Compression at $0.41 on Cardano ADA crypto sets up the next move

Price action on Cardano ADA crypto is locked in a tight range around a key level, with volatility compressed and the next impulsive leg likely to be sharp once it breaks.

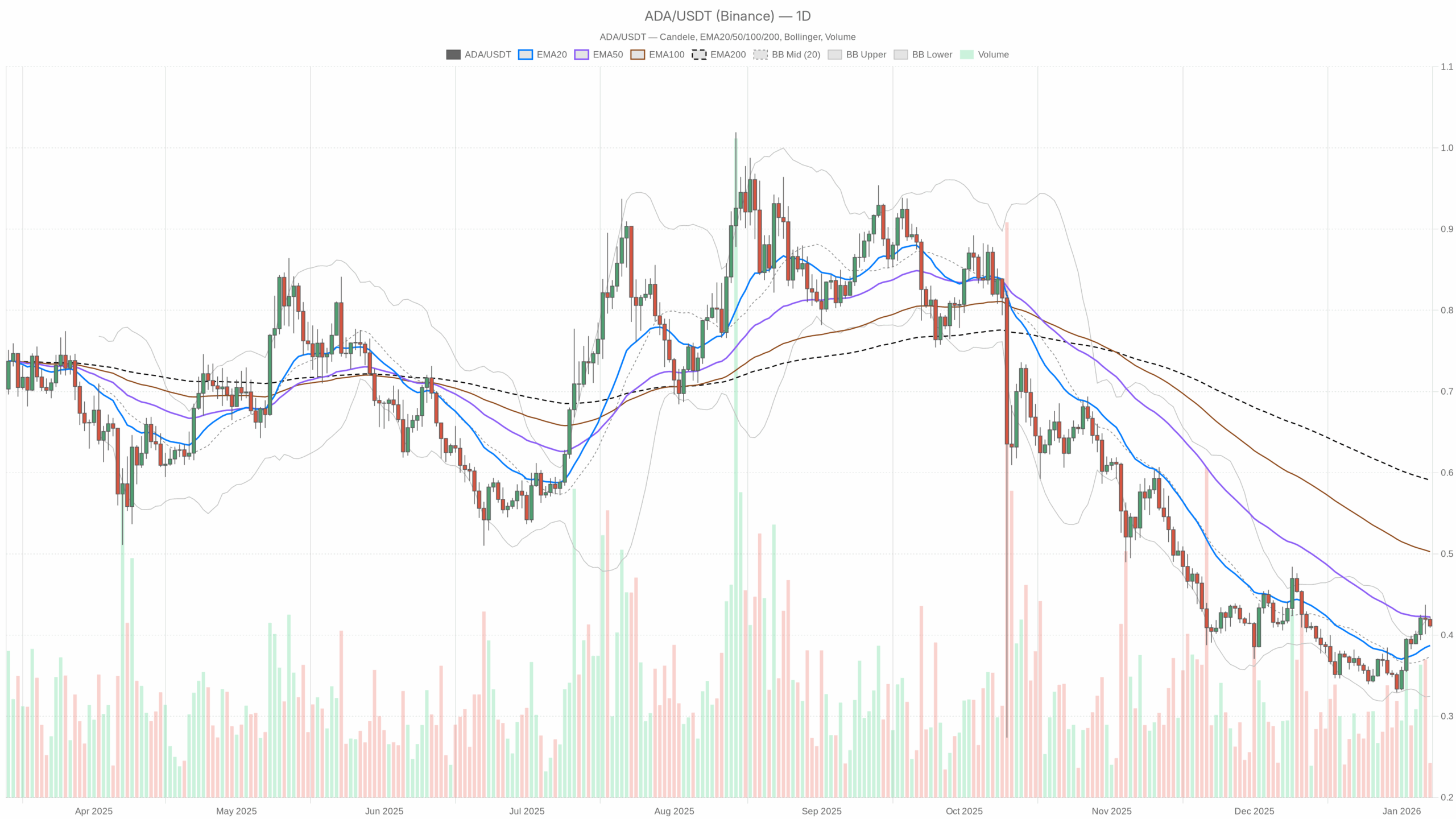

ADA/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

ADA/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Daily chart (D1): neutral base with a mild bullish tilt

Trend and EMAs: early recovery under a heavy 200-day cap

On the daily, ADA closes at $0.41:

- Price vs EMA20/50/200: close $0.41, EMA20 $0.39, EMA50 $0.42, EMA200 $0.59.

Price has reclaimed the 20-day EMA and is hovering just below the 50-day, while still miles under the 200-day. That tells you the short-term downtrend has stalled and flipped into a tactical rebound, but the broader cycle is still bearish. In other words, the market is willing to trade ADA tactically on the long side, yet nobody believes in a full trend reversal as long as it is pinned under the 200-day near $0.59.

RSI: momentum back to the middle

RSI 14 (D1): 55.98

Momentum has recovered into the upper half of the range without being overbought. That is typical of a market coming out of a weak phase and moving into a more balanced, two-sided environment. Buyers have the ball short term, but they are not driving a breakout yet.

MACD: early bull crossover, but not explosive

- MACD line: 0

- Signal: -0.01

- Histogram: 0.01

The MACD has nudged into a small positive crossover with a shallow histogram. This is what early stabilization looks like: the aggressive downside phase has ended, but the follow-through from buyers is still modest. It backs the idea of a constructive base rather than a powerful trend.

Bollinger Bands: sitting toward the upper band in a still-narrow range

- Mid-band: $0.37

- Upper band: $0.42

- Lower band: $0.32

- Close: $0.41

Price is riding near the upper band while the band width is still relatively contained. That is a sign of mild upside pressure within a volatility squeeze, not a full volatility expansion yet. ADA is leaning higher inside a range rather than breaking out with real power.

ATR: compressed volatility, coiled for a move

ATR14 (D1): $0.02

Daily ATR of two cents on a $0.41 asset is low. The range has tightened, which is exactly what you see before bigger trend legs in crypto. It does not tell you direction, only that traders should not get used to this calm.

Daily pivots: $0.41 as the balance point

- Pivot (PP): $0.41

- R1: $0.42

- S1: $0.41

Price is basically glued to the daily pivot. The first resistance at $0.42 is aligned with the upper Bollinger Band and close to the EMA50, making that zone a logical short-term decision area. A decisive daily close above there would be the first real win for bulls. However, repeated failures would keep ADA boxed in and open the door to another rotation lower.

Putting it together, the daily timeframe defines a neutral regime with a soft bullish bias. Short-term trend and momentum are turning up, but the larger bearish structure is untouched.

1-hour chart (H1): micro-range, structure flat

- Close: $0.41

- EMA20: $0.41

- EMA50: $0.41

- EMA200: $0.39

- RSI 14: 46.19

- MACD: flat (line ≈ signal, hist ≈ 0)

- Bollinger Bands: mid $0.41, upper $0.42, lower $0.41

- ATR14: $0.01

On the 1-hour chart, ADA is fully range-bound. Price is sitting right on top of the short EMAs, which themselves are flat, with the 200-hour EMA slightly below at $0.39. That supports the idea of a mild intraday up-bias but no real momentum.

RSI in the mid-40s and a dead MACD tell the same story. There is no clear intraday dominance from either side. The Bollinger Bands are extremely tight, clipped around $0.41–0.42. Paired with a tiny ATR, this is classic intraday compression, where liquidity is being built, not chased.

In relation to the daily setup, the H1 is not confirming a strong bullish extension. Instead, it is consolidating just under the key near-term resistance cluster ($0.42 / EMA50 D1 / upper band D1). That keeps the door open both to a breakout continuation and a failed attempt.

15-minute chart (M15): execution timeframe, pure chop

- Close: $0.41

- EMA20/50/200: all ≈ $0.41

- RSI 14: 43.16

- MACD: flat

- Bollinger Bands: mid $0.41, upper $0.42, lower $0.41

- ATR14: ≈ 0

The 15-minute chart is pure noise at the moment. All EMAs are on top of each other, momentum is slightly soft (RSI low-40s), and volatility is almost non-existent. This is the definition of a chop zone where market makers, not trend traders, are in control.

For active traders, this timeframe only matters for entries and risk placement. Any move you see here needs confirmation from H1 or D1. Otherwise, it is just micro-structure.

On-chain / DeFi context: activity improving under the hood

The interesting backdrop for Cardano is on-chain. Major Cardano DEXs — Minswap, WingRiders, SundaeSwap V2, Splash Protocol — are all showing strong fee growth over 7–30 days, with some printing several-hundred-percent increases in 30-day fees. That usually means higher trading volumes, more users cycling through the ecosystem, and increasing speculative activity on ADA pairs and Cardano-native tokens.

Yet, price has not broken out. The market is cautious, with the global sentiment index in Fear and BTC dominance elevated above 56%. So there is a tension. Fundamentals inside the Cardano ecosystem are improving, but macro crypto positioning remains defensive. That is exactly the kind of mismatch that can resolve violently once risk appetite shifts, in either direction.

Dominant scenario from D1: neutral with upside skew

Given the D1 data, the main scenario is neutral, leaning slightly bullish. Short-term trend and momentum are supportive, but the long-term downtrend and macro risk-off backdrop cap expectations.

Bullish scenario for Cardano ADA crypto

In the constructive case, ADA uses this tight range as a launching pad.

What it needs to do:

- Break and hold above $0.42 on a daily closing basis, clearing R1, the upper Bollinger Band, and essentially the EMA50 cluster.

- See daily RSI push firmly into the 60–65 area while MACD histogram extends higher, confirming that buyers are not just squeezing shorts but are actually building a trend leg.

- Expand ATR upward, with wider daily ranges in favor of green candles, showing genuine follow-through instead of a fake breakout.

If those conditions line up, the path opens toward the next structural zones: first the mid-$0.40s, and then the more meaningful battleground around the 200-day EMA near $0.59. That 200-day region is where the narrative would shift from a tactical bounce to a conversation about a genuine medium-term reversal.

What would invalidate the bullish setup?

- A clean rejection from the $0.42 area with multiple failed attempts, followed by a daily close back under $0.39, beneath the 20-day EMA.

- RSI rolling back under 50 on the daily while MACD flips back toward negative territory, signaling that the current uptick was just a dead-cat bounce.

- Volatility expansion to the downside, with bigger red days out of this compression instead of green ones.

Bearish scenario for Cardano ADA crypto

The bear case is that this entire consolidation is merely distribution under the 50-day EMA in a still-bearish market regime.

What that would look like:

- Price fails repeatedly at $0.42 and gradually starts printing lower highs on the H1 or D1 structure.

- A decisive break below $0.39 with a daily close under the 20-day EMA, turning that level into resistance instead of support.

- Daily RSI slipping back toward the low-40s or below, with MACD rolling negative and the histogram extending lower.

From there, the door opens to revisit the lower part of the Bollinger range, initially toward the mid-$0.30s. If the broader crypto market stays risk-off and BTC dominance keeps grinding higher, altcoins like ADA usually underperform, and deeper tests of prior support become more likely.

What would invalidate the bearish angle?

- A strong, high-volume daily close above $0.42–0.44, turning that area into a new support band.

- Daily RSI holding comfortably above 55–60 even on pullbacks, indicating that dips are being bought, not sold.

- H1 structure shifting into a sequence of higher highs and higher lows that actually holds on dips, instead of rolling back into the range.

Positioning, risk and uncertainty

Right now, Cardano ADA crypto is a market in waiting. The daily trend structure still says cautious, the intraday charts say chop, but on-chain activity and DeFi usage hint that interest in the ecosystem is quietly rising. That blend usually favors traders who respect the range first and the breakout story second.

From a positioning standpoint, this is a place where sizing and patience matter more than direction. Volatility is compressed, which means the eventual move out of this $0.39–0.42 box is likely to be fast and emotional. The technical levels are clear: $0.39 as the near-term line in the sand for the short-term up-bias, $0.42 as the local ceiling, and the 200-day EMA around $0.59 as the bigger structural checkpoint. How price behaves as it interacts with those levels will tell you far more than any single indicator snapshot today.

If you want to monitor markets with professional charting tools and real-time data, you can open an account on Investing using our partner link:

Open your Investing.com account

This section contains a sponsored affiliate link. We may earn a commission at no additional cost to you.

Disclaimer: This analysis is for informational and educational purposes only and is based on publicly available market data at the time of writing. It is not investment, trading, or financial advice, and it should not be the basis for any investment decision. Cryptoassets are highly volatile and carry a significant risk of loss, including the possible loss of all capital invested. Always conduct your own research and consider your risk tolerance before engaging in any trading or investment activity.

You May Also Like

Trump-Linked World Liberty Financial Seeks National Trust Bank Charter for USD1 Stablecoin

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?