SBI VC Trade Launches Recruitment for Rent Coin Lending Service

SBI VC Trade, a leading cryptocurrency exchange and subsidiary of SBI Holdings, has announced the opening of a new recruitment round for its Rent Coin lending service. The recruitment period is set to begin on December 18, 2025, at 20:00 JST. This service allows users to lend their cryptocurrencies, including XRP, Bitcoin (BTC), and Dogecoin (DOGE), to the exchange for a set period, generating income in the form of “usage fees.”

Crypto Lending for Profits

The Rent Coin service is a significant development for cryptocurrency holders looking to generate passive income. Users can lock up their crypto assets, such as XRP, for a fixed duration, ranging from a week to 28 days. In return, they receive interest payments in the same cryptocurrency they lend, turning idle holdings into revenue-generating assets. This offering is beautiful as it contrasts with traditional investments, where stocks offer dividends, and banks provide interest. With this lending model, crypto holders now have a chance to earn profits from assets that typically don’t yield any returns.

The demand for popular cryptocurrencies like XRP and Polkadot (DOT) in the Rent Coin lending service is high. As applications are approved on a first-come, first-served basis, users may experience waitlists if the service reaches its capacity. As a result, participants interested in lending popular coins must act quickly to secure a spot before the service fills up. This trend highlights the increasing interest in crypto lending platforms and the demand for alternatives to traditional financial products.

History of SBI VC Trade’s Crypto Lending Service

SBI VC Trade originally launched its cryptocurrency lending service in November 2020. The platform has experienced significant growth since then, particularly following its merger with TaoTao and subsequent platform upgrade. The service was relaunched under the new Rent Coin brand, which made the platform more user-friendly. The addition of prominent cryptocurrencies, such as Ethereum (ETH) and XRP, has made it a more attractive option for investors looking to diversify their crypto portfolios.

SBI VC Trade’s latest recruitment round for the Rent Coin service marks a significant milestone for crypto lending in Japan. By offering users the opportunity to earn passive income on cryptocurrencies like XRP, Bitcoin, and Dogecoin, the platform continues to cater to the growing demand for alternative investment options in the digital asset space.

This article was originally published as SBI VC Trade Launches Recruitment for Rent Coin Lending Service on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

Gold continues to hit new highs. How to invest in gold in the crypto market?

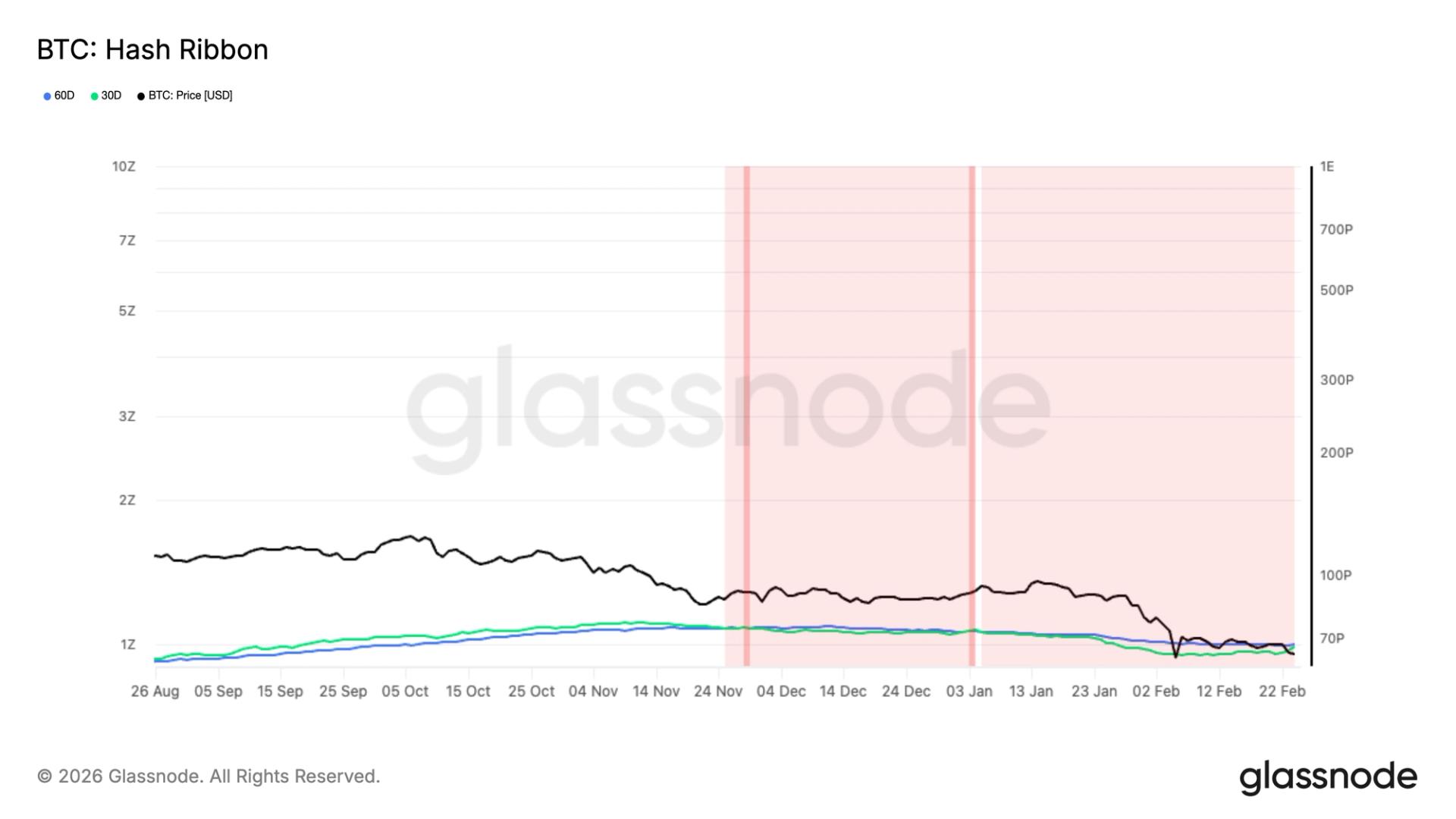

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail