Bitcoin Price Faces Heavy Sell Pressure Near $94,000—Is the BTC Rally Losing Momentum?

The post Bitcoin Price Faces Heavy Sell Pressure Near $94,000—Is the BTC Rally Losing Momentum? appeared first on Coinpedia Fintech News

After printing consecutive bullish candles, the Bitcoin bulls are facing some resistance, which is causing the price rise to stall. The token has been attempting to break the $94,000 barrier consistently since December but has thus far been unsuccessful. With this, it could appear that the momentum could be cooling off, but the BTC price remains above the key support zone. Therefore, with sellers defending overhead levels and buyers stepping in only on dips, the market is entering a critical decision phase.

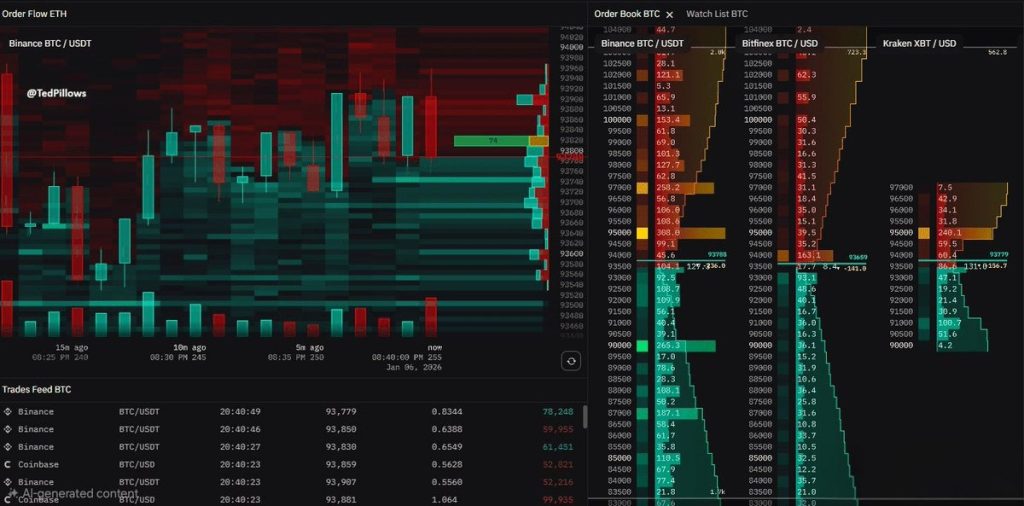

Order Flow Shows Aggressive Sell Walls Above Price

Currently, the BTC price is trading around $92,000, after facing repeated rejection near this zone. While buyers continue to defend the downside, the latest order book and heatmap data suggest that sellers remain firmly in control at higher levels.

The order-flow heatmap highlights dense sell liquidity clusters between $94,500 and $96,000 on major exchanges, including Binance, Bitfinex, and Kraken. These sell walls have repeatedly absorbed buy pressure, preventing Bitcoin from sustaining a breakout.

Source: X

Source: X

Large resting sell orders are visible just above $94,000, while cumulative asks increase sharply closer to $95,000. This explains why upward moves have stalled quickly despite multiple attempts. The trades feed shows consistent market buying near $93,500–$93,800, indicating that dip buyers are still active. However, this demand appears reactive rather than aggressive, stepping in only when the price pulls back instead of chasing higher levels. This behavior keeps BTC locked in a tight range, with neither side willing to fully commit.

The current liquidity distribution suggests a compression phase rather than a clean breakout setup. While downside liquidity below $92,000–$91,000 looks thinner compared to overhead resistance, buyers have so far managed to prevent a sharp breakdown.

From a market-structure perspective:

- Above $94K: Heavy sell-side dominance

- Below $92K: Buyers step in, but cautiously

- Between $92K and $92K–$94K: Choppy, low-conviction trading

What This Means for Bitcoin Price Action

Order-flow data indicates that Bitcoin needs clear absorption of sell walls near $94,500–$95,000 to unlock further upside. Without that, price is likely to remain range-bound or face renewed rejection from overhead supply.

As seen in the above chart, after breaking the decisive symmetric triangle, the BTC price faced resistance between $93,500 and $94,500. The RSI and the OBV also displayed a sharp bearish divergence along with the price. This suggests the bullish momentum has stalled, and as the CMF remains under 0, no major liquidity is supporting the upswing. Therefore, the Bitcoin price is believed to remain consolidated below the resistance zone but defend the support zone at the 50-day MA around $89,200.

The Bottom Line

From a trading perspective, Bitcoin remains capped below the $94,500–$95,000 supply zone, where repeated sell absorption is visible on the order-flow heatmap. A sustained break and acceptance above this region could open the door toward $98,000, followed by the psychological $100,600 level. On the downside, failure to hold $92,000 would expose BTC to a deeper pullback toward $90,400 and potentially $88,800, where buyers have previously stepped in. Until one of these levels gives way with volume, Bitcoin is likely to remain in a range-bound, high-volatility environment.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council