Iran’s Internet Blackout Could be Critical for Bitcoin

Amid anti-government protests, Iran’s near-total internet blackout today has raised a quiet but important question for Bitcoin mining.

The blackout is not a systemic threat to Bitcoin. But it does expose a fragile intersection between geopolitics, energy policy, and hashpower concentration that investors often overlook.

Iran’s Bitcoin Mining Industry Faces Massive Threat

Authorities in Iran sharply restricted internet access as nationwide protests escalated. Monitoring groups reported near-total outages, especially on mobile networks.

At first glance, this looks like a political story. However, Iran is also a meaningful—though no longer dominant—Bitcoin mining hub. That link makes the blackout relevant beyond Iran’s borders.

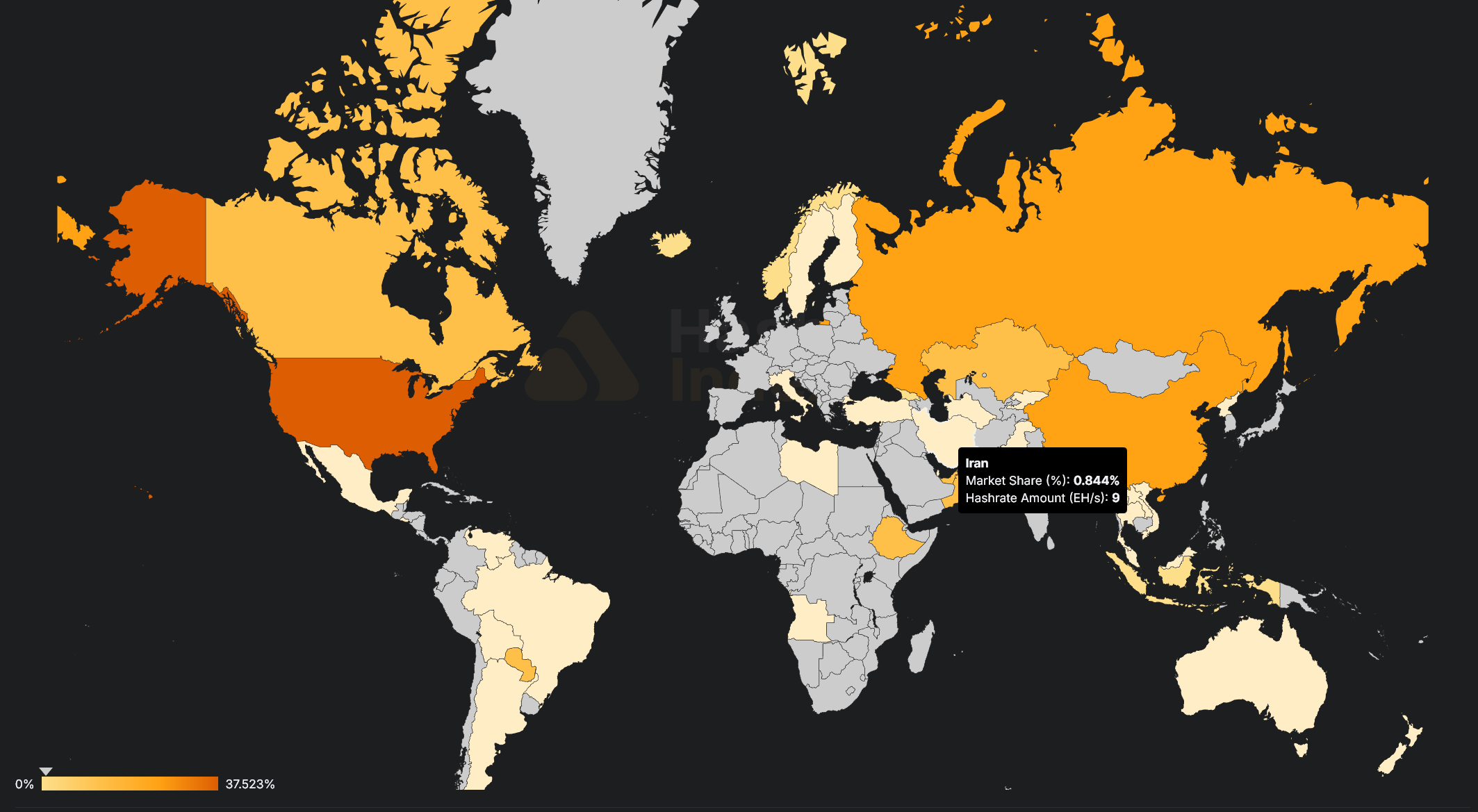

Iran contributes an estimated low-single-digit percentage of global Bitcoin hashrate. This is down sharply from its 2021 peak but still large enough to matter at the margins.

Cheap, subsidized energy made Iran attractive for mining. Sanctions pushed parts of the industry underground. Repeated crackdowns forced many operations to remain informal or semi-legal.

Importantly, Iran is not critical infrastructure for Bitcoin. The network no longer depends on any single country. But Iran remains a non-trivial contributor.

Global Bitcoin Mining Hashrate Map. Source: Hashrate Index

Global Bitcoin Mining Hashrate Map. Source: Hashrate Index

Does an Internet Blackout Stop Bitcoin Mining?

Not immediately. Most industrial mining farms rely on stable power and intermittent connectivity, not constant high-bandwidth internet.

Blocks propagate globally every ten minutes, and miners can remain operational even with limited access.

However, prolonged or unstable connectivity creates friction:

- Pool coordination becomes harder

- Firmware updates and payouts may be delayed

- Smaller or illicit miners face higher downtime risk

In short, the blackout raises operational costs rather than shutting mining down overnight.

Even a full Iranian outage would likely remove less than 5% of global hashrate. Bitcoin difficulty adjusts automatically. The network absorbs the shock.

However, if unrest spreads and energy rationing resumes, Iran-based miners could face sustained shutdowns. This would modestly tighten hashpower but not destabilize the chain.

Important to note that Bitcoin survived China’s 2021 mining ban, which removed over 40% of hashrate. Iran’s situation is orders of magnitude smaller.

Could Iran’s Crisis Hurt or Help Bitcoin?

The effects cut both ways.

On one hand, geopolitical instability reinforces Bitcoin’s decentralization narrative. No state can “turn off” the network. Hashpower migrates. The system adapts.

On the other hand, repeated crises highlight a real risk. Hashpower still follows cheap energy, often in politically fragile regions. That creates volatility at the edges.

For markets, Iran’s blackout is more symbolic than structural. It underscores resilience, not fragility.

The real story is not Iran alone. It is the ongoing redistribution of global mining.

As politically risky regions cycle in and out of mining, hashpower continues shifting toward regulated, energy-rich jurisdictions. Iran’s role is shrinking, not growing.

This blackout may disrupt local miners. It does not threaten Bitcoin. However, it does remind investors that the real long-term risks lie in energy policy, geopolitics, and how quickly miners can adapt.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Gold continues to hit new highs. How to invest in gold in the crypto market?