Best Meme Coins to Buy – Bonk Price Prediction, Next Crypto to Explode

The cryptocurrency market is experiencing a renewed wave of meme coin momentum, with Bonk (BONK) standing out as one of the top performers.

Strength across the broader market, driven by Bitcoin holding above $90,000 and Ethereum defending support near $3,000, has pushed capital back into higher-risk assets and given meme coins fresh upside.

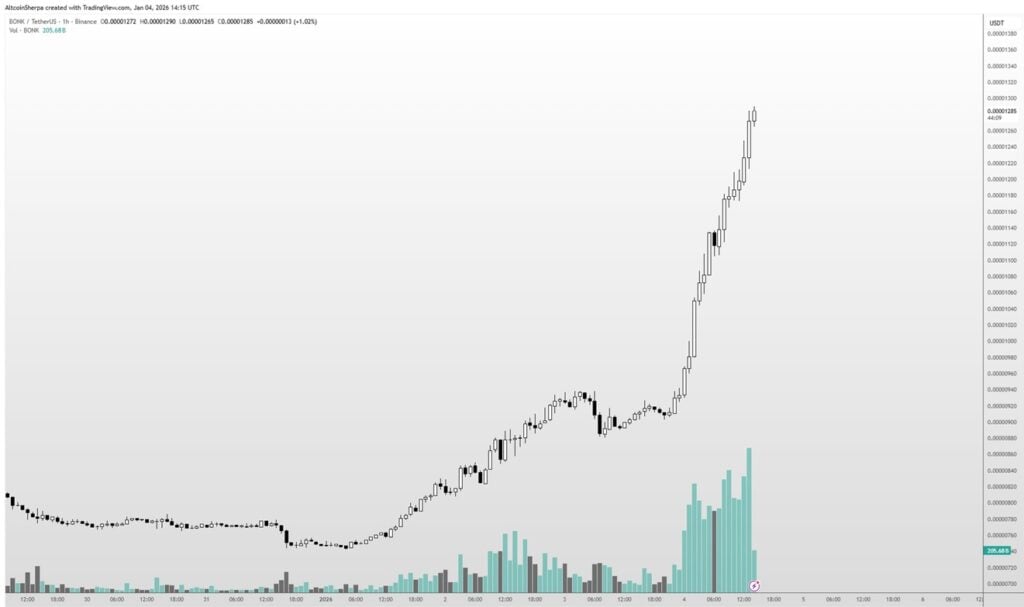

BONK’s recent 53% weekly surge has sparked debate about whether the move has more room to run, yet the token still trades well below its previous all-time highs.

Whether the rally turns into a short-lived spike or the early phase of a new bull cycle, BONK has already reclaimed its role as a key driver of the meme coin market as 2026 begins.

As traders look beyond established names for the next crypto to explode, Pepenode (PEPENODE) is quickly gaining traction as a high-utility contender.

Source – 99Bitcoins YouTube Channel

BONK Price Prediction

At the time of writing, Bonk (BONK) has surged more than 32%, leading a broader market recovery and pushing its weekly gains past 52%. This rally wipes out losses from the late 2025 consolidation and signals a possible return to the mainstream crypto spotlight.

Momentum behind BONK continues to build as trading activity jumps sharply, pointing to a strong recovery even though the token still trades below its early 2025 highs.

The New Year rally draws support from a major liquidity surge, with 24-hour trading volume exploding more than 418%.

BONK is not moving alone, as Pepe (PEPE) has also climbed 55% in recent days, lifting the wider meme coin sector and confirming that demand for high-beta assets has returned for 2026.

However, technical signals show the rally stretching thin. The 7-day RSI has reached 88 and the 14-day RSI sits near 74, levels that often precede short-term pullbacks or consolidation.

Overbought conditions now appear across the broader market as investor confidence improves, with the Crypto Fear and Greed Index recently turning Neutral at 40, up sharply from Extreme Fear just a month ago.

Source – Altcoin Sherpa via X

Prominent analyst Altcoin Sherpa has warned that the vertical price move may represent a classic bull trap. After a long accumulation phase, BONK’s near-parabolic rise on rising volume often pulls in late retail buyers just before momentum turns.

He cautions that traders who chase current prices risk getting caught in a sharp correction if buying pressure fades.

As established tokens like BONK face bull trap risks near local highs, strategic investors are rotating into Pepenode (PEPENODE) as the best meme coin to buy for those aiming to position early in the next phase of the cycle.

Best Meme Coin to Invest Beyond BONK

Pepenode (PEPENODE) offers a new way to “mine” cryptocurrency without expensive hardware, high electricity bills, or technical skills. Instead of running physical GPUs, users create a digital setup by buying Miner Nodes and upgrading their facilities through a simple dashboard.

This gamified approach turns mining into a fun, strategic experience, with progress updating in real time, more like a game than a traditional mining chart.

During the presale, Pepenode keeps users engaged with an off-chain Play-to-Earn system. When the platform officially launches, it will move fully on-chain, providing users with full transparency and permanent rewards.

Pepenode also rewards top miners with popular meme coins like PEPE and FARTCOIN, offering a rare cross-token bonus in the meme coin space.

A key feature of Pepenode is its deflationary system. Every time users spend tokens on upgrades, up to 70% of those $PEPENODE tokens are burned, reducing the circulating supply as the community grows and improves their virtual rigs.

The project has already raised around $2.5 million during the presale. Investors are drawn to its high 530% staking APY, which allows early participants to earn rewards before the token hits exchanges.

With less than four days left in the presale, $PEPENODE is attracting attention as a potential next crypto to explode, with a projected 500% ROI if early momentum continues.

Users can buy $PEPENODE with ETH, BNB, USDT, or credit and debit cards. The project recommends Best Wallet, a leading non-custodial wallet.

For added security, Coinsult has fully audited Pepenode’s smart contract, ensuring a safe and transparent system.

Visit Pepenode

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Spot platinum and palladium both fell by more than 3%.