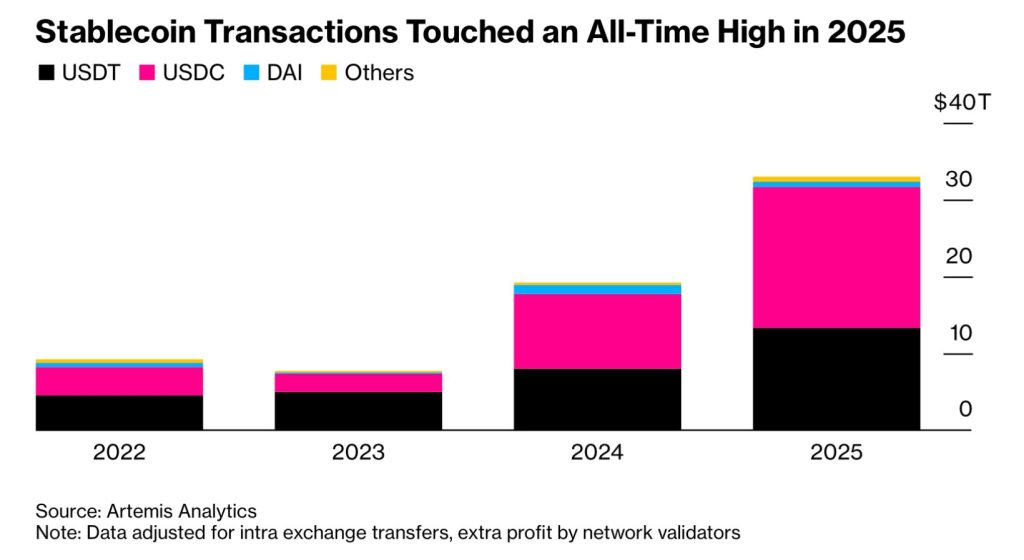

Stablecoin Transactions Soared 72% in 2025, Hit $33T With USDC in Lead

Global Stablecoin transaction value totalled $33 trillion in 2025, up 72% from the previous year, Bloomberg reported on Friday, citing data compiled by Artemis Analytics.

Circle-issued digital dollar USDC processed $18.3 trillion worth of transactions, leading the boom and becoming the most-used stablecoin by transaction flow. Meanwhile, Tether’s USDT stablecoin, which still leads by market cap of $187 billion, recorded US$13.3 trillion.

Source: Artemis Analytics

Source: Artemis Analytics

The unprecedented rise in stablecoin transactions comes after the passing of the Trump administration’s GENIUS Act in July 2025. Known as the Guiding and Establishing National Innovation for U.S. Stablecoins, the legislation is the first comprehensive regulatory framework for payment stablecoins in the country.

In a previous conversation with Cryptonews, Tether creator Reeve Collins said that the passing of laws like GENIUS paves the way for global acceptance of stablecoins.

“The reason why that’s so powerful… and all the large financial institutions get involved, is because, it’s lucrative,” he noted.

DeFi Users Prefer USDC – Here’s Why

According to Anthony Yim, co-founder of Artemis, decentralized finance or “DeFi” traders prefer the USDC stablecoin to frequently move in and out of positions.

Further, the “unstable geopolitical landscape” signalled mass adoption of digital US dollars, Yim added. Citizens of countries suffering inflation also prefer to hold USD-pegged stablecoins due to ease of access.

That said, Tether is a more widely used stablecoin for day-to-day payments and business transactions. Users prefer to simply hold its value in wallets rather than using it for moving around.

Stablecoin Transaction Flows to Hit $56T by 2030

Bloomberg Intelligence analysis predicted that the total stablecoin payment flows could reach $56 trillion by 2030. However, regulators such as the IMF have warned that stablecoins could disrupt traditional finance and growth.

Even though the growth isn’t slowing down. Artemis data noted that transaction volumes in the last quarter of 2025 alone recorded $11 trillion, compared to $8.8 trillion in Q3.

Elsewhere, the East is also building a distinct, sustainable path for digital assets, challenging Western dominance with pragmatic regulation.

Chengyi Ong, Head of Public Policy, APAC at Chainalysis, told Cryptonews, “unquestionably, stablecoins are a game-changer.”

Besides, the stablecoin dominance and the GENIUS Act have led to a broader adoption of digital assets among banking and tech giants such as Standard Chartered and Amazon, exploring launching their own stablecoin.

You May Also Like

YUL: Solidity’s Low-Level Language (Without the Tears), Part 1: Stack, Memory, and Calldata

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC