Solana (SOL) Price Alert: Is a 50% Collapse on the Way?

Solana (SOL) witnessed substantial gains in late summer, but over the past several months, it has been in a steep decline.

According to some renowned analysts, the asset may experience a further collapse in the short term, with sub-$70 levels now in focus.

Brutal Crash on the Horizon?

The X user, Ali Martinez, observed SOL’s performance from March 2024 until now. He believes the price structure resembles a textbook “head and shoulders” pattern, with the head taking shape late last year when Solana reached $240.

Based on this formation, Martinez argued that the valuation could continue to sink to as low as $66.20, representing a 50% collapse from the current $132 mark.

“Head and shoulders” is a bearish pattern and forms when the price makes three peaks. The first is the left shoulder, the second is the head, and the third is the right shoulder. If the valuation breaks below a critical support level, known as “the neckline,” traders view it as a sign of further decline.

Martinez isn’t the only analyst envisioning bearish times for SOL. X user Crypto Tony suggested there might be a minor uptick to $134, followed by a plunge.

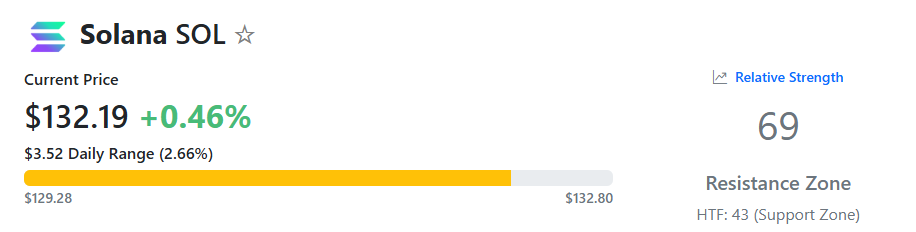

Meanwhile, SOL is nearing overbought territory, which indicates additional problems for the bulls. The asset’s Relative Strength Index (RSI) measures the speed and magnitude of the token’s recent price changes and ranges from 0 to 100. Anything above 70 is considered bearish territory, while readings below 30 could be interpreted as a buying opportunity. SOL’s current RSI stands at around 69.

SOL RSI, Source: RSI Hunter

SOL RSI, Source: RSI Hunter

The Bullish Scenario

Despite the downtrend and the pessimism coming from the aforementioned analysts, others think SOL could still stage a comeback. X user TraderSZ (who has almost 700,000 followers) predicted the price might surpass $160 in the following days, while James set a potential target of $152.

SOL’s recent exchange netflow supports the optimistic theories. Over the past several months, outflows have significantly exceeded inflows, meaning investors have switched from centralized platforms to self-custody methods. This is considered bullish since it reduced the immediate selling pressure. On the contrary, flocking to exchanges is typically seen as the move before a massive cash out.

SOL Exchange Netflow, Source: CoinGlass

SOL Exchange Netflow, Source: CoinGlass

The post Solana (SOL) Price Alert: Is a 50% Collapse on the Way? appeared first on CryptoPotato.

You May Also Like

XRP Price Prediction: Can Ripple Rally Past $2 Before the End of 2025?

BlackRock boosts AI and US equity exposure in $185 billion models