Morgan Stanley and Citigroup Expects At Least 50Bps Fed Rate Cuts In 2026

The post Morgan Stanley and Citigroup Expects At Least 50Bps Fed Rate Cuts In 2026 appeared first on Coinpedia Fintech News

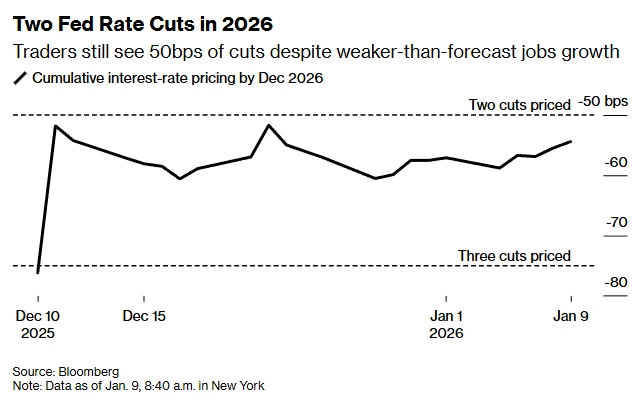

The Federal Reserve is expected to continue with its interest rate cut in 2026, amid the high executive pressures. As President Donald Trump prepares to name his pick for the Fed Chair to replace Jerome Powell, Wall Street analysts are now forecasting at least a 50 bps rate cut in 2026.

Morgan Stanley and Citigroup Forecast More Fed Rate Cuts in 2026

According to client notes from Morgan Stanley (NYSE: MS) and Citigroup Inc. (NYSE: C), the Federal Reserve will initiate at least two 25-bps rate cuts in 2026. Morgan Stanley changed its forecast of 25 bps rate cuts in January and April to June and September 2026.

Citigroup changed its forecast for 2026 Fed rate cuts from January, March, and September to March, July, and September. As such, Citigroup expects the Fed to initiate a up to 75 bps rate cut in 2026, thus pushing the range below 3%.

Why is Wall Street Anticipating More Rate Cuts?

Wall Street expects the Fed to continue with its rate cuts in 2026 after undertaking three cuts in 2025. With President Trump expected to name a new Fed Chair soon, Wall Street is confident of at least two rate cuts in the coming months.

Source: X

Despite the weaker than expected jobs growth, Treasury Secretary Scott Bessent has emphasized the need for lower interest rates to spur economic growth.

What’s the Expected Impact on Bitcoin and Crypto?

The expected Fed rate cuts have coincided with the ongoing liquidity injection under President Trump. The Fed kick-started its Quantitative Easing (QE) in early December 2025 and President Trump will inject $200 billion through the housing industry.

These events are extremely dovish for the crypto market. Furthermore, Wall Street investors have gradually turned on risk-on mode. With the expected capital rotation from the precious metals industry, amid the ongoing stock market bull rally, Bitcoin and the wider altcoin industry will ultimately register a strong bull run in 2026.

You May Also Like

YUL: Solidity’s Low-Level Language (Without the Tears), Part 1: Stack, Memory, and Calldata

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC