Trump’s WLFI is pivoting to “narrow banking,” a move that exposes the fatal flaw of competitors

On Jan. 7, Donald Trump’s World Liberty Financial (WLFI) formally applied for a national banking charter to establish the “World Liberty Trust Company.”

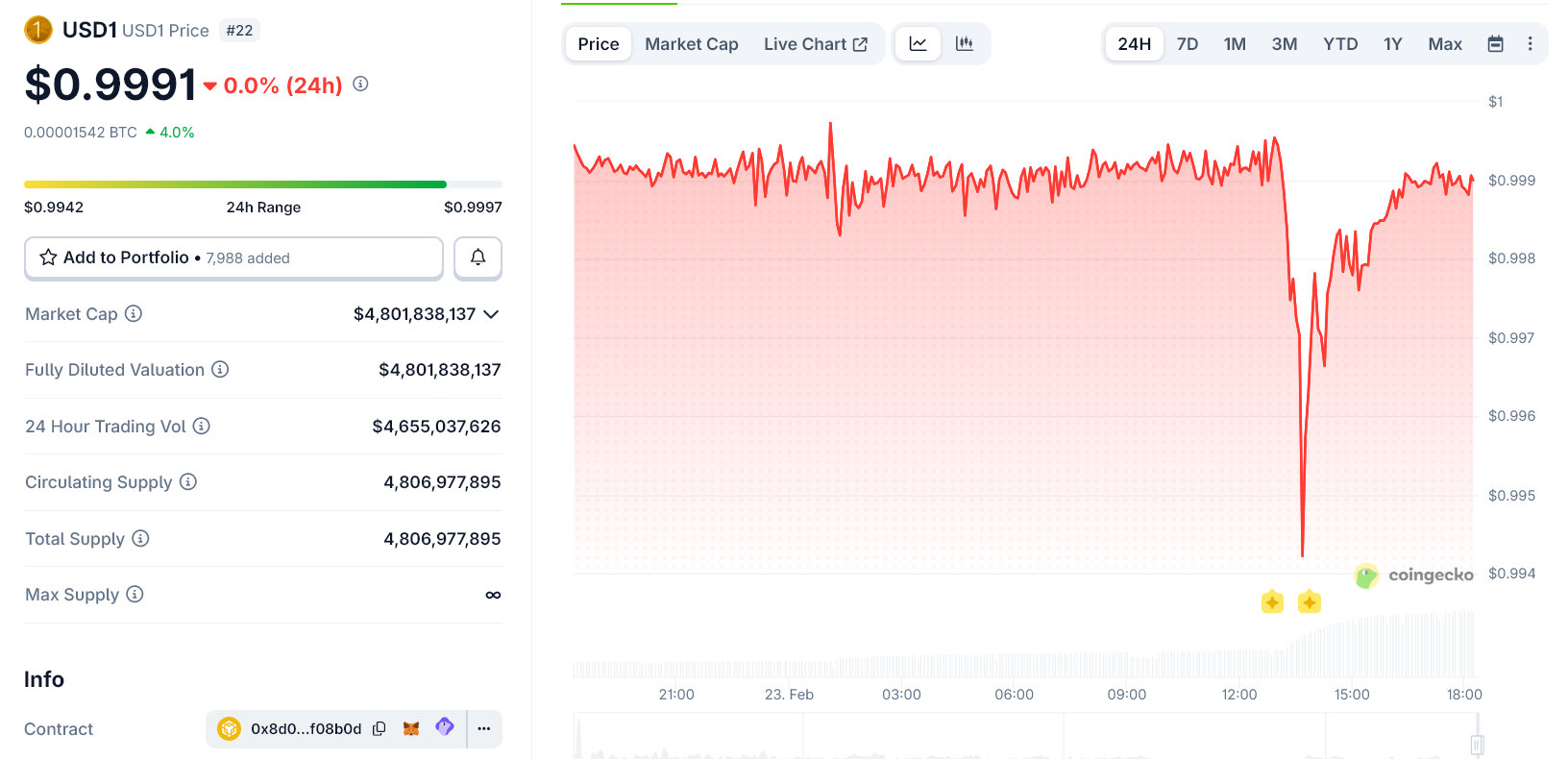

This is a proposed national trust bank specifically designed to handle USD1 stablecoin issuance, custody, redemption, and reserve management. USD1 is WLFI's flagship product, with more than $3.3 billion in supply across 10 blockchain networks.

On the surface, the move appears to be a standard compliance upgrade—a predictable attempt by a high-profile crypto issuer to appear more “institutional” to skeptical observers.

However, a closer examination of the application reveals a more complex, forward-looking wager on the trajectory of the digital asset market.

WLFI’s move represents a bet that stablecoins are evolving away from their roots as the dollar chips that power speculative trading and toward a future as regulated settlement infrastructure that banks, payment firms, and large multinational corporations can plug into their daily operations.

From market hack to infrastructure

To understand the strategic logic behind WLFI's application, one must first examine how the role of stablecoins is shifting.

For most of their history, stablecoins have functioned effectively as a market hack. They provided a dollar-like instrument that could move 24/7 across global networks without touching the slow-moving banking system at every hop.

That “outside the perimeter” status was a critical advantage that allowed stablecoins to scale rapidly during the early boom years of crypto.

However, it also kept the asset class trapped in a regulatory gray zone—sufficient for decentralized finance (DeFi) protocols and offshore exchanges, but far too risky for mainstream payments or corporate balance sheets.

That dynamic fundamentally changed as Washington began formalizing stablecoin rules in 2025.

Regardless of the political optics surrounding the Trump-linked project, the market effect of this regulatory shift is straightforward: once a federal framework exists, regulatory status becomes a distinct product feature that institutions can underwrite.

If stablecoins are ever going to power serious economic activity, such as payroll, cross-border remittances, merchant settlement, or wholesale treasury operations, the issuers behind them need to offer more than monthly attestations and marketing promises. They need regulators.

A trust bank charter is perhaps the clearest way to package that message to the market. It would place the issuance and custody of WLFI's “USD1” stablecoin under a single federal supervisor.

It wraps the entire operation in bank-grade governance, examinations, and controls without requiring the firm to become a traditional deposit-taking, lending bank.

This distinction is critical to the application. A national trust bank is indeed “banking,” but it is “narrow banking.” It focuses on fiduciary activities, such as custody and asset safekeeping, rather than credit creation.

This is a corporate structure that cleanly maps to the ideal vision of a stablecoin: fully backed, redeemable, and used primarily for payments rather than for leverage.

The strategic logic of the trust charter

WLFI's pitch implicitly assumes that stablecoin adoption is entering a new era. In this phase, distribution will not be gated by the number of trading pairs an issuer can land on a decentralized exchange, but by compliance.

So, the application for a national trust charter appears designed to secure advantages on three specific fronts.

First, it aims to secure counterparty confidence.

Large exchanges, market makers, payment processors, and enterprise treasury desks are increasingly treating stablecoins as financial plumbing. When an asset functions as plumbing, users prioritize safety and predictability over novelty.

In this context, a federal charter is “boring” in exactly the right way. It signals the presence of strict controls, mandatory reporting, and an examiner with the authority to force operational changes—factors that risk committees at major financial institutions demand.

Second, the charter offers a path toward vertical integration and margin capture. The economics of the stablecoin business are simple but powerful: issuers earn the spread on the reserves they hold, which are typically invested in short-dated government securities.

From that revenue, they must pay operating costs, compliance fees, distribution incentives, and partner fees.

If WLF is currently relying on third-party vendors for custody and operational rails, securing a trust bank charter would allow it to internalize significant parts of that stack.

In a market environment where yield curves shift and issuer incentive wars intensify, owning the entire stack can be the difference between achieving profitable scale and relying on perpetual subsidies to survive.

Third, the charter provides a plausible path toward deeper payment connectivity. The industry’s “north star” remains access to the core US payment system.

While a trust bank charter does not guarantee direct access to the Federal Reserve, it places an issuer in a regulatory category that makes such conversations more credible.

The goal is not for WLFI to suddenly transform into a consumer bank. Rather, WLFI is attempting to make USD1 legible to conservative financial institutions that are being told, by both law and internal policy, what a “real” stablecoin is supposed to look like.

Zach Witkoff, the proposed President and Chairman of World Liberty Trust Company, said:

The macro stakes

Beyond the immediate mechanics of banking, stablecoins are increasingly a monetary macro story disguised as a crypto story.

The sector's profitability is increasingly tied to interest rates. When short-term rates are high, stablecoin reserves generate meaningful income, subsidizing growth and incentives. When rates fall, that easy revenue compresses, forcing issuers to compete much harder on distribution and utility.

In either scenario, scale is paramount. The stablecoin market has grown large enough that reserve management is no longer a side detail for issuers; it is the business model itself. This is why regulation is rapidly becoming an economic moat.

In a high-rate environment, even mediocre issuers can afford to fund incentives to attract users. However, in a lower-rate environment, the durable winners will be issuers with the broadest acceptance and the lowest compliance costs.

These firms can operate on tighter margins without losing their users' trust or access to banking rails.

If the market consensus holds that 2026 will bring some rate easing, WLFI's pursuit of a trust bank charter becomes a strategic hedge. It is a way to compete on structural efficiency when the strategy of “just pay more incentives” becomes less viable financially.

This comes as the competitive chessboard is shifting. For years, the market was a “duopoly-plus” dominated by Tether’s USDT offshore liquidity and Circle’s USDC, which positioned itself as the “regulated-ish” US-facing option.

The next wave, however, looks different. Banks, custodians, and regulated infrastructure providers are repositioning stablecoins as settlement layers.

This trend raises the bar for every issuer. When incumbents and regulated financial utilities begin integrating stablecoin settlement, they will naturally prefer counterparties with clear regulatory status, robust controls, and transparent auditability.

While this doesn’t eliminate existing incumbents, it opens a window for new entrants like WLFI to bundle regulation with distribution.

So, WLFI's banking application reads like an attempt to join that club before the door narrows further.

The post Trump’s WLFI is pivoting to “narrow banking,” a move that exposes the fatal flaw of competitors appeared first on CryptoSlate.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

OpenClaw Creator Bans Bitcoin, Crypto Chatter After Joining OpenAI