Here’s why the crypto market is at a standstill as tech stocks take flight

The crypto market has remained mostly stagnant as Amazon, Meta and Nvidia reach record-highs on the market over the previous weekend. Here’s why.

In a miraculous turn-around, investors seemed to have regained a sense of new-found confidence as they flock back to the major tech stocks. In fact, the technology-heavy Nasdaq was able to bounce back by 32% from its previous slump in April after it was hit hard by the blanket tariffs which led to a 21% drop.

On the other hand, S&P 500 saw a 23% surge in the second half of the year. The U.S. blue-chip stock collective was able to beat out its European rival, Stoxx 600, which only rose around 8%. Analysts have attributed the breakthrough to tech stocks like Nvidia, Google, Amazon and more, which have historically powered other rallies in the past.

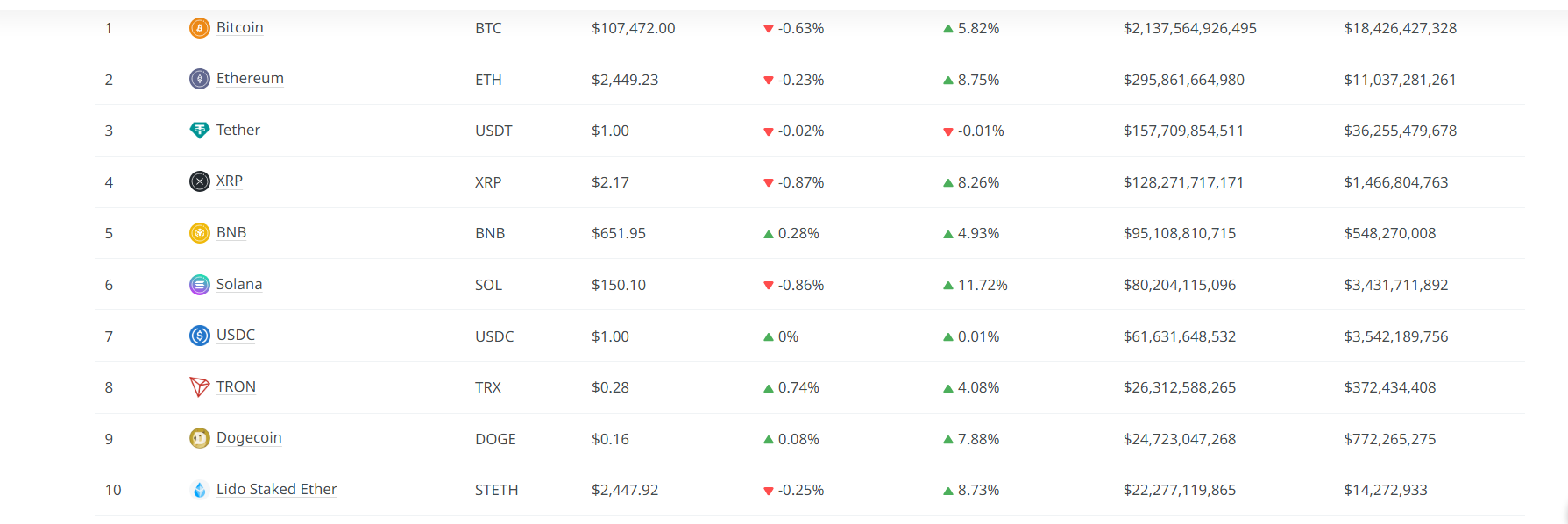

Despite the rise in stocks, the crypto market has remained relatively stagnant amidst rising tech stocks. As of June 30, the crypto market cap fell by 1.6% to only $3.4 trillion in the past 24 hours. Major tokens like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP (XRP) have also seen more zeroes than anything else.

Bitcoin in particularly has stayed mostly stagnant in the past 24 hours, only seeing a dip 0.63% as it stayed within the $107,000 range. On the other hand XRP and Solana have both experienced 0.8% drops as Ethereum plummets by 0.23%. Although the overall board does not look particularly worse for wear, traders expected higher gains that reflect the tech stocks rally.

Tech and crypto stocks reach record highs

Most of the tech stocks listed under the umbrella of “Magnificent Seven,” which refers to the top seven technology firms in the stock market, have reached major gains based on their performance during pre-market period and previous closing prices.

As previously reported by the Wall Street Journal, the S&P 500 and Nasdaq composite closed just below their respective all-time highs in an unexpected comeback fueled by tech stocks after the Fed declared markets may suffer from impacts of Trump’s tariffs.

Alphabet Inc., more widely known as Google, saw its price soar by 2.20% during intraday trading. This indicated a rise by 3.84 points to the internet giant’s stock. Amazon is not far behind, with a 2.85% gain adding to its current 223.30 share value. Meanwhile, it previously closed on the market with a meager 0.63% gain.

According to the Financial Times, Nvidia hit a record-high last week, becoming the main driver of the Wall Street AI rally. The same can be said about Peter Thiel’s Palantir which saw a surge of more than 50% in the second half of this year. Meta Platforms has also seen a 25.3% rise in the past six months.

Microsoft and Tesla saw a dip in their stocks in the past day of trading, falling by 0.30% and 0.61% respectively. Though that may be the case, Microsoft’s stock has risen by 17% in the past six months while Tesla has continued its downward trend, going down by 20%.

On the crypto side, Coinbase also enjoyed a 1.64% boost in the past 24 hours. According to the Financial Times, COIN’s value has doubled in the past weekend as investors flock to crypto-related stocks.

Moreover, Strategy or MSTR closed at 5.53, enjoying a brief 1.44% surge before dipping by 0.66% on June 30. MSTR has enjoyed a week-long rally thanks to its BTC accumulations strategy, seeing 5.83% gains in the past five days.

Why are tech stocks outperforming while the crypto market stays flat?

Analysts identified the main driver for the tech stock rally to be the advancement of AI technology and market clarity which has helped boost investor confidence in the sector. For instance, both Amazon and Meta announced significant investments in the AI sectors leading up to the rally.

Not only that, most of the tech sector giant have also been reporting strong second-quarter earnings. Both factors have led investors to inject more cash flow into the market, lifting share prices off the ground.

Meanwhile, the crypto market has seen a decline in trading volume. The daily trading volume has fallen by 43% compared to the previous day. Just a day prior, the daily trading volume for the overall crypto market reached $132.63 billion.

However, it has since fallen far on June 30, being able to reach only around $75 billion, shedding nearly $60 billion in just 24 hours.

On the other hand, Bitcoin’s price gains this month, which range from 0% to 2% at most, are relatively minimum compared to its ETFs. Bitcoin ETFs saw its third week of consecutive inflows, reaching $2.2 billion in net inflows. Although institutional demand for BTC has seen a major rise, retail investors seem to have pulled back from the race.

On the other hand, investors are still on a wait-and-see basis when it comes to crypto regulatory clarity. As a result, even though interest rates and inflation are easing, which pose a benefit to risk assets like tech, the regulatory ambiguity continues to constrain the crypto market’s full momentum.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

MYX Finance price surges again as funding rate points to a crash