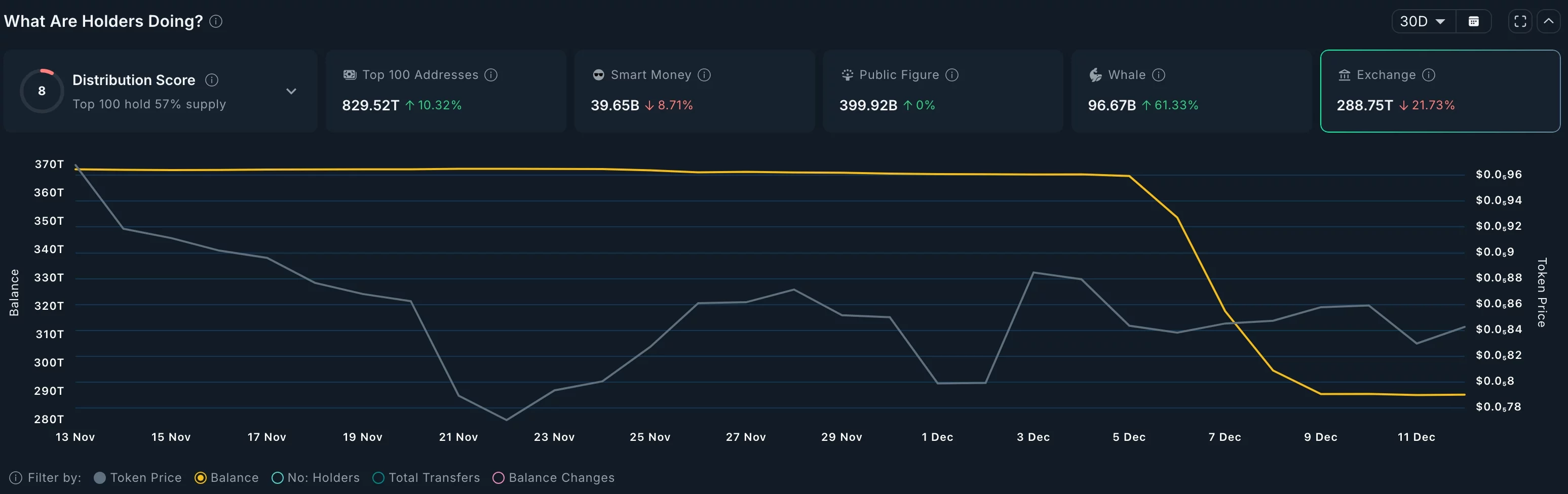

Additional data indicate that the supply of SHIB tokens on exchanges has declined sharply. Its supply dropped to 288.75 trillion today, down from this month’s high of 366.1 trillion. A decline in exchange supply indicates increased demand for the token.

This demand is coming from whales, who have suddenly started buying. These investors now hold 96.67 billion tokens, up from this week’s low of 1.36 billion.

Therefore, a combination of falling exchange supply, whale and smart money buying, and burn rate means that the token may rebound soon.

SHIB price technical analysis

Technicals suggest that Shiba Inu Coin price bottomed at $0.0000075 in November and then rebounded to the current $0.0000084.

A closer look shows that the token has formed a falling wedge pattern and is slightly below the upper side. It has also formed a small inverted head-and-shoulders pattern, another highly bullish chart pattern.

Therefore, the Shiba Inu price will likely rebound, potentially to the significant resistance level at $0.000010, approximately 20% above the current level. This view will be confirmed if it moves above the 50-day moving average and the upper side of the descending wedge.

You May Also Like

Tether’s Cash Offer for Juventus Ownership Rejected by Exor

TROLL Price Prediction, Next Crypto To Explode