Bitcoin Price Bleeds Below $89,000 After Grim Weekend

Bitcoin Magazine

Bitcoin Price Bleeds Below $89,000 After Grim Weekend

Bitcoin price endured another grim weekend, bleeding from the low-$92,000 range on Thursday to weekend lows near $87,000 as thin liquidity and sell pressure weighed on risk appetite.

The move below $90,000 came during typically illiquid Sunday trading, amplifying downside volatility as traders positioned cautiously ahead of a dense slate of U.S. economic data and central bank events this week.

At the lows, the bitcoin price was down roughly 7% on the month, continuing a choppy consolidation that has defined price action since October’s all-time high, per Bitcoin Magazine Pro data.

Broader crypto markets showed little sign of strength.

Major altcoins including Solana, XRP, Dogecoin and Cardano continued to slide, extending double-digit monthly losses and reinforcing bitcoin’s dominance near 57% of total crypto market capitalization. Volumes remained muted, reflecting a lack of conviction rather than outright capitulation.

Macro overhangs remain front and center. In the U.S., traders are bracing for employment data, inflation prints, PMI readings and Fed commentary that could reshape rate expectations.

Globally, attention is turning to Japan, where the Bank of Japan is widely expected to raise rates later this week — an event that could pressure yen-funded carry trades that have helped support risk assets, including bitcoin, over the past year.

Technically, analysts are watching the mid-$80,000s closely. A sustained break below that zone could invite a deeper correction, while holding it would reinforce the idea that the bitcoin price remains range-bound rather than entering a new bear phase.

How low will the Bitcoin price go?

Despite the uneasy backdrop, some of the loudest bearish calls are running far ahead of the data. Bloomberg Intelligence strategist Mike McGlone warned this week that the bitcoin price could collapse as much as 90% from its peak, potentially revisiting $10,000 in a future deflationary downturn.

The forecast echoes prior bearish calls and comes as leveraged long positions continue to unwind, with roughly $230 million in bitcoin longs liquidated over the past 24 hours.

On-chain data, however, tells a far more nuanced story.

Bitcoin Magazine Pro’s Price Forecast Tools — built on network fundamentals rather than sentiment — suggest the market is trading below fair value, not on the brink of structural collapse.

Aggregated indicators such as CVDD, Balanced Price and the Bitcoin Cycle Master currently point to a fair market value near $106,000, with long-term downside risk clustering closer to the $80,000 range rather than anywhere near five figures.

Historically, these metrics have aligned closely with cycle tops and bottoms, offering a framework that cuts through short-term noise.

While macro conditions will continue to dictate volatility, on-chain signals suggest the current drawdown looks more like late-cycle consolidation than the start of a generational unwind.

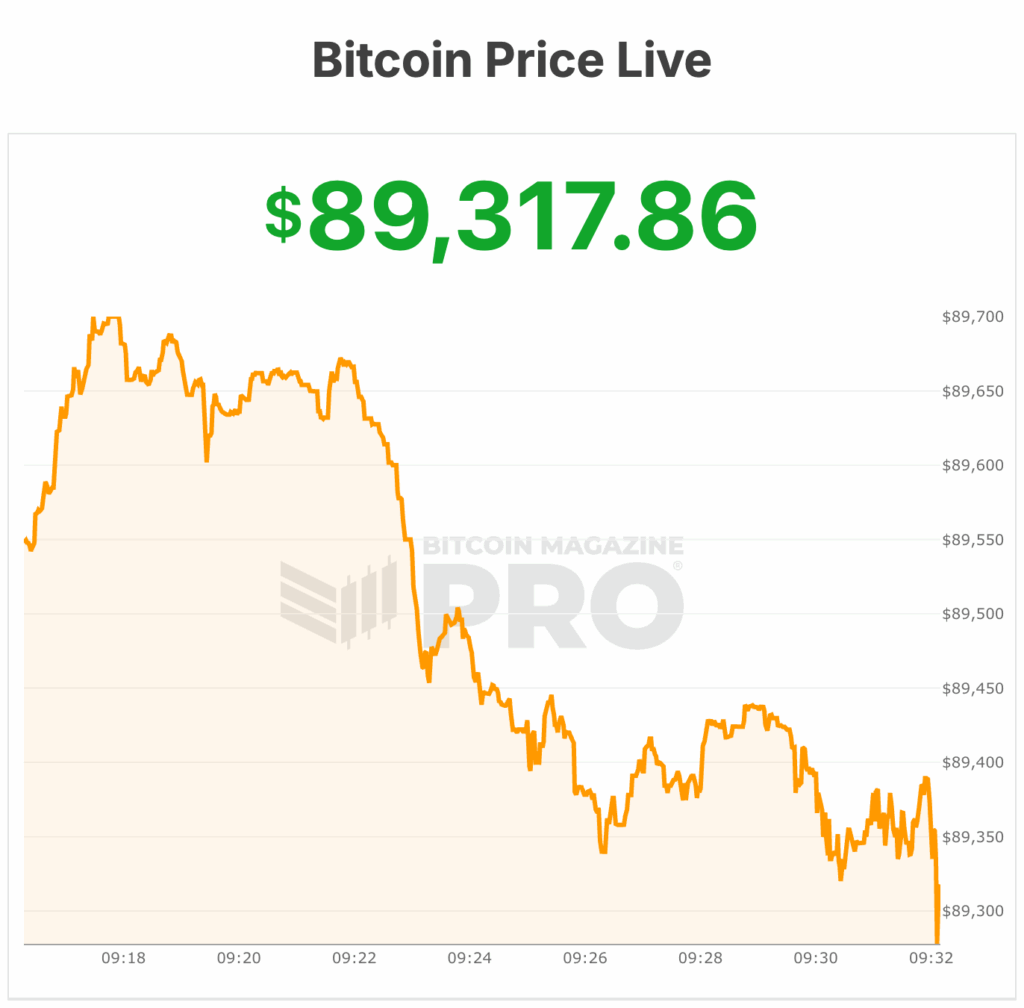

At the time of writing, the bitcoin price is $89,317.

This post Bitcoin Price Bleeds Below $89,000 After Grim Weekend first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

CME Group to Launch Solana and XRP Futures Options