USDC Minted: 250 Million Dollar Stablecoin Injection Sparks Market Liquidity Surge

BitcoinWorld

USDC Minted: 250 Million Dollar Stablecoin Injection Sparks Market Liquidity Surge

On-chain analytics platform Whale Alert reported a significant blockchain transaction on March 21, 2025, revealing that the USDC Treasury minted a substantial 250 million USDC. This single event, representing a quarter-billion dollars in new stablecoin supply, immediately captured the attention of traders, analysts, and decentralized finance (DeFi) protocols globally. Consequently, market participants began scrutinizing the potential catalysts and ramifications for digital asset liquidity. Such a sizable mint often precedes notable capital movements within the cryptocurrency ecosystem.

USDC Minted: Decoding the Treasury’s Quarter-Billion Dollar Move

The act of minting USDC involves Circle, the issuer, creating new tokens against an equivalent reserve of U.S. dollars held in regulated financial institutions. This process is fully transparent and auditable on the blockchain. When 250 million USDC is minted, it signals that institutional or corporate partners have deposited an equal amount of cash to acquire the stablecoin. This mechanism ensures the stablecoin maintains its 1:1 peg to the U.S. dollar. Therefore, a mint of this scale is a direct indicator of incoming fiat capital seeking entry into the digital asset space.

Historically, large USDC mints have correlated with increased trading activity and liquidity provision on centralized and decentralized exchanges. For instance, similar mints in early 2024 preceded periods of heightened volatility and capital rotation. Analysts from firms like Glassnode and CoinMetrics often track these treasury movements as a leading indicator of institutional intent. The minting process itself is a foundational element of the stablecoin’s operational model, ensuring scalability to meet market demand.

The Ripple Effect on Cryptocurrency Market Liquidity

A fresh injection of 250 million USDC directly impacts market depth and trading pairs across the board. Major exchanges like Coinbase and Binance list hundreds of trading pairs against USDC. This new supply can alleviate selling pressure on other assets by providing a deep pool of stable buying power. Moreover, in DeFi ecosystems on Ethereum, Polygon, and Solana, USDC serves as the primary collateral and liquidity asset for lending protocols and automated market makers.

- Enhanced Market Depth: Additional USDC increases the available bids on order books, potentially reducing slippage for large trades.

- DeFi Yield Opportunities: New capital often flows into lending protocols like Aave and Compound, seeking yield and thereby lowering borrowing rates temporarily.

- Arbitrage Stability: Ample supply helps arbitrageurs maintain the USDC peg across various trading venues and blockchain networks.

Data from previous liquidity events shows that such mints can stabilize markets during periods of stress by providing a reliable exit into dollar-pegged assets.

Expert Analysis: Interpreting Whale Alert’s Signal

Blockchain analysts emphasize that the entity requesting the mint is the critical variable. While the treasury action is public, the beneficiary’s identity often remains private until they move the funds. “A mint of this size is rarely speculative,” notes a researcher from a major crypto analytics firm. “It typically represents a pre-planned capital deployment by a financial institution, trading desk, or large enterprise preparing for a specific transaction, such as an OTC trade or collateral posting.”

Furthermore, the timing is analyzed against broader macroeconomic conditions. With the Federal Reserve’s monetary policy in 2025 influencing traditional and digital markets, large stablecoin mints can reflect a strategic shift into crypto-native dollars. This move potentially hedges against banking system friction or seeks operational efficiency in global settlements. The transparency of the blockchain provides a real-time ledger of these macro-financial shifts.

Stablecoin Dynamics and the Broader Financial Ecosystem

The stablecoin sector, led by USDC and its main competitor Tether (USDT), forms a multi-trillion-dollar settlement layer. The decision to mint USDC specifically, rather than another stablecoin, can indicate a preference for its regulatory clarity and full-reserve auditing. Circle operates under U.S. money transmitter licenses and subjects its reserves to monthly attestations by a major accounting firm. This compliance framework makes USDC the preferred choice for regulated entities and traditional finance bridges.

Recent Major Stablecoin Minting Events (2024-2025)| Stablecoin | Amount | Date | Noted Context |

|---|---|---|---|

| USDC | 250 Million | Mar 21, 2025 | Reported by Whale Alert |

| USDT | 1 Billion | Feb 10, 2025 | Preceded a market rally |

| USDC | 500 Million | Jan 5, 2025 | Tied to a known institutional onboarding |

This ecosystem’s health is vital for the functioning of crypto markets. It provides the necessary liquidity for everything from NFT purchases to corporate treasury management on blockchain networks. As such, treasury minting activity is a key pulse point for the entire industry’s financial plumbing.

Conclusion

The report of 250 million USDC minted at the USDC Treasury is a significant event that underscores the growing integration of traditional capital with blockchain-based finance. This action directly increases the stablecoin supply available for trading, lending, and collateralization across global markets. By analyzing such on-chain data, market participants gain valuable insights into liquidity flows and institutional behavior. Ultimately, transparent events like this USDC minting reinforce the critical role stablecoins play in providing efficiency and stability within the modern digital asset landscape.

FAQs

Q1: What does it mean when USDC is “minted”?

Minting USDC means the issuer, Circle, creates new tokens. This process occurs after an equivalent amount of U.S. dollars is deposited into its reserved accounts, ensuring the stablecoin remains fully backed.

Q2: Who typically requests a large USDC mint of 250 million?

Large mints are usually requested by institutional players. This includes cryptocurrency exchanges, hedge funds, market makers, or large corporations preparing for major transactions like over-the-counter (OTC) trades.

Q3: Does minting new USDC cause inflation or affect its price peg?

No. Each USDC is minted 1:1 against a U.S. dollar deposit, so it does not cause inflationary devaluation. The primary goal is to meet market demand for liquidity while strictly maintaining the dollar peg.

Q4: How can I verify that the 250 million USDC mint actually happened?

You can verify the transaction by using a blockchain explorer like Etherscan. Search for the USDC contract address and look for the large “Mint” transaction from the official treasury address on the date reported.

Q5: What is the immediate impact of such a mint on DeFi protocols?

The immediate impact is an increase in available stablecoin liquidity. This can lead to slightly lower lending rates on platforms like Aave as supply increases. It also provides more capital for liquidity pools on decentralized exchanges.

This post USDC Minted: 250 Million Dollar Stablecoin Injection Sparks Market Liquidity Surge first appeared on BitcoinWorld.

You May Also Like

Why Following Sui Crypto News Gives Early Insight Into Cross-Chain and Interoperability Trends

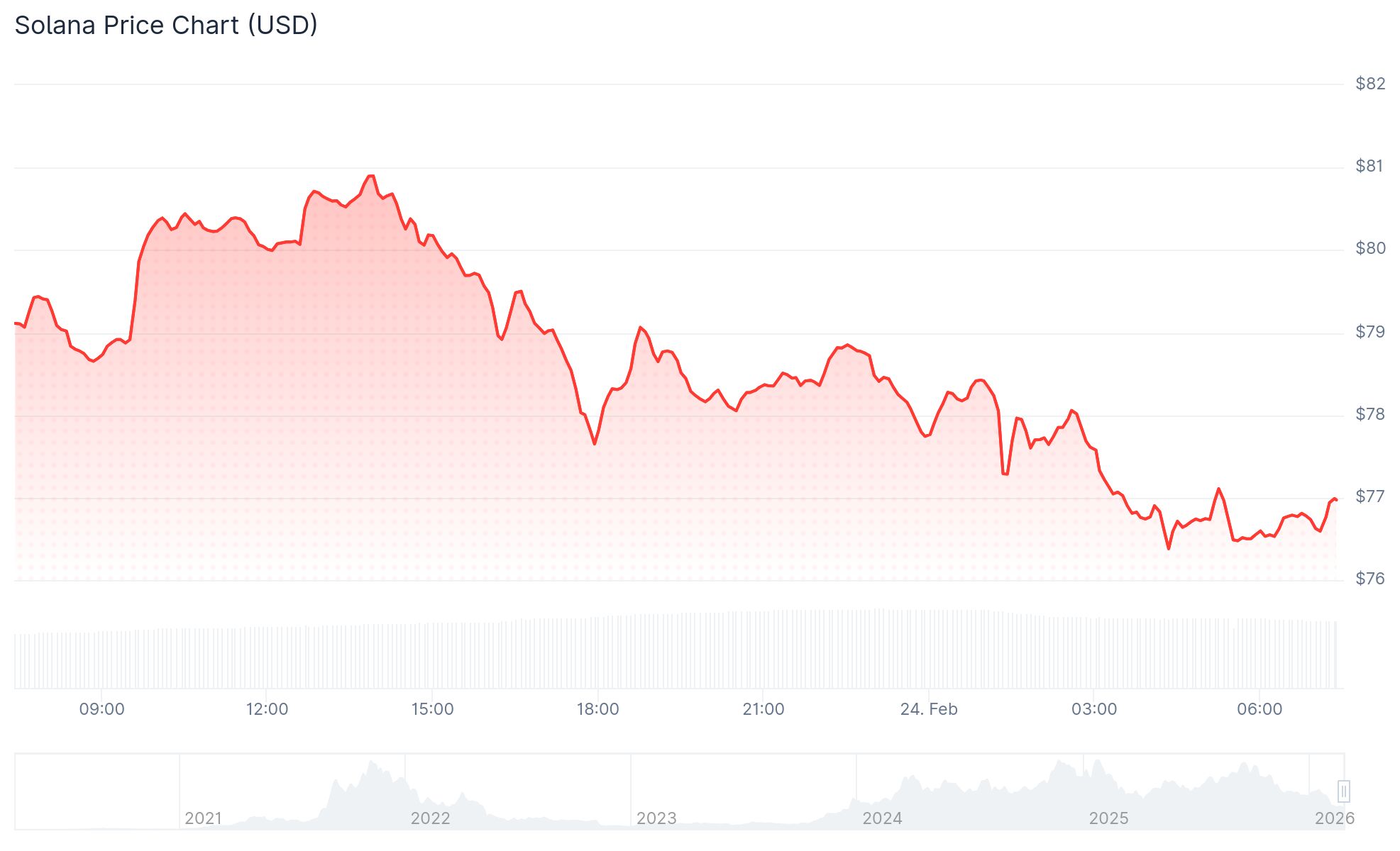

Solana (SOL) Price: Most SOL Holders Are Underwater as Token Drops to $76