Cardano Founder Calls For Crypto ‘Reset’ Heading Into 2026

Cardano founder Charles Hoskinson wants crypto to stop acting like it’s permanently stuck in 2021 brain.

In a Dec. 15 livestream titled “Some End of Year Thoughts,” the IOG CEO delivered a blunt year-end diagnosis of a market that, in his telling, lost its retail engine, let politics turn into a sideshow, and drifted back into the easiest (and laziest) narrative in the business: find the next 10x, then dump it on someone else.

“This has been a really [expletive] up year for our industry as a whole,” Hoskinson said from Colorado, describing 2025 as “a donkey of a year” — “an old donkey with a gas problem.”

Cardano’s Hoskinson Warns Of Retail Exodus

His first big complaint was structural, not emotional. The Cardano founder argued that institutional capital did arrive, but much of it got “locked into the Bitcoin layer,” and didn’t rotate into altcoins the way prior cycles did. “So we lost our trickle down effect that we enjoyed in 2021 and in 2017,” he said, framing it as a market-mechanics issue as much as a sentiment one.

Then he pivoted to politics. Hoskinson described a messy set of expectations heading into 2025 — hopes of a more constructive US regulatory posture, then disappointment as crypto became entangled in headline-grabbing memes and what he characterized as erratic signaling. He pointed to the launch of TRUMP coin at the inauguration (as he recounted it), followed by MELANIA, calling them “cash grab situations” that left the broader industry wearing the reputational fallout while still chasing regulatory relief.

The deeper problem, though, was retail. The Cardano founder argued the industry never rebuilt trust after the 2022 wipeout, and that 2025 didn’t offer a compelling reason for everyday participants to come back beyond speculative churn. “Retail showed up in 2021… and then they got screwed again and again and again,” he said. “And now you want them to come back so you can do it again. Will they? No.”

That sets up his core pitch for 2026: a reset framed as a return to “first principles,” with less reliance on governments, celebrity catalysts, or “the cavalry.” His language wasn’t subtle. “No government is coming to save us. No large company is coming to save us. No large investor is coming to save us,” he said. “We are on the island.”

He also tied that reset to a broader, darker worldview — AI, robotics, and a society he worries will drift into a “dystopian hellscape” without credible systems for agency, ownership, and verification. Whether you buy that framing or not, it’s clearly the rhetorical engine he wants crypto to run on: less number-go-up, more “what are we actually building, and who does it help?”

Hoskinson didn’t completely let his own camp off the hook, either. He acknowledged missed predictions — including his past expectation that bitcoin would reach $250,000 in 2025 — and the ongoing criticism he gets for timelines.

“I honestly believed [Bitcoin] would be back in December of 2024. Because I believed that Trump would be good for crypto. I was wrong. I believed it and I was wrong. I’ll admit that. But I do believe in 2026 there’s a path for it to get there. And I do believe we as an industry will pivot and return to retail and rebuild those relationships and get it done. It’ll be a difficult road, but I see a path to make that happen. Leios will ship. We know how to do it. We wrote all the code down. We got it done,” Hoskinson said.

Towards the end, he tried to anchor the “reset” in concrete ecosystem moments, pointing to Midnight’s launch mechanics as an example of retail-first distribution and highlighting heavy trading activity around the token. “The bullshit’s over,” he said. “We’re back to work… in 2026 it’s a return to first principles.”

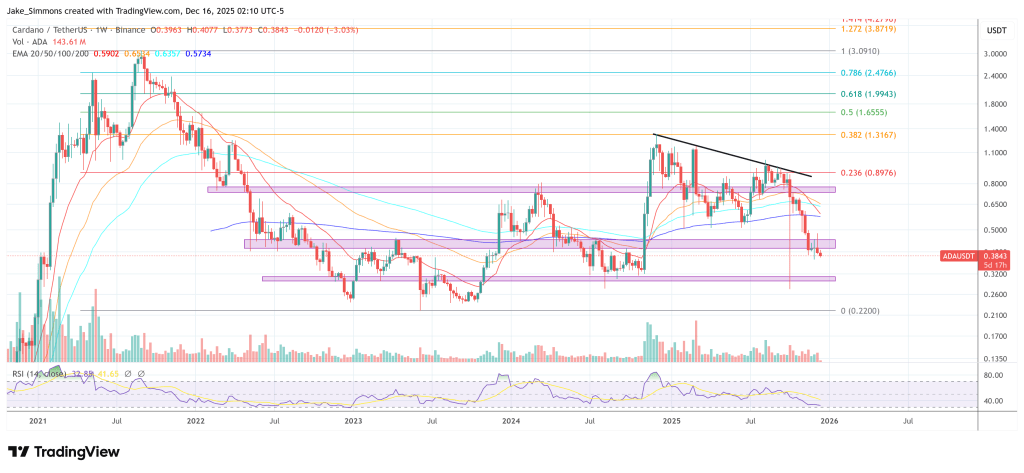

At press time, Cardano traded at $0.3843.

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

North America Sees $2.3T in Crypto