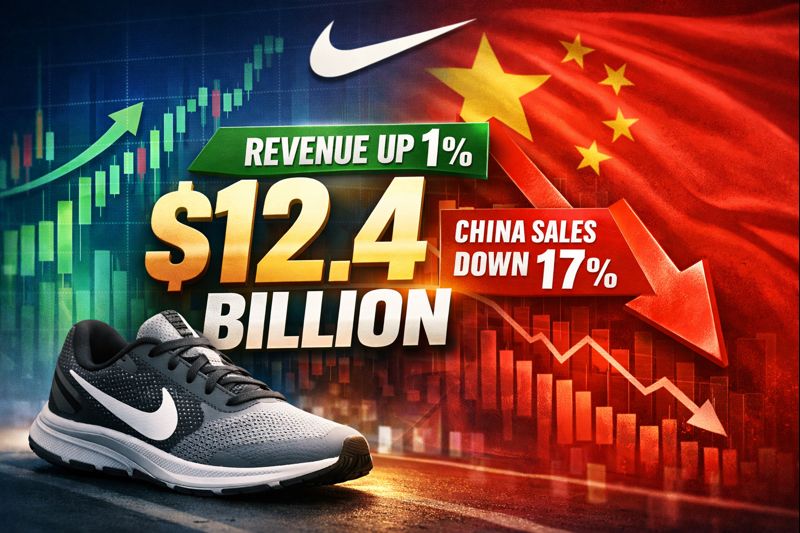

Nike Revenue Up 1% to $12.4bn as China Slumps 17%

Abu Dhabi, United Arab Emirates – December 19, 2025:

Nike (NYSE: NKE) beat revenue expectations in the second quarter, but the overall result was far from convincing in its turnaround story. Revenue rose 1% year on year to USD$12.4 billion, ahead of expectations at USD$12.2 billion, but profits fell, which put pressure on the shares in after-hours trade.

North America led the way with revenue up 9% on the year, while EMEA grew 3%, both comfortably beating forecasts. Digital was still under strain, falling 14%, although that was an improvement from last year’s 21% decline. The softness in Greater China continues to be a big drag, with sales falling 17% year on year, well below expectations. Converse was again a weak spot, with revenue down 30%, reinforcing concerns that it’s a brand struggling to find a foothold.

Farhan Badami, Market Analyst at eToro, shares that margins reflected the challenges of another tough quarter. Gross margin fell to 40.6%, down from 43.6% a year earlier, reflecting higher markdowns and ongoing channel mix shifts. Inventories fell 3.2%, which is a slight improvement over expectations, a bright spot as Nike works to reset the marketplace and strengthen relationships with retail partners.

CEO Elliott Hill described Nike as being in the middle innings of its comeback, emphasising progress in the areas that were prioritised early in the strategy shift. That message will reassure some, but the results also underline how much work is still ahead.

Nike is repairing wholesale relationships, cleaning up inventory, and regaining momentum in running, which remains a bright spot, with new products leading the way. But the recovery is happening in pockets rather than across the board. China is still soft, competition is intensifying, and key categories like basketball and sportswear, which carry much of the brand’s weight, are yet to show consistent improvement.

These results show a step in the right direction, but it’s less than what investors wanted. Nike shares have fallen 13% this year and are tracking towards a fourth straight annual decline, meaning patience is thin, and sentiment is rock bottom, especially for a brand built on consistent performance. Ultimately, Nike is jogging forward, not sprinting.

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have over 38 million registered users from more than 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So, we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro (ME) Limited, is licensed and regulated by the Abu Dhabi Global Market (“ADGM”)’s Financial Services Regulatory Authority (“FSRA“) as an Authorised Person to conduct the Regulated Activities of (a) Dealing in Investments as Principal (Matched), (b) Arranging Deals in Investments, (c) Providing Custody, (d) Arranging Custody and (e) Managing Assets (under Financial Services Permission Number 220073) under the Financial Services and Market Regulations 2015 (“FSMR”). Its registered office and its principal place of business is at Office 207 and 208, 15th Floor, Al Sarab Tower, ADGM Square, Al Maryah Island, Abu Dhabi, United Arab Emirates (“UAE”).

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without considering any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

This article was originally published as Nike Revenue Up 1% to $12.4bn as China Slumps 17% on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued