1.34 Billion NFTs And No Buyers: Is Gaming The Only Thing Keeping The NFT Market Alive?

NFT supply has hit 1.34B as sales plunge. Digital art fades, while gaming NFTs thrive through real utility and play-to-own adoption.

The NFT space is currently facing a harsh reality check. A new year has begun, and the total number of NFTs minted across all blockchains has surged to a staggering 1.34 billion.

However, investors are jumping ship and sales revenue has been down. Is this the end of the NFT space?

The NFT Decline And What Comes Next

This decline in NFT sales revenue is a 25% increase from the previous year.

It also shows that creators are still pumping out content at an incredible pace despite the lack of demand from buyers.

While the supply is at an all-time high, the actual sales revenue for the past year dropped to just $5.63 billion. This is a heavy decline from the $8.9 billion recorded in 2024.

Even worse, the average price of an NFT has also tumbled from $124 to roughly $96.

This data now shows the NFT market as one that is “oversupplied and under-demanded”, and gone are the days when Bored Ape NFTs sold for millions of dollars.

Yet while all of this is happening, the lights are still on, and the volume is actually growing.

The Collapse of Speculative Digital Art

One of the biggest reasons for the “no buyers”problem is the collapse of the Profile Picture (PFP) and digital art segments.

In 2021 and 2022, projects like Bored Ape Yacht Club and CryptoPunks dominated the headlines. Today, the floor prices for many of these “blue chip” collections have dropped by as much as 75%.

Investors who once bought these assets for their rarity are now finding it nearly impossible to find a secondary buyer.

The market has so far moved away from the “culture coin” era.

People are no longer willing to pay high premiums for static images that offer no functional use, and according to data from CryptoSlam, the number of unique purchasers per month has remained low for most of the past year.

This is a clear sign that the “hype” buyers have left the building, and are leaving behind a mountain of 1.34 billion unsold tokens.

Why Gaming Is Different in the NFT Market

While digital art is gathering dust, NFTs in the gaming space are moving faster than ever.

The global NFT gaming market was valued at roughly $6.1 billion last year. This happened because, unlike a piece of digital art, a gaming NFT has a specific job, whether it be a sword, a skin or a piece of virtual land.

This “utility” (or use case) is what keeps the market alive. Gamers are not buying these items to “flip” them to the next person, even though that is still possible.

They are buying them to use, and this creates a cycle of demand that does not rely on purely speculative hype.

Major platforms like OpenSea and Magic Eden have also recognised this trend and are moving away from being “art galleries” to “gaming hubs”.

Related Reading: NFT Market Outlook: Why Utility May Shape The Next Growth Phase

The Rise of the “Play-to-Own” Model

The focus used to be on Play to Earn games in the early days of Blockchain gaming.

Games like Axie Infinity allowed players to make a living, but these models collapsed when token prices fell. This year, the industry has so far moved toward “Play-to-Own” (P2O).

In this model, the focus is on fun first, and the NFTs are a reward for engagement, rather than a financial obligation.

This simple change has brought back the players and companies like Mythical Inc. and Splinterlands have built massive communities of tech-savvy gamers who value digital ownership.

In North America, roughly 30% of NFT gamers now view blockchain titles as their main form of entertainment.

They are not looking for a quick profit, and are looking for a deeper connection to the games they love.

The post 1.34 Billion NFTs And No Buyers: Is Gaming The Only Thing Keeping The NFT Market Alive? appeared first on Live Bitcoin News.

You May Also Like

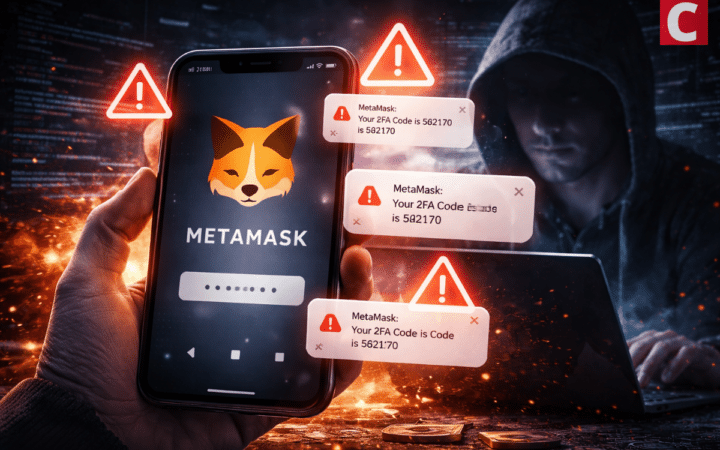

MetaMask Users Attacked via Fake 2FA Alerts: SlowMist

Venezuela May Hold Up to 600,000 BTC in Shadow Reserve