Next 100x Memecoin: These 3 Meme Coins Are Showing Bullish Signals During the Market Downturn

Slump in the market divides good projects and bad projects. Whereas the vast majority of cryptocurrencies are struggling, there are some memecoins that exhibit odd persistence and accretion trends that are historically followed by significant movements. There are three tokens now which have different bullish indicators. PEPE at $0.000006619 holds on to $2.78B experiencing a strong increase in holders. BONK is trading with accumulation at the price of $0.00001177 with the market capital of $1.04B, despite the other wider market weak performance.

Then there's Pepeto ($PEPETO) at $0.000000176, showing presale momentum that seems completely disconnected from market conditions. This discussion deconstructs the bullish indicators that each of them presents, and which provide the most decisive road to 100x returns.

\

PEPE: Strength in Market Feebleness

PEPE is trading at the moment at $0.000006098 and a market cap of $2.78B (CoinMarketCap). Most memecoins have fallen in the recent market volatility, but PEPE has been relatively stable in its trading ranges. The number of holders is also increasing slowly. Exchange listing is still effective on all key platforms. The trading volume is maintained even in the market lows.

The optimistic indicator of this case is strength. PEPE has already survived several market cycles. Social groups that retain each other in tough times tend to have greater rebounds when the markets go up. The token is relevant in the social platforms in terms of memes. Recognition of the brand is also high. The above factors indicate that PEPE may engage in the coming upswing of the cycle.

Nevertheless, the math of 100x is problematic. Out of a total of $2.78B, a 100x gives an approximate of $278B market cap. That would make PEPE larger than Ethereum's current $377.2B. More realistic assumptions indicate 2x to 5x in bull markets that are strong. PEPE has demonstrated staying power, not geometrical returns on existing levels.

\

BONK: Build-Up Trend developing.

BONK is traded at 0.00001177/$1.04B indicating interesting on-chain trends. The balances of exchanges have been dwindling despite the fact that the holders of tokens are migrating to self-custody. That is generally a positive indication of conviction as opposed to trading motive. Solana is resilient despite the wider market issues. BONK continues to be the top Solana memecoin.

The recent trends are elaborated by the increased DeFi additions as well as gaming collaborations. The combustion process proceeds to lower supply. Social participation remains alive. These indicators indicate that BONK might perform better on the following up leg, especially when Solana keeps attracting more developers and institutions.

The 100x question is difficult however. The 100x value is at $1.04B, which means that the market cap will need $104B to attain this level. It is ambitious even in the most optimistic cases. Under extraordinary circumstances, BONK would be able to perform 5x to 10x. But 100x returns are life-changing only mathematically bounded at the present values.

\

Pepeto: Building Momentum Independent of Market Conditions

Pepeto shows the most remarkable bullish signal. The presale has generated $7.14M despite weakness in the market on a market-wide basis. Participation of community is over 100K+. The number of projects applications in the exchange platform is over 850. These metrics grow regardless of Bitcoin or Ethereum price action. That is fundamental driven demand and not speculatively following the market trends.

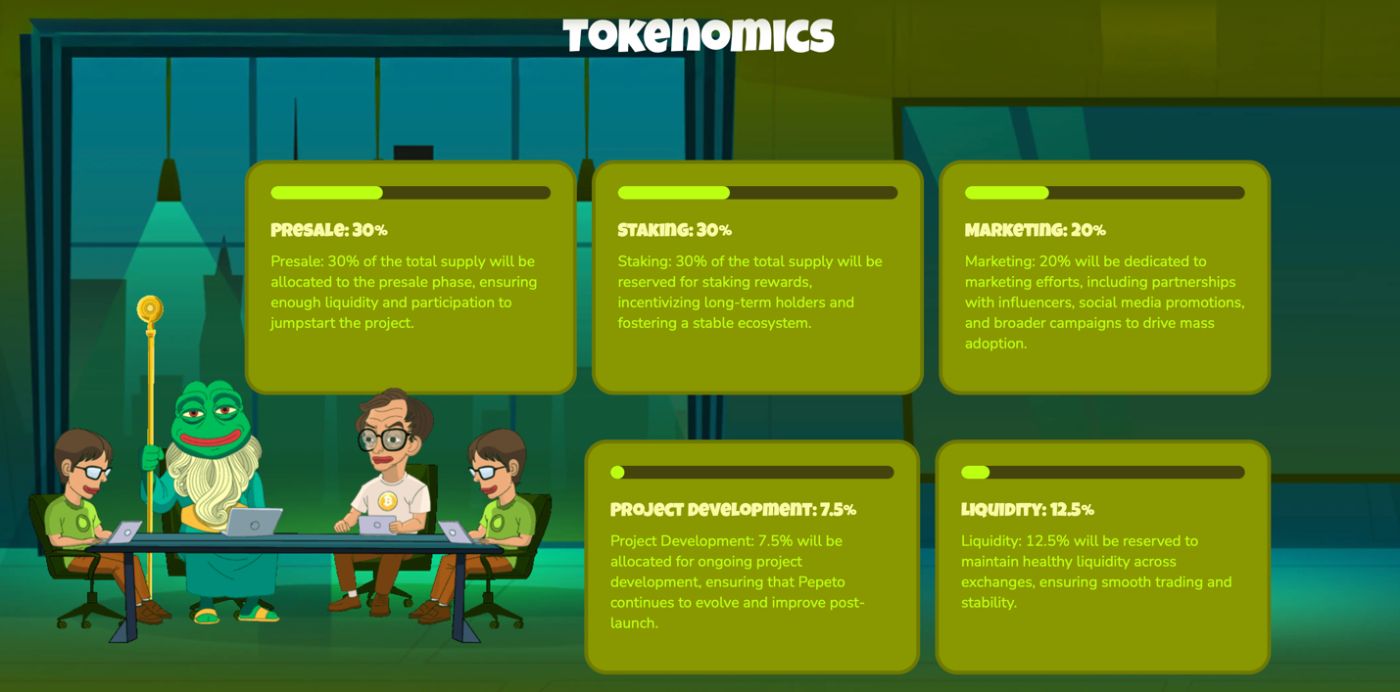

The infrastructure roadmap gives numerous catalysts that do not rely on wider market feeling. PepetoSwap launch doesn't depend on bull market conditions. The cross-chain bridge is a solution that solves the issues irrespective of aggregate crypto prices. The free market does not charge any fee to exchange memecoin projects when markets rise or fall. The 216% staking brings the yields that are absolutely independent of the price volatility.

\ Operating on Ethereum positions Pepeto to benefit when DeFi activity increases, but the platform utility creates value even during quiet periods. This freedom of the market situation is a different risk profile than pure speculation tokens.

Most importantly, the 100x mathematics really work. Since $0.000000176 to 100x will take time, it will take around $300M to $400M market cap. That is less than 15% of the PEPE valuation and less than 4% of BONK. The calculation of the probability becomes easy. Lesser market caps require capital in the percentages by exponential means.

\

\

Comparison of the Bullish Signal Strength.

The bullish indicator of PEPE is resilience. It was the token that made it through the death of others. That's valuable but passive. Expansion requires an extension of market recovery and re-interest in retail. Active catalysts do not have independent momentum.

Accumulation is a bullish indicator of BONK. Con conviction is demonstrated by self-custody moves by holders. The development of the ecosystem goes on. That is more robust than passive resilience and still reliant on the performance of Solana and the health of the memecoin sector in general.

Pepeto's bullish signal is active growth. $7.14M raised during market weakness. 100K+ participants joining regardless of market conditions. 850+ projects applying for platform access. These metrics improve independent of Bitcoin price. That is the best indicator since it is an indication of actual demand and not a mere positioning.

\

Recovery Positioning and Market Context.

Bitcoin trades at $91,243.14 with $1.82T. Ethereum sits at $3,131.71 with $377.2B. Both are stable and yet volatile in the recent past. Recessions in the market are strategic positioning opportunities. Constructions that take place in quiet times tend to do much better when markets are in a dramatic recovery.

Historical trends indicate that early-cycle projects where the development and the community is in full blast during tough times will give the best returns in the later bull markets. PEPE and BONK established their bases in the past quiet periods. Pepeto appears to be following that playbook now.

\

Getting Investment Opportunities.

PEPE and BONK are traded at primary exchanges. Regular methods of buying cryptocurrencies are used. Pepeto requires visiting Pepeto.io during presale. Connect an Ethereum wallet, use ETH, USDT, BNB, or payment cards, then optionally stake to earn 216% yields while awaiting exchange listings.

https://www.youtube.com/watch?v=wR3oOlNJj64&embedable=true

Conclusion

There are three memecoins that indicate a bullish signal in the times of market weakness but have a different connotation. PEPE at $0.000006619 is resilient by 2 to 5 times. The accumulation patterns in BONK at $0.00001177 indicate 5x to 10x. Pepeto at $0.000000176 displays active growth independent of market conditions, creating conditions for 100x probability through lower entry price and utility infrastructure.

With $7.14M raised, 100K+ participants, and 850+ platform applications during market downturn, Pepeto shows the strongest bullish conviction. Building projects that occur during quiet time in history work better during recoveries. For investors seeking 100x opportunities rather than moderate gains, Pepeto's combination of earlier-stage entry, comprehensive infrastructure, and market-independent momentum presents the clearest path.

\ Buy Pepeto Now Through The official Website: https://pepeto.io

\

\ To stay ahead of key updates, listings, and announcements, follow Pepeto on its official channels only:

Website: https://pepeto.io \n X (Twitter): https://x.com/Pepetocoin \n Telegram: https://t.me/pepeto_channel \n Instagram: https://www.instagram.com/pepetocoin/

\

:::tip This story was published as a press release by Tokenwire under our Business Blogging Program.

:::

\

You May Also Like

YUL: Solidity’s Low-Level Language (Without the Tears), Part 1: Stack, Memory, and Calldata

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC