Pump.fun Overhauls Creator Fees to Curb ‘Dangerous’ Low-Risk Activity – Here’s the New Model

Pump.fun has announced a major overhaul of its creator fee system, marking a shift in how the Solana-based memecoin launchpad wants activity on the platform to function.

The update comes as the team moves to curb what it described as “dangerous” incentives that encouraged low-risk coin creation over high-risk trading, a balance the platform says had begun to tilt too far in the wrong direction.

Pump.fun Adds Fee-Sharing Tools for Token Creators

In a statement posted on X, Pump.fun said creator fees “needed a change” and introduced a new fee-sharing model that allows creators to distribute fees across up to 10 wallets.

Creators and CTO admins can now assign percentages directly through the Pump.fun app or web interface after launch.

The platform said the goal is to improve trust and transparency after finding that many teams struggled to share fees cleanly and often relied on informal arrangements.

Co-founder Alon expanded on the reasoning behind the change, pointing back to the introduction of Dynamic Fees V1 earlier in 2025.

That system, rolled out under an update called Project Ascend, tied creator fees to market capitalization.

Smaller tokens earned higher fees, up to 0.95% per trade between roughly 420 SOL and 1,470 SOL in market cap, with fees gradually declining to as low as 0.05% as projects grew toward $20 million valuations.

Protocol and liquidity provider fees remained unchanged.

The model succeeded quickly in boosting activity, as Pump.fun saw bonding curve volumes more than double, driven in part by a streaming-led launch trend that attracted first-time crypto users.

However, Alon said the incentives failed to change behavior for the average memecoin deployer.

Instead, creator fees increasingly reward coin creation itself, which is relatively low risk, rather than trading, which carries real downside but also generates liquidity and volume.

According to the team, traders are the core of the platform, and skewing incentives away from them threatens the health of the market.

The newly announced fee-sharing tools are designed to address another weakness of the original system.

Pump.fun said creator fees lacked practical utility despite their potential.

Projects often wanted to route fees to figures connected to a token’s narrative or to multiple contributors, but the process was clunky and sometimes required community takeovers or off-platform trust.

Under the new model, fee claims are synchronized across recipients, and unclaimed fees remain permanently available to their assigned wallets.

Additionally, Alon said further changes are coming and emphasized that no member of the Pump.fun or Terminal team will accept creator fees.

Pump.fun Sees $6.6B Weekly Volume, But Few Tokens Break Through

The changes arrive as Pump.fun continues to post record activity.

This week, the platform processed $6.6 billion in trading volume, its highest weekly total to date.

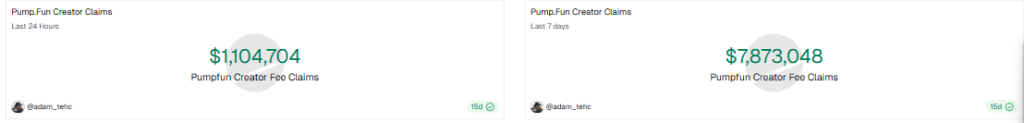

Creator earnings remain substantial, with data tracked by Adamtec showing more than $1.1 million claimed in the past 24 hours and nearly $7.9 million claimed over the last seven days.

Source: Dune/Adamtec

Source: Dune/Adamtec

At the same time, token creation and graduation metrics suggest activity is concentrated in a smaller number of successful tokens.

More than 27,000 tokens were launched in the past day, but fewer than 200 graduated, keeping daily graduation rates below 1%.

Pump.fun’s native token, PUMP, has also seen renewed short-term momentum.

The token is trading around $0.0024, up roughly 10% over 24 hours, with daily volume near $175 million. Despite the rebound, PUMP remains more than 70% below its all-time high.

Since August 2025, the protocol has spent roughly 1.36 million SOL, or about $236 million, on buybacks, absorbing close to 18% of the circulating supply.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Price May Drop To This Level Before Major Rally