Coinbase Plans All-in-One Exchange for Crypto, Stocks, and Commodities in 2026

Coinbase CEO Brian Armstrong announced that the exchange will pursue an “everything exchange” strategy in 2026, combining crypto, equities, prediction markets, and commodities across spot, futures, and options products.

The plan positions Coinbase to compete directly with traditional brokerages while expanding beyond its core digital asset business into tokenized securities and event-based markets that have attracted billions in recent trading volume.

Armstrong outlined three priorities in a post on X:

- Building out the Everything Exchange globally

- Scaling stablecoins and payments

- Bringing users onchain through Coinbase’s developer tools, Base blockchain, and consumer app.

“Goal is to make Coinbase the #1 financial app in the world,” he wrote, adding that the company is making major investments in product quality and automation to support the expansion.

Prediction Markets and Tokenized Stocks Take Center Stage

Coinbase moved aggressively into prediction markets in late 2025, partnering with Kalshi, a federally regulated platform approved by the US Commodity Futures Trading Commission.

Leaked screenshots in November revealed a Coinbase-branded prediction interface supporting USDC or USD trading across economics, politics, sports, and technology categories.

The product operates through Coinbase Financial Markets, the exchange’s derivatives arm, using Kalshi’s regulatory framework to offer event contracts structured as simple yes-or-no questions.

Beyond prediction markets, Coinbase plans to issue tokenized equities in-house rather than through external partners, marking a departure from rivals like Robinhood and Kraken that rely on third-party providers for stock tokens in select jurisdictions.

Monthly transfer volumes for tokenized equities have climbed roughly 76% over the past 30 days to about $2.46 billion, according to rwa.xyz, as platforms experiment with bringing traditional assets onchain.

The push fits Coinbase’s ambition to become an “everything app” for digital assets where customers can trade crypto, tokenized securities, and event-based markets under one roof.

Prediction markets have experienced explosive growth over the past year, attracting interest from both traditional exchanges and crypto-native firms that see them as a new way to monetize information and order flow.

Gemini recently secured CFTC approval to launch its prediction platform, Gemini Titan, for American customers.

At the same time, Crypto.com struck deals with partners, including Trump Media & Technology Group, to help build prediction markets.

Robinhood and trading firm Susquehanna also agreed to buy 90% of the regulated venue LedgerX, deepening their exposure to the crypto prediction market sector.

Regulatory Tailwinds and Institutional Momentum Build

Coinbase executives see favorable conditions ahead as regulatory clarity improves and institutional participation deepens.

David Duong, the exchange’s head of investment research, said in a year-end outlook that 2025 marked a turning point for digital assets, with regulated spot ETFs opening broader investor access and stablecoins becoming more embedded in traditional financial workflows.

“We expect these forces to compound in 2026 as ETF approval timelines compress, stablecoins take a larger role in delivery-vs-payment structures, and tokenized collateral is recognized more broadly across traditional transactions,” Duong wrote.

Armstrong emphasized the regulatory shift during a February earnings call, telling investors, “it’s hard to overstate the significance of the change that’s happened in the last few months.”

He argued that the transformation in US attitudes toward crypto is prompting global markets to follow, while Coinbase benefits from a playbook for international expansion.

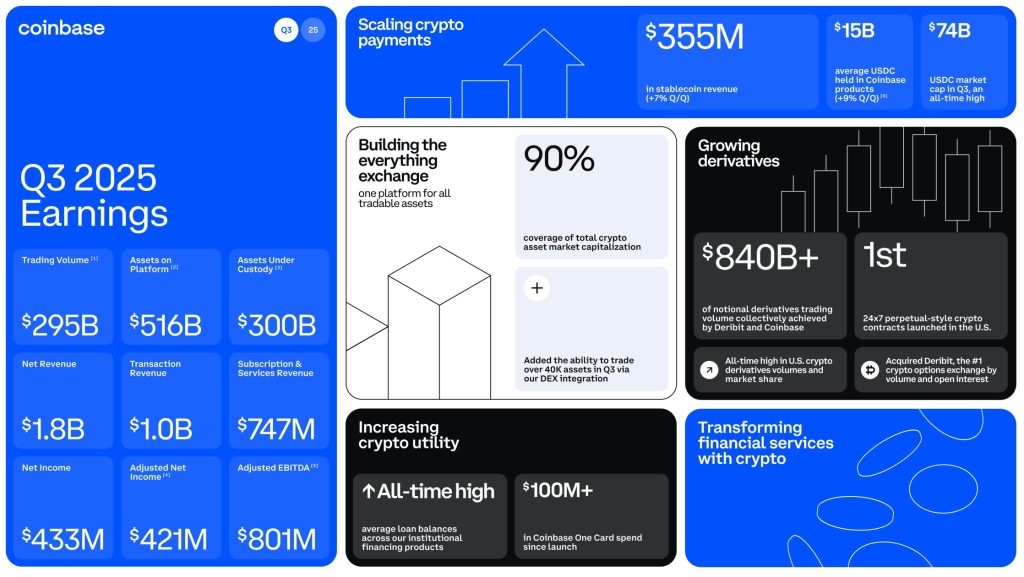

According to its Q3 shareholder letter, the exchange managed $516 billion in assets, equivalent to 16% of total crypto market capitalization.

Source: Coinbase

Source: Coinbase

Armstrong projected that up to 10% of global GDP could run on crypto rails by decade’s end, comparing the shift to how companies adapted to the internet in the early 2000s.

“It’s a little bit like the early 2000s when every company had to figure out how to adapt to the Internet,” he said during the call.

Regarding stablecoins, Coinbase’s chief policy officer, Faryar Shirzad, recently warned that restrictions on stablecoin rewards could weaken the United States’ position in digital payments, as China allows commercial banks to pay interest on digital yuan wallets starting January 1, 2026.

The People’s Bank of China unveiled the framework to shift its central bank digital currency beyond a cash substitute, triggering Chinese investors to pour more than $188 million into digital yuan-related stocks following the announcement.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless