Trump’s crypto ventures worth at least $620M, report claims

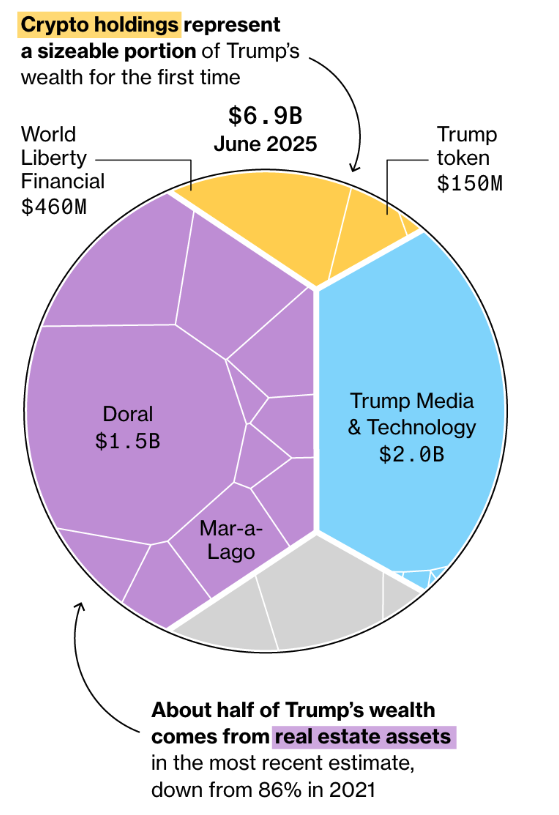

Trump’s crypto assets make up roughly 9% of his $6.9 billion net worth, a Bloomberg report claims.

Crypto ventures represent a sizeable portion of U.S. President Donald Trump’s wealth. According to a Bloomberg report published on Wednesday, June 2, Trump’s crypto-related businesses are worth $620 million. This amounts to about 9% of the $6.9 billion in Trump’s personal wealth.

Trump’s 60% stake in digital assets company World Liberty Financial is worth around $460 million. The business, in which Trump’s sons Eric Trump and Donald Trump Jr. are actively involved, invests in digital assets. It also launched its own stablecoin, USD1.

Trump also netted a sizeable return on his memecoin, the Official Trump (TRUMP) token. His holdings of the token are worth $150 million. Most recently, the President promoted his memecoin by offering a private dinner to the top tokenholders.

Trump’s crypto wealth prompts conflict of interest concerns

Trump and his family’s crypto ventures have drawn significant criticism from political opponents. Among the most vocal are Rep. Maxine Waters and Senator Elizabeth Warren, who raised concerns about potential conflicts of interest and opportunities for bribery.

Waters stated that Trump’s stake in WLFI opens the door for foreign entities to buy access to the President. She also criticized the launch of the Trump memecoin, claiming that it lost investors at least $2 billion, while Trump and his family pocketed at least $350 million.

Trump’s sons also have stakes in his crypto firms, meaning crypto could account for an even larger share of the Trump business empire. Still, the bulk of Trump’s personal wealth remains in his various real estate holdings and media ventures. Notably, Trump’s stake in Trump Media and Technology, the company that owns Truth Social, is estimated at $2 billion.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more