Ethereum Staking Demand Spikes with Tom Lee’s BitMine Leading

Ethereum ETH $3 227 24h volatility: 1.9% Market cap: $389.53 B Vol. 24h: $24.84 B staking demand is once again on the rise, with a major drop in the exit queue for the first time since July 2025. Market analysts noted that this could ease the near-term selling pressure on ETH. Moreover, institutional players like Tom Lee’s BitMine Technologies (NASDAQ: BMNR) have increased their ETH staking recently.

Ethereum Staking Validator Exit Queue On Decline

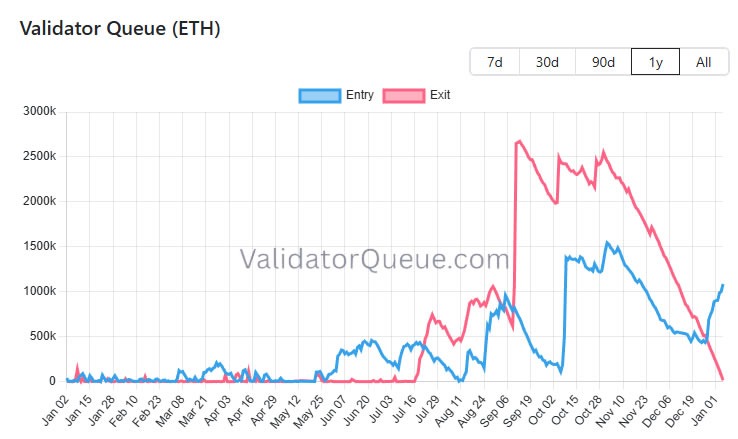

According to the data provided by beaconcha.in, the current validator exit queue stands at just 32 ETH, with a wait time of roughly one minute. This represents a decline of about 99.9% from the mid-September 2025 peak, when more than 2.67 million ETH were queued for exit.

Ethereum Validator Exit Queue | Source: Validator Queue

At the same time, the staking entry queue has risen to approximately 1.3 million ETH. This is the highest level reported since mid-Nov. 2025, which shows a renewed interest from participants looking to stake ETH.

Commenting on the shift, Rostyk, chief technology officer at Asymetrix, said the exit queue is now “basically empty.” He added that a very negligible number of stakers want to withdraw their ETH.

Experts noted that the revival of ETH staking demand could reduce the selling pressure on ETH, driving potential price upside.

BitMine Accelerates ETH Staking, Grayscale Offers First Reward

The world’s largest ETH treasury firm BitMine (BMNR) has accelerated its ETH staking activity in recent weeks. This shows rising institutional demand, tightening the overall ETH supply in the market.

The company began staking Ether on Dec. 26 and added another 82,560 ETH, worth nearly $260 million. According to data from Arkham Intelligence, BitMine staked an additional 186,336 ETH, worth $605 million, in the last 12 hours.

This latest move brings BitMine’s total staked Ether to about 779,488 ETH, representing more than $2.5 billion locked into the Ethereum network. The staked ETH is removed from active trading circulation and instead earns staking yield.

It leads to tighter ETH liquidity that can drive ETH price higher. As of press time, ETH is trading 1.59% up at $3,219 with daily trading volume surging 50% to over $25 billion.

nextThe post Ethereum Staking Demand Spikes with Tom Lee’s BitMine Leading appeared first on Coinspeaker.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council