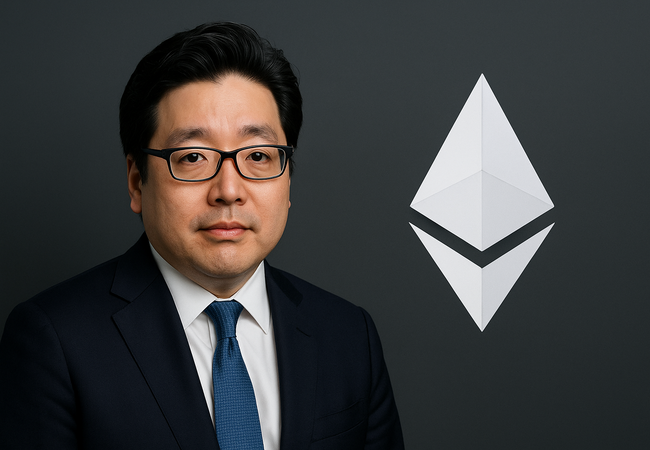

Tom Lee Urges Investors to Back BitMine’s Share Expansion From 500M to 50B

Highlights:

- Tom Lee has asked BitMine shareholders to support a proposal pushing for the company’s share expansion.

- The Chairman noted that the stock expansion will fund the company’s long-term plans.

- Shareholders have until January 14, 2026, to vote either in support or against the proposal.

Tom Lee, the Chairman of BitMine Immersion Technologies (BMNR), has called on shareholders to approve a massive share expansion proposal. Speaking in a short clip posted on YouTube on January 2, the Chairman explained why the company needs to increase its authorized shares from 500 million to 50 billion. He said the move seems huge, but it will be crucial to support the company’s long-term plans.

Lee highlighted three main reasons for the proposed share expansion. First, the additional shares will support the company’s capital market activities and transactions, including at-the-market offerings, warrants, preferred shares, and convertible instruments. Second, it will make funds available for timely investments. Finally, the additional shares will allow the company to carry out large stock splits when needed.

ETH’s Price Impacts on BitMine’s Stock Valuation

Explaining further, the Chairman noted that BitMine’s stock price closely follows Ethereum’s price, implying that the share’s valuation could significantly spike if Ethereum’s price appreciates. For example, if Ethereum climbs to $22,000, BitMine’s stock could rise to about $500 per share. He added that if Ethereum soars to as high as $62,000, then the stock price could reach $1,500.

Lee noted that investors do not like stocks that trade at very high prices. According to the Chairman, many investors prefer shares that are trading around $25. To maintain BitMine’s stock valuation within that range, the company must be prepared to carry out large stock splits as Ethereum’s price appreciates. He said the company may need a 20:1 split if ETH climbs to $22,000, a 60:1 split for ETH at $62,000, and a 100:1 split for ETH at $250,000.

Each of these splits will significantly increase the number of shares in circulation, exceeding the company’s current share limit. Concluding his speech, Lee urged shareholders to vote in favour of the share expansion proposal. The deadline to submit votes is January 14, 2026, at 11:59 pm Eastern Time. Aside from voting, he encouraged shareholders to attend the company’s annual meeting on January 15, 2026, at the Wynn Las Vegas.

BitMine’s Share Spikes as Tom Lee Urges Shareholders to Support the Company’s Stock Expansion

At the time of writing, BitMine’s stock is up 14.88%, trading at $31.19, according to Google Finance data. Its previous close was $27.15 with a daily price range of $27.46 to $31.26. The shares have a market cap of $13.28 billion, with an average daily trading volume of 49.02 million shares.

Meanwhile, Ethereum is changing hands at approximately $3,106 following a 2.9% upswing in the past 24 hours. It has a market cap of roughly $375.2 billion and a trading volume of $25.9 billion. Ethereum is up 6.1% 7-day-to-date and 14.2% 14-day-to-date. However, its month-to-date and year-to-date price change variables are down 2.7% and 10.1%, respectively.

Source: CoinGecko

Source: CoinGecko

In related news, EmberCN reported that BitMine has continued to stake ETH tokens. Recent on-chain data revealed that the company deposited 82,560 ETH, valued at approximately $259 million, into Ethereum’s Proof of Stake (PoS) network. “Since starting the ETH staking action on 12/27, it has staked a total of 544,064 ETH ($1.7 billion) over the past week. The staked amount accounts for 13.2% of their total ETH holdings (4.11 million ETH),” EmberCN added.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

TSMC shares hit record after Goldman Sachs raises target 35%

Japanese Digital Assets Revolution: Finance Minister’s Bold Pledge to Integrate Crypto into Mainstream Finance