El Salvador Strengthens State Reserves With Additional Bitcoin Purchases

- El Salvador has resumed Bitcoin purchases, adding to its national reserves as part of ongoing digital asset integration efforts.

- The latest acquisitions reinforce the country’s strategy to diversify reserves and support the use of Bitcoin in its economy.

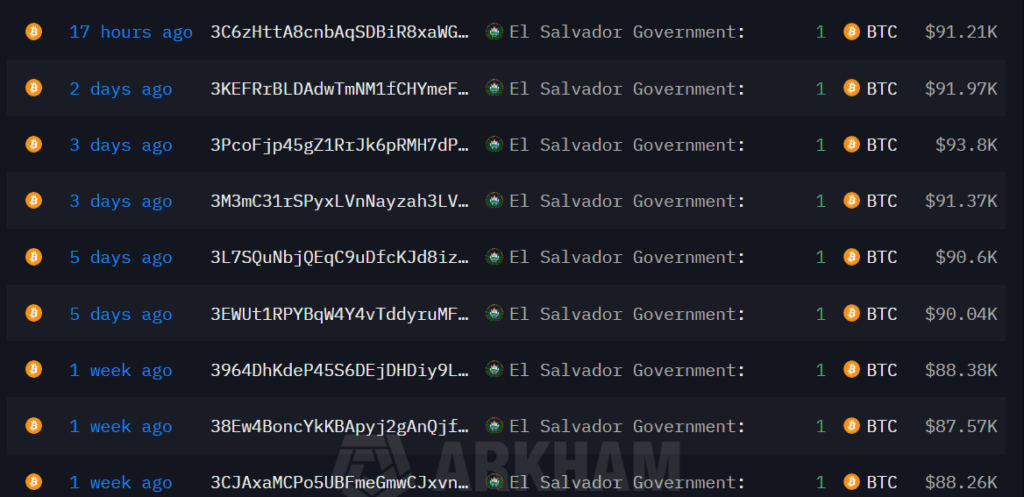

El Salvador has added additional Bitcoin to its national reserves as the Central American nation continues its high-profile embrace of digital assets. The latest purchase marks another step in the government’s multi-year effort to integrate Bitcoin into its financial strategy following the asset’s adoption as legal tender in 2021.

(Source: Arkaham)

(Source: Arkaham)

According to data, the reserves of El Salvador in Bitcoin have surged to about 7,500 BTC, worth $6.77 million, symbolizing the consistent accumulation pursued by the government through its reserve strategy and daily purchase policy initiated in 2021. The move to buy Bitcoin is occurring at a time when the world is debating how to diversify with Bitcoin.

President Nayib Bukele, who has championed Bitcoin adoption since his administration enacted the legal tender law in 2021, has regularly confirmed incremental purchases through public channels, citing long-term reserve strengthening as a key rationale. The government’s Bitcoin acquisition strategy has been ongoing for several years, with purchases timed at various market levels.

Observers note that El Salvador’s approach is unique among sovereign nations, as few governments have formally integrated Bitcoin holdings into national reserve management. By continuing to add to its Bitcoin stockpile, El Salvador reinforces its position at the forefront of experimentation with crypto-enabled reserve diversification.

Context of Bitcoin Adoption in El Salvador

El Salvador became the first nation to recognize Bitcoin as legal tender in 2021, a move that sparked global attention and debate among policymakers, investors, and international financial institutions. The government introduced a digital wallet platform, Chivo Wallet, to facilitate Bitcoin transactions and disburse incentives to users, though adoption rates have varied across different segments of the population.

Officials have described Bitcoin integration as a means to reduce remittance costs, broaden financial inclusion, and attract foreign investment into the country. Remittances account for a significant portion of El Salvador’s GDP, making cost-efficient and secure transfer mechanisms an important policy focus.

Critics of the policy have expressed concerns over volatility risk and fiscal implications for a developing economy, while proponents argue that long-term adoption could reduce reliance on traditional currency reserves and create new financial infrastructure opportunities.

The ongoing addition of Bitcoin to national holdings occurs as the broader crypto market continues to evolve, with Bitcoin prices fluctuating based on macroeconomic factors, regulatory developments, and investor sentiment. El Salvador’s reserve strategy effectively places digital assets alongside traditional reserve instruments as part of a hedging and diversification play.

El Salvador’s continued accumulation of Bitcoin reinforces its status as a pioneer in integrating digital assets into sovereign reserve management. By expanding its Bitcoin holdings, the nation underscores a broader strategy of fiscal diversification and digital innovation, even as debates persist about the long-term implications of such policies. As Bitcoin’s role in global finance continues to evolve, El Salvador’s experience will remain a closely watched case study in sovereign digital asset adoption.

Highlighted Crypto News:

Zcash Developers Quit ECC After Board Dispute, ZEC Price Drops

You May Also Like

Tom Lee’s Bitmine stakes $3.9 billion in Ethereum, hits nearly 70% of accumulation goal

Surprising Decision from Dubai! “These Altcoins Are Completely Banned!”