Why MicroStrategy’s Collapse Could Be the Next Black Swan for Crypto in 2026

Strategy (formerly MicroStrategy) is the largest corporate holder of Bitcoin, owning 671,268 BTC, which represents over 3.2% of all Bitcoin in circulation. That makes the company a high-risk keystone in the Bitcoin ecosystem.

If it falls apart, the impact could be larger than the 2022 FTX collapse. Here’s why that threat is real, what could trigger it, and how bad the fallout could be.

MicroStrategy Is a Leveraged Bitcoin Bet

MicroStrategy’s entire identity is now tied to Bitcoin. The company spent over $50 billion buying BTC, mostly using debt and stock sales. Its software business brings in just $460 million a year, which is a fraction of its exposure.

As of December 2025, its stock trades well below the value of its Bitcoin holdings. The market value is approximately $45 billion, but its BTC is worth around $59–60 billion.

MicroStrategy’s Share Prices Over the Second Half of 2025. Source: Google Finance

MicroStrategy’s Share Prices Over the Second Half of 2025. Source: Google Finance

Investors are discounting its assets because of concerns about dilution, debt, and sustainability.

Its average BTC cost basis is around $74,972, and most of its recent buys were near Bitcoin’s peak in Q4 2025.

More than 95% of its valuation hinges on the price of Bitcoin.

If BTC drops sharply, the company could be trapped — holding billions in debt and preferred equity with no way out.

For instance, Bitcoin dropped 20% since October 10, but MSTR’s loss has been more than double in the same period.

MSTR Stock Performance Comparison with NASDAQ-100 and S&P 500 in 2025. Source: Saylor Tracker

MSTR Stock Performance Comparison with NASDAQ-100 and S&P 500 in 2025. Source: Saylor Tracker

What Makes This a Black Swan Risk?

MicroStrategy used aggressive tactics to fund Bitcoin buys. It sold common stock and issued new types of preferred shares.

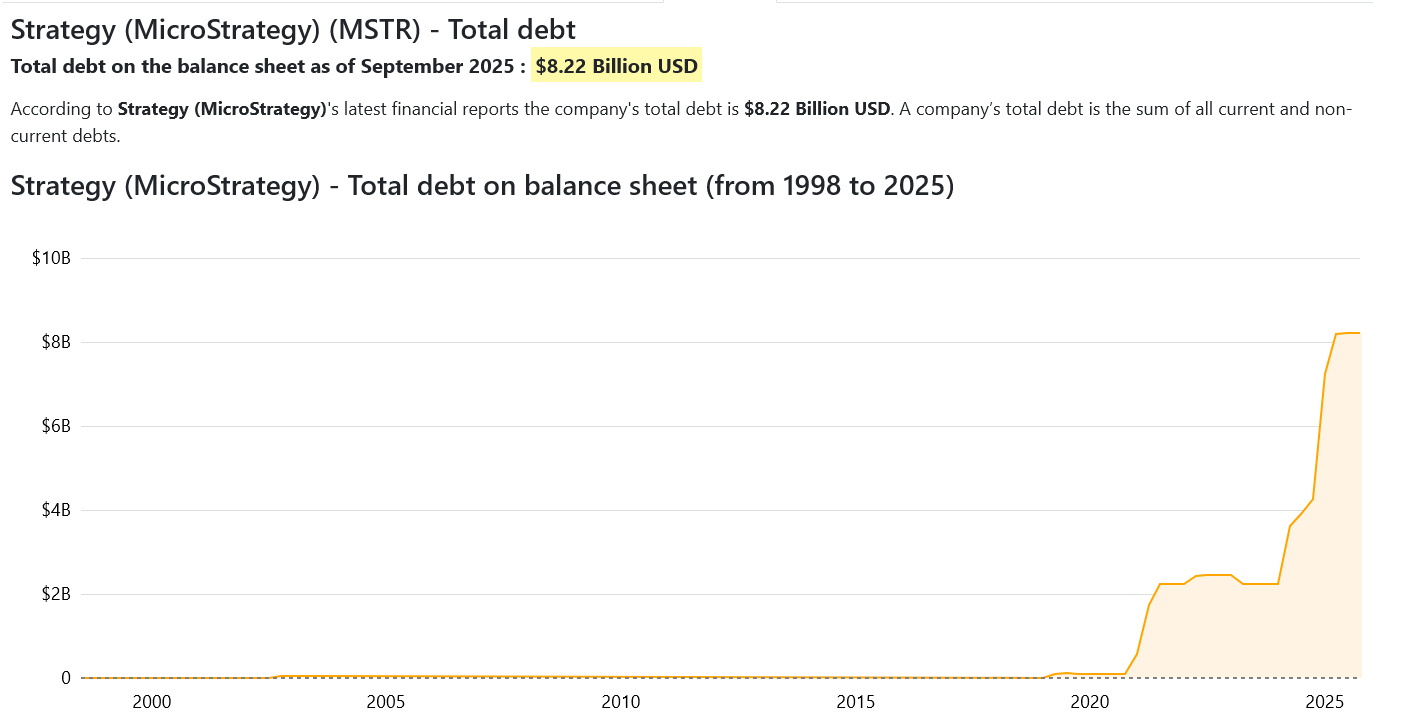

It now owes over $8.2 billion in convertible debt and has more than $7.5 billion in preferred stock. These financial tools require large cash outflows: $779 million annually in interest and dividends.

At the current levels, if Bitcoin crashes below $13,000, MicroStrategy could become insolvent. That’s not likely in the near term, but BTC’s history shows that 70–80% drawdowns are common.

A large crash, especially if paired with a liquidity crunch or ETF-driven volatility, could push the company into distress.

Strategy’s Total Debt as of Q3 2025. Source: Companies Market Cap

Strategy’s Total Debt as of Q3 2025. Source: Companies Market Cap

Unlike FTX, MicroStrategy is not an exchange. But the effect of its failure could be deeper. It owns more Bitcoin than any entity except a few ETFs and governments.

Forced liquidation or panic over MicroStrategy’s collapse could drive BTC’s price down sharply — creating a feedback loop across crypto markets.

MicroStrategy has promised not to sell its BTC, but that depends on its ability to raise cash.

As of late 2025, it holds $2.2 billion in reserves. This is enough to cover two years of payouts. But that buffer could vanish if BTC falls and capital markets close.

How Likely Is a Collapse for Michael Saylor’s Strategy?

Probability isn’t binary. But the risk is rising.

MicroStrategy’s current position is fragile. Its stock has fallen 50% this year. Its mNAV is below 0.8×. Institutional investors are shifting to Bitcoin ETFs, which are cheaper and less complex.

Index funds may drop MSTR due to its structure, triggering billions in passive outflows.

MicroStrategy mNAV. Source: Saylor Tracker

MicroStrategy mNAV. Source: Saylor Tracker

If Bitcoin falls below $50,000 and stays there, the company’s market cap could fall below its debt load. At that point, its ability to raise capital could dry up — forcing painful decisions, including asset sales or restructuring.

The odds of a total collapse in 2026 are low, but not remote. A rough estimate might place the probability between 10–20%, based on current balance sheet risk, market behavior, and Bitcoin volatility.

But if it does happen, the damage could exceed FTX’s collapse. FTX was a centralized exchange. MicroStrategy is a key holder of Bitcoin’s supply.

If its holdings flood the market, Bitcoin’s price and confidence could be hit hard. This would potentially trigger a broader selloff across crypto.

You May Also Like

Will US Banks Soon Accept Stablecoin Interest?

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse