XRP Price Struggles Despite $1B ETF Inflows, Analysts Explain Why

The post XRP Price Struggles Despite $1B ETF Inflows, Analysts Explain Why appeared first on Coinpedia Fintech News

XRP Price remains under pressure as the broader altcoin market continues to weaken. The token is trading near $1.84, down about 14% year-to-date and more than 17% over the past month. While long-term confidence in XRP has not faded, analysts agree that the current market lacks the strength to support a sustained move higher.

XRP ETF Demand and Shrinking Exchange Supply

Despite weak price action, spot XRP ETFs in the U.S. have crossed $1 billion in assets under management, signaling steady institutional demand. XRP’s long trading history and regulatory clarity make it easier for traditional investors to gain exposure.

On-chain data strengthens the long-term outlook. Around 750 million XRP has moved off exchanges in recent weeks, leaving roughly 1.5 billion XRP on trading platforms. If this trend continues, a supply squeeze could develop by early 2026, especially if institutional inflows increase.

XRP Price To Move Sideways Before Any Upside

Nansen senior research analyst Jake Kennis expects XRP to remain range-bound in the near term. He notes that altcoins usually struggle until Bitcoin stabilizes or forms a clear bottom. According to Kennis, better conditions may emerge in the second half of 2026, supported by improved macro trends and investor sentiment.

However, he adds that XRP’s next major move will depend on clear catalysts, such as ETF growth, real-world use in payment systems, and stronger institutional participation, not short-term price momentum.

- Also Read :

- Ripple IPO Back in Spotlight as Valuation Hits $50B

- ,

Ripple Price Levels to Watch in the Coming Days

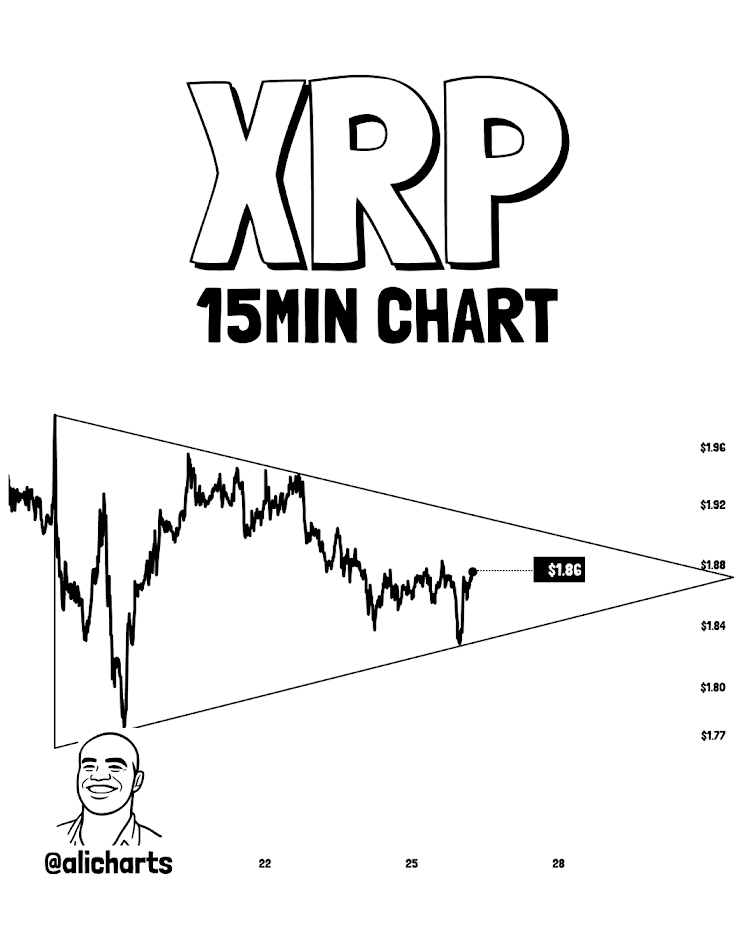

From a technical standpoint, analyst Ali Charts says XRP is consolidating within a triangle pattern, which often leads to a sharp move. He estimates a 10% price swing once a breakout or breakdown occurs.

Key levels remain crucial. $1.80 is a critical support zone. A clear break below this level could push XRP toward $1.37. On the upside, a bullish reversal would require higher trading volume and a break in the current bearish structure signals that have not appeared yet.

Price forecasts vary. Conservative estimates suggest XRP Price could stay near $1.80–$1.90 if major catalysts fail to emerge. More bullish projections place XRP between $3.00 and $4.00 or higher in the second half of 2026, assuming ETF inflows grow, regulation remains favorable, and the broader crypto market recovers.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP is under pressure because the broader altcoin market is weak and Bitcoin lacks a clear trend, limiting short-term buying momentum.

XRP ETFs signal steady institutional interest, which supports long-term demand, but they haven’t yet been strong enough to drive prices higher.

Less XRP on exchanges can reduce selling pressure, increasing the chance of a supply squeeze if demand rises in the future.

Analysts expect clearer upside potential in late 2026 if ETFs grow, adoption increases, and the broader crypto market recovers.

You May Also Like

Putin Claims U.S. Wants to Use Europe’s Largest Nuclear Plant for Bitcoin Mining

Analysts See XRP Trading Sideways in 2026 as Market Awaits New Catalysts