PSEi surges to 6,000 level on holiday optimism

PHILIPPINE SHARES surged on Monday to push the bellwether index back above the 6,000 line on improved business optimism amid the holidays and positive spillovers from both Wall Street and regional markets.

The benchmark Philippine Stock Exchange index (PSEi) jumped by 2.03% or 120.39 points to end at 6,041.26, while the broader all shares index increased by 1.43% or 48.58 points to 3,446.30.

“Philippine equities surged higher and joined the regional upswing as businesses are more optimistic this fourth quarter with the expectations that accelerated holiday spending will improve margins,” AP Securities, Inc. said in a market note.

“The local market bounced back as investors hunted for bargains following two straight days of decline,” Philstocks Financial, Inc. Research Manager Japhet Louis O. Tantiangco said in a Viber message. “The positive cues from Wall Street’s closing performance last week also helped in Monday’s session.”

Early on Monday, Asian shares rose broadly, tracking tech-driven gains on Wall Street, Reuters reported.

Despite it being a holiday-shortened week for much of the world, momentum funds were still flowing to equities, precious metals and commodities ahead of delayed data that is forecast to show the US economy had continued to grow strongly in the third quarter.

Median forecasts tip annualized growth of 3.2%, due in part to a sharp pullback in imports after a run-up earlier in the year ahead of the introduction of tariffs.

Japan’s Nikkei climbed 1.9%, extending Friday’s bounce as a steep decline in the yen promised to boost export earnings for Japanese corporates.

MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.8%, while South Korea jumped 1.7% on optimism over artificial intelligence-related earnings.

Chinese blue chips gained 0.8%, while Singapore’s main index climbed 1% to a record top.

All sectoral indices closed higher on Monday. Services surged by 3.13% or 72.69 points to 2,395.42; mining and oil jumped by 3.09% or 434.72 points to 14,485.72; financials went up by 2.61% or 52.19 points to 2,051.31; property increased by 1.32% or 29.41 points to 2,251.03; industrials rose by 1.13% or 97.13 points to 8,640.34; and holding firms climbed by 0.41% or 19.32 points to 4,708.66.

“International Container Terminal Services, Inc. was the day’s top index gainer, rising 4.55% to P574.50. ACEN Corp. was the worst index performer, dropping 2.53% to P2.70,” Mr. Tantiangco said.

Advancers overwhelmed decliners, 130 to 69, while 57 names closed unchanged.

Value turnover went down to P8.28 billion on Monday with 7.16 billion shares traded from the P18.72 billion with 26.2 billion issues that changed hands on Friday.

Net foreign selling increased to P975.15 million from P103.39 million. — Alexandria Grace C. Magno with Reuters

You May Also Like

Santander’s Openbank Sparks Crypto Frenzy in Germany

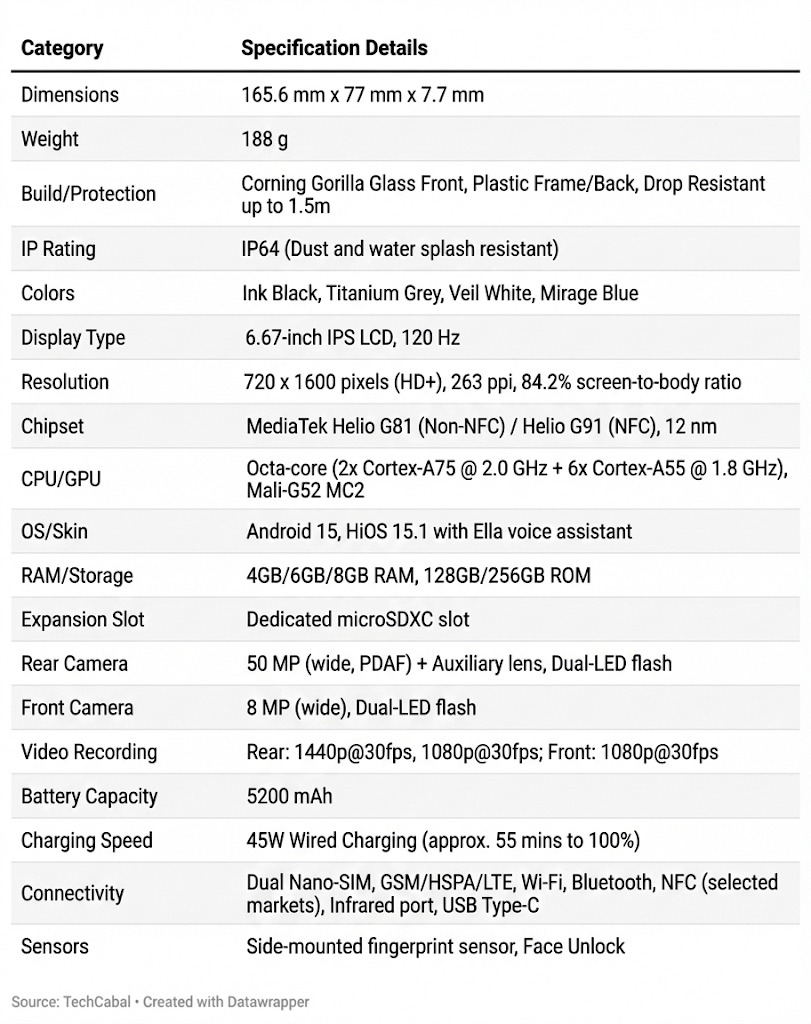

Tecno Spark 40 review: TDV certification, price and full specs