Best Crypto To Buy Now – Why Bitcoin Hyper Is The Next High Potential Layer 2 Token

Bitcoin is once again at the center of the crypto market conversation. As price action stabilizes near major psychological levels, investors are closely watching whether Bitcoin can reclaim six figures and push the broader market into its next phase.

Institutional activity remains mixed, ETF flows fluctuate daily, and sentiment continues to shift between caution and optimism.

This kind of environment often confuses short term traders, but it tends to attract longer term capital. Historically, when Bitcoin enters a consolidation phase after a strong run, attention begins to shift toward projects that benefit from Bitcoin’s dominance without directly competing with it.

This is why Bitcoin related infrastructure and adjacent projects are increasingly discussed when investors search for the best crypto to buy now.

Source – 2Bit Crypto YouTube Channel

Bitcoin’s Role in the Current Market Cycle

Bitcoin remains the foundation of the crypto ecosystem. Despite short term volatility, its long term trajectory continues to be reinforced by growing institutional participation.

Large banks are building Bitcoin products, ETFs are reshaping market liquidity, and Bitcoin is steadily being integrated into traditional financial frameworks.

Public commentary has reflected this shift for years. In a widely cited interview with CNBC posted by Wu Blockchain on X, Jack Ma stated that if Bitcoin works, international trade and financial rules would fundamentally change.

While his focus was on digital payments through Alipay under Alibaba, the broader implication remains relevant today. Bitcoin challenges legacy systems by enabling fast, global value transfer without centralized control.

At the same time, Bitcoin’s design prioritizes security and decentralization. This makes it reliable, but it also means Bitcoin becomes slower and more expensive during periods of high network usage. As adoption increases, these limitations become more visible.

Where Bitcoin Hyper Fits In

Bitcoin Hyper has emerged as a project that attempts to address this gap. It is important to be clear about what Bitcoin Hyper is and what it is not. It is not an official Bitcoin upgrade, not a replacement for Bitcoin, and not directly connected to Bitcoin core developers.

Bitcoin Hyper is an independent presale token designed to operate alongside the Bitcoin ecosystem.

Its goal is to provide faster and cheaper transaction capabilities for Bitcoin related activity, enabling use cases such as payments, decentralized applications, and token based ecosystems that are impractical on Bitcoin’s base layer.

Rather than competing with Bitcoin, Bitcoin Hyper’s value proposition depends on Bitcoin continuing to grow. As Bitcoin adoption expands, demand for complementary layers and supporting infrastructure naturally increases. This is the narrative Bitcoin Hyper is positioning itself around.

Why Bitcoin Hyper’s Timing Aligns With the Current Bitcoin Cycle

The current market environment strongly favors Bitcoin aligned projects. Bitcoin has firmly established itself as the dominant asset of this cycle, and institutional participation has moved beyond speculation.

As capital continues to rotate, increasing attention is being directed toward projects that reinforce Bitcoin’s long term relevance and infrastructure.

This shift has encouraged many market participants to seek early stage opportunities that benefit from Bitcoin’s success while still offering higher growth potential. Bitcoin Hyper fits this narrative by directly connecting its use case to Bitcoin while remaining early in its development lifecycle.

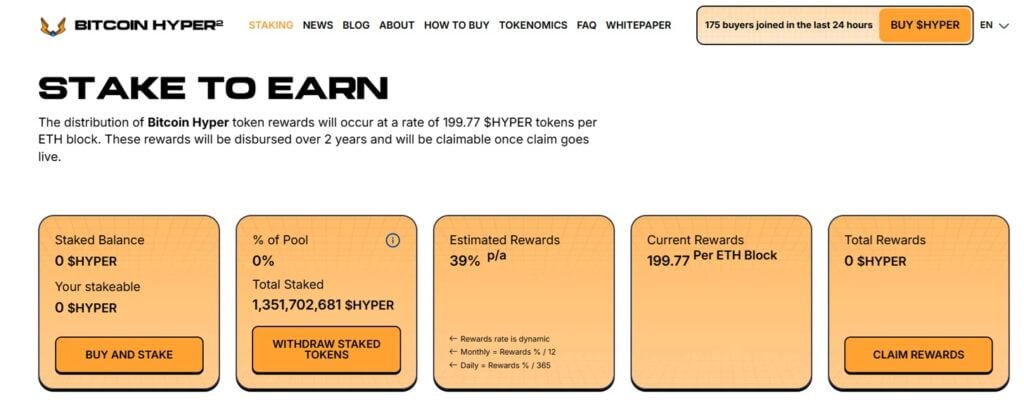

Presale opportunities are particularly attractive at this stage of the market, as they allow exposure before broader price discovery occurs. Bitcoin Hyper has already raised more than $29.8 million during its presale, offers staking rewards of up to 40%, and has over 1.35 billion tokens currently staked.

This level of participation reflects strong conviction among investors who expect Bitcoin adjacent scalability solutions to remain in demand. At present, Bitcoin Hyper is available exclusively through its official presale website.

Participation requires a Web3 compatible wallet capable of connecting directly to the presale smart contract.

One widely used option is Best Wallet. Best Wallet is a non custodial, multi chain wallet designed to support interactions with new tokens and upcoming crypto presales, allowing users to retain full control over their assets while accessing early stage opportunities.

Security remains a critical consideration within the presale market. Fake websites, phishing attempts, and imitation tokens are common risks.

Best Wallet addresses these concerns through features such as scam filtering, encrypted backups, biometric authentication, and clear portfolio tracking, helping reduce unnecessary exposure when engaging with early stage crypto projects.

Conclusion

As Bitcoin trades near key technical levels, market direction remains closely tied to its movement. Assets such as Ethereum and Solana may show periods of strength, but Bitcoin continues to anchor overall liquidity and sentiment.

Investor attention is shifting away from comparisons between Bitcoin and altcoins toward projects positioned to benefit from Bitcoin’s expansion. Bitcoin aligned projects are increasingly viewed as speculative opportunities designed to move in step with Bitcoin rather than compete against it.

Bitcoin Hyper fits this approach. It is structured around Bitcoin’s core strengths while focusing on areas outside Bitcoin’s primary priorities, positioning it as a complementary, early stage project intended to develop alongside Bitcoin’s long term growth.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Trump Media received 260 BTC from Coinbase, worth $21 million.