Optimism Price Prediction 2026, 2027 – 2030, Can the Superchain Vision Revive OP’s Long-Term Value?

The post Optimism Price Prediction 2026, 2027 – 2030, Can the Superchain Vision Revive OP’s Long-Term Value? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of Optimism is $ 0.31590746.

- OP could attempt a recovery toward $1.093 by 2026 if OP Stack usage, and governance-driven incentives.

- By 2030, Optimism could target the $7.20, if the Superchain becomes a core part of Ethereum’s

Optimism is not just another Ethereum Layer 2. It is the foundation of a broader vision called the Superchain, a network of interoperable rollups built using the open-source OP Stack.

These networks share infrastructure, security assumptions, and upgrade paths while remaining independent.

The OP token is mainly used for governance, helping decide upgrades, funding, and long-term plans, not just for paying fees. Because of this, OP’s value depends on developer use and decision-making power.

However, OP is now trading near $0.32, down about 82% from its yearly high, raising concerns about its future.

So, let’s look at Optimism’s price outlook for 2026, 2027, and 2030.

Optimism Price Today

| Cryptocurrency | Optimism |

| Token | OP |

| Price | $0.3159 |

| Market Cap | $ 614,153,325.39 |

| 24h Volume | $ 97,000,708.7485 |

| Circulating Supply | 1,944,092,497.00 |

| Total Supply | 4,294,967,296.00 |

| All-Time High | $ 4.8515 on 06 March 2024 |

| All-Time Low | $ 0.2518 on 26 December 2025 |

Table of contents

- Optimism Price Targets For January 2026

- Technical Analysis

- Optimism Price Prediction 2026

- Optimism (OP) Price Prediction 2026 – 2030

- Optimism Price Prediction 2026

- Optimism Price Prediction 2027

- Optimism Price Prediction 2028

- Optimism Price Prediction 2029

- Optimism Price Prediction 2030

- What Does The Market Say?

- CoinPedia’s Optimism(OP) Price Prediction

- FAQs

Optimism Price Targets For January 2026

January 2026 could become a sentiment-shifting month for Optimism due to a proposed OP token buyback plan. The plan suggests using 50% of Superchain sequencer revenue to buy OP tokens from the market for 12 months.

If approved on January 22, monthly buybacks would start in February using ETH earned from OP Stack chains like OP Mainnet and Base.

This could reduce supply, improve confidence, and help support OP demand in early 2026.

As of now, OP trades around $0.316, with a 24-hour trading volume jumping to $102.22 million.

Technical Analysis

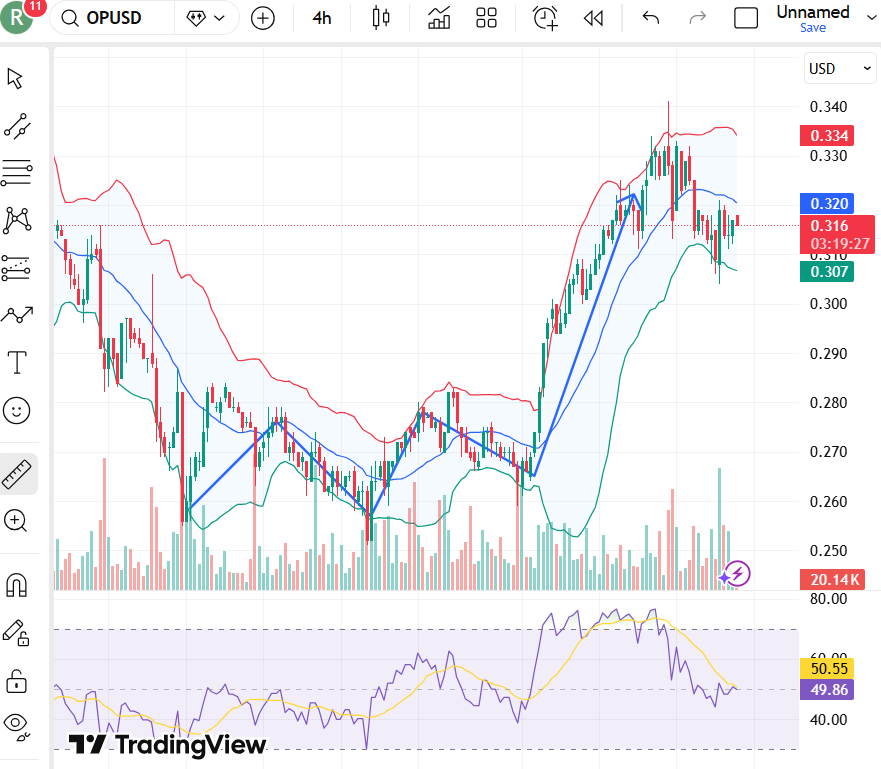

OP recently made a strong move up but is now cooling down after the rally. Price is trading around $0.32, showing consolidation after the sharp rise. This is normal after a fast upside move.

The $0.33–$0.34 zone is acting as strong resistance, where the price was rejected earlier.

The price is still near the middle Bollinger Band, which suggests the market is neutral right now. The RSI is near 50, showing neither strong buying nor strong selling pressure.

Therefore, a break above $0.34 could push the OP price to $0.418 in this month alone, while a drop below may lead to near its all time low of $0.24.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| Optimism Crypto Price Prediction January 2026 | $0.24 | $0.305 | $0.418 |

Optimism Price Prediction 2026

In 2026, Optimism’s performance depends on execution of its governance and economic model, not hype. One of the most important dynamics is how OP Stack chains contribute back to the ecosystem through shared standards and incentives.

As more projects build Layer 2 networks using the OP Stack, Optimism gains value through governance and ecosystem coordination, not just fees. This makes OP more of a network coordination token.

At the same time, planned Superchain upgrades will improve cross-chain links, raise gas limits, and speed up transactions, helping the ecosystem grow stronger.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| OP Price Prediction 2026 | $0.012 | $0.028 | $0.050 |

Optimism (OP) Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | $0.22 | $0.57 | $1.093 |

| 2027 | $0.48 | $1.12 | $2.15 |

| 2028 | $0.93 | $2.40 | $3.85 |

| 2029 | $1.56 | $3.35 | $5.39 |

| 2030 | $2.10 | $4.94 | $7.21 |

Optimism Price Prediction 2026

In 2026, OP may trade cautiously as markets evaluate the long-term viability of Layer 2 governance tokens, pushing prices toward $1.093.

Optimism Price Prediction 2027

By 2027, deeper interoperability between OP Stack chains could increase the relevance of OP governance. Under this scenario, OP could approach $2.15.

Optimism Price Prediction 2028

In 2028, Ethereum’s scaling narrative may favor interoperable rollups.

Optimism Price Prediction 2029

As rollup ecosystems mature, governance coordination may be valued more highly. OP could rise to $5.39.

Optimism Price Prediction 2030

By 2030, if the Superchain becomes a core Ethereum scaling layer, OP could test $7.20 levels.

What Does The Market Say?

| Year | 2026 | 2027 | 2030 |

| Coincodex | $0.87 | $0.708 | $1.36 |

| Ventureburn | $0.35 | $0.75 | $1.50 |

| DigitalCoinprice | $0.55 | $0.77 | $1.90 |

CoinPedia’s Optimism(OP) Price Prediction

From a CoinPedia perspective, Optimism should be viewed as Ethereum infrastructure governance, not a short-term scaling trade. OP’s long-term value depends on whether the Superchain becomes a dominant coordination layer for Ethereum rollups.

CoinPedia expects OP to recover gradually through 2026, with a potential high near $1.093. On, if OP Stack adoption continues and governance mechanisms remain effective.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | $0.22 | $0.57 | $1.093 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Optimism price prediction for 2026 suggests OP could reach up to $1.09 if OP Stack adoption and Superchain governance incentives continue to grow.

Optimism price prediction for 2027 estimates OP could trade near $2.15 as interoperability between OP Stack chains strengthens.

Optimism price prediction for 2028 points toward $3.85 if Ethereum scaling favors interoperable rollups like the Superchain.

Optimism price prediction for 2030 targets around $7.20 if the Superchain becomes a core Ethereum infrastructure layer.

You May Also Like

ETH Exit Queue Gridlocks As Validators Pile Up

TheWell Bioscience Launches VitroPrime™ 3D Culture and Imaging Plate for Organoid and 3D Cell Culture Workflows