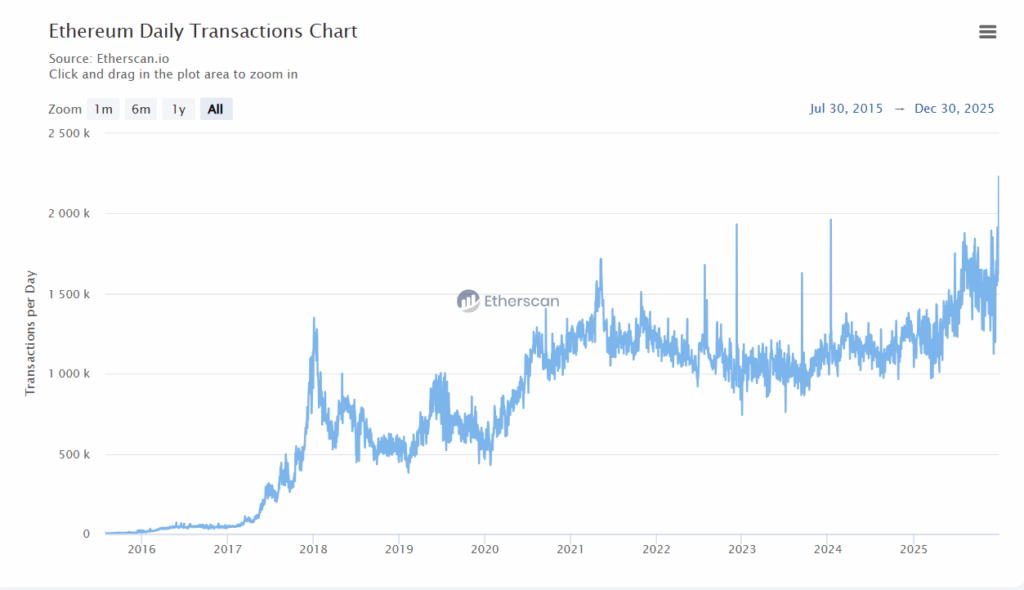

Ethereum On-Chain Activity Surges with 2.2M Daily Transactions Amid Fee Drop

- Ethereum reached above 2 million daily transactions on Dec 29 & Dec 30, with average fees at $0.17

- At the same time, 8.7 million smart contract deployments in the fourth quarter of 2025 highlight the strong and sustained developer engagement.

According to Etherscan, Ethereum’s daily transaction activities have fluctuated dramatically since the network’s launch in 2015. It recently achieved a new record, making about 2.2 million transactions on December 29 and 2.1 million on December 30.

Source: Etherscan

Source: Etherscan

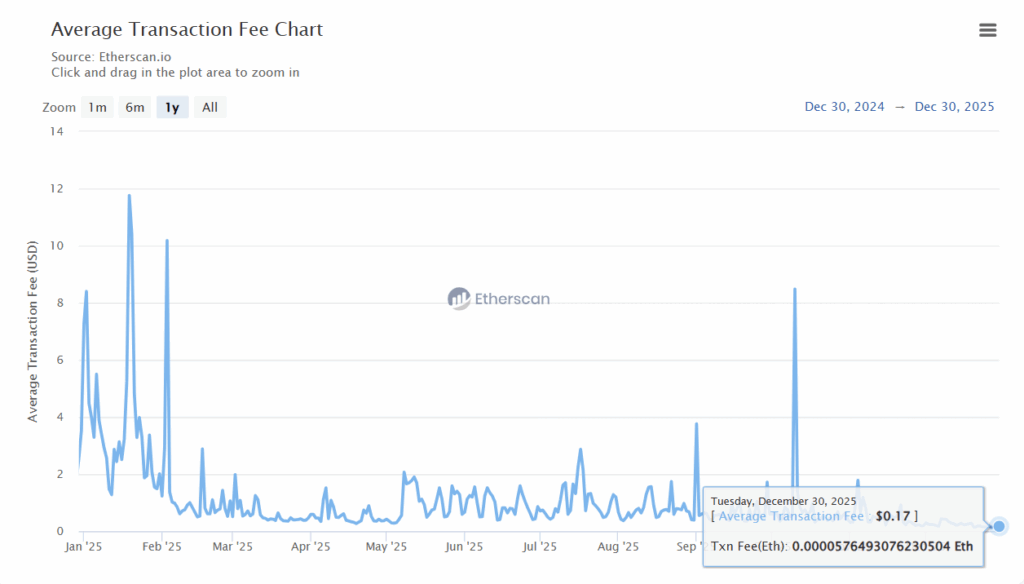

With that, transaction fees also significantly dropped. While attaining this milestone, the average fees for each transacting activity were about $0.17, which is 17 cents. Since its launch, only on May 22, users have paid highly, which is around $200.06 per transaction.

However, in January 2025, the transaction charges were around $11.76. Then, it saw a peak in October, and then in December, the fees had dropped. The current low fees and a high number of transactions show that Ethereum has become more efficient, and it can manage more transactions while charging lower costs.

Source: Etherscan

Source: Etherscan

Ethereum Network Developments and Price Update

As Token Terminal data says that Ethereum contract deployment, which is the creation and publication of smart contracts, touched a peak of 8.7 million in the fourth quarter of 2025, outpacing the previous highs. This recent surge in activities shows that Ethereum remains a leading and widely used L1 blockchain.

Then, supporting this trend of high activity and low fees, where Ethereum rolled out two major upgrades this year, the first one is Pectra, which went live in May 2025, and helps in bolstering staking efficiency, usability, and Ethereum network performance.

Secondly, the major upgrade is Fusaka, which went live this month. It increases the gas limit so that a block can include more transactions, strengthening the network efficiency.

With these, rising network usage, and declining fees over the past two days, the Ethereum price has shown noticeable movement. On December 29, the ETH price reached around $3,040 range, before pulling back. Now, while writing, ETH is trading at $2,971.41, with 18.4% down in trading volume of the day, as per CoinMarketCap data. Thus, Ethereum’s year-end on-chain activity remains an important metric to watch in 2026.

Highlighted Crypto News Today:

Grayscale Files First U.S. Bittensor ETF, TAO Eyes $300

You May Also Like

Solana Tokenized RWAs Surge 10% to $873.3M: How Blockchain’s Revolutionary Growth Captures Real-World Value

Mark Cuban, Dallas Mavericks Cleared Of Lawsuit Linked To Promotion Of Bankrupt Crypto Company