ICICI Bank (IBN) Stock: Edges Higher on ICICI AMC Listing Momentum

TLDRs;

- ICICI Bank shares edged higher today amid thin trading volumes and stable market conditions across Indian benchmarks.

- The recent ICICI AMC listing lifted investor sentiment, highlighting the bank’s strong ecosystem and embedded value potential.

- Investors are closely watching the upcoming Q3 FY26 results scheduled for 17 January 2026 for guidance.

- New 2026 credit card fees and D-SIB regulatory requirements are shaping investor perceptions of the bank’s future.

On 23 December 2025, ICICI Bank (IBN) shares experienced a modest increase, trading around ₹1,360 in early afternoon sessions. The stock recorded minor intraday fluctuations, ranging from ₹1,357 to ₹1,365, reflecting a largely flat market backdrop. Investor activity remained subdued as year-end holiday volumes limited trading momentum, while the broader benchmark indices showed little directional movement.

Market analysts noted that today’s small gains were less about immediate triggers and more about gradual price discovery, positioning ICICI Bank for potential catalysts in the coming weeks. The stock’s six-month beta of approximately 1.40 signals that while it can amplify broader market swings, current movements are consistent with a slow, low-volume trading environment rather than any company-specific shock.

ICICI AMC Listing Boosts Market Perception

A major driver of optimism for ICICI Bank has been the recent listing of ICICI Prudential Asset Management Company (ICICI AMC) on 19 December 2025. The IPO debut saw AMC shares surge to an intraday high of around ₹2,663.40 against the issue price of ₹2,165, giving the asset manager a market valuation of roughly $14.4 billion.

Even though ICICI Bank has not yet monetized its stake, the AMC’s public listing enhances investor perception of the bank’s embedded value and ecosystem strength.

ICICI Bank Limited, IBN

Analysts suggest that the “sum-of-the-parts” valuation approach now better captures the value of ICICI Bank’s diversified operations, highlighting cross-selling opportunities between banking and asset management services.

Upcoming Q3 FY26 Results: Investor Focus

Attention is increasingly turning toward the bank’s Q3 FY26 financial results, with the Board meeting scheduled for 17 January 2026. Investors are expected to closely monitor loan growth, deposit cost trends, net interest margin trajectory, and credit quality indicators.

Historical patterns suggest that Q3 results often influence short-term stock performance, particularly regarding unsecured lending segments and margin pressures. Analysts emphasize that even subtle shifts in guidance tone or asset quality assessments could drive stock movement as market participants adjust expectations for FY26 performance.

Regulatory and Consumer Updates Shape Outlook

ICICI Bank remains classified as a Domestic Systemically Important Bank (D-SIB) by the RBI, requiring an additional 0.2% CET1 capital buffer. While not restrictive, this status underscores the importance of disciplined capital management and oversight.

Additionally, the bank’s planned credit card rule changes for 2026, including a 2% fee on online gaming transactions and 1% on certain transportation-category spends above ₹50,000, have attracted investor attention. These adjustments, while minor in immediate financial impact, could influence consumer behavior, fee income stability, and perceptions of pricing power across the banking sector.

The broader regulatory environment also supports investor confidence. India’s Parliament recently approved a 100% FDI cap in insurance, expanding opportunities for bancassurance channels and potentially enhancing revenue streams for large banks like ICICI.

Analyst Targets and Market Sentiment

Consensus analyst forecasts suggest a potential upside for ICICI Bank shares, with average target prices ranging between ₹1,568 and ₹1,707, and some high-end estimates approaching ₹1,990. Brokerages continue to rate the stock favorably, citing resilient earnings growth, net interest margin stability, and strong operational execution.

Market observers note that while ICICI Bank’s recent gains have been modest, the combination of AMC listing momentum, regulatory clarity, and an upcoming earnings release provides a compelling backdrop for potential appreciation in early 2026.

The post ICICI Bank (IBN) Stock: Edges Higher on ICICI AMC Listing Momentum appeared first on CoinCentral.

You May Also Like

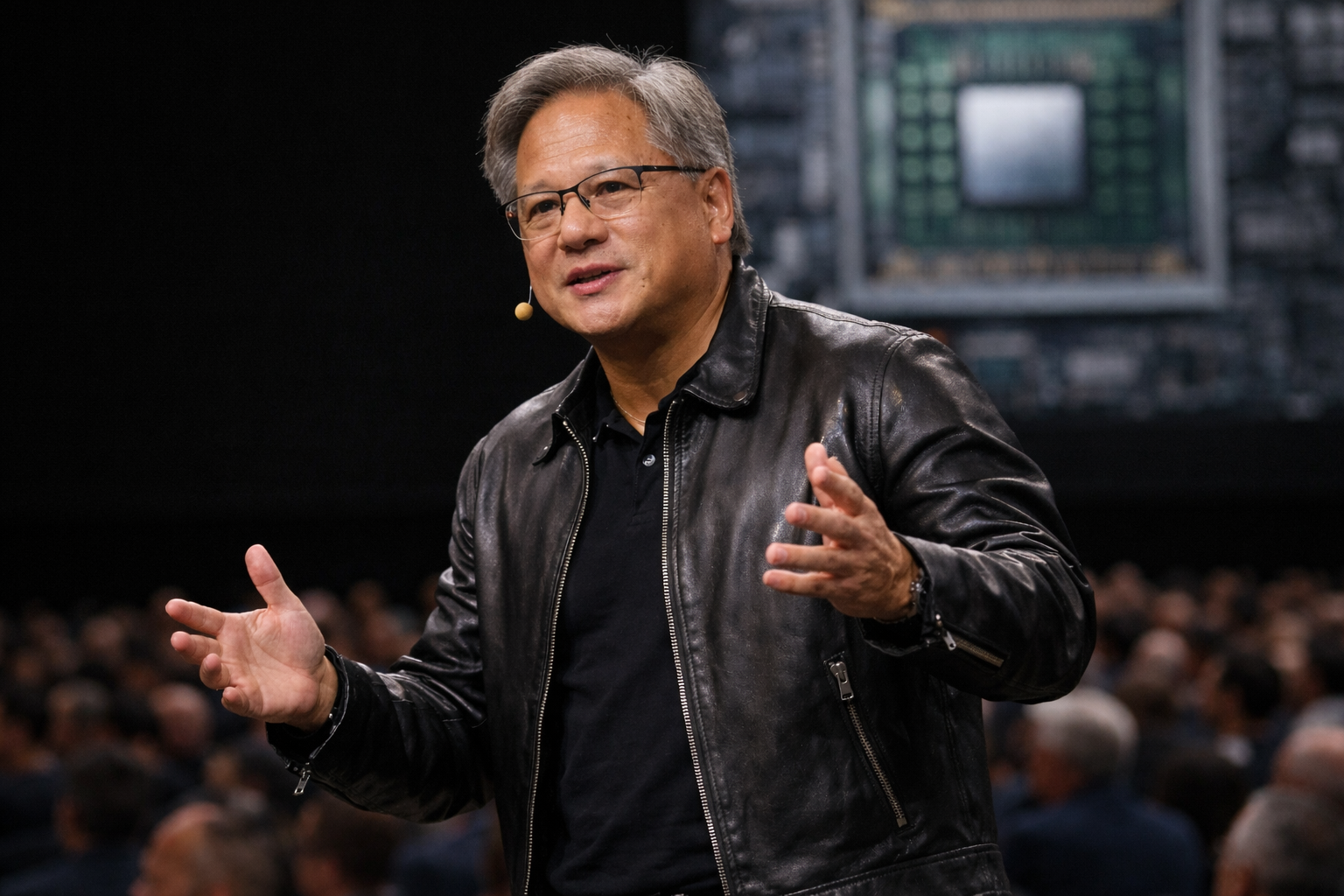

Nvidia’s Jensen Huang believes markets are wrong on software selloff

Stunning Three-Year High Against USD Fueled By Hawkish RBA Bets