Monero (XMR) Price Explodes to New Highs Amid Renewed Interest in Privacy Coins—Is $1000 Next?

The post Monero (XMR) Price Explodes to New Highs Amid Renewed Interest in Privacy Coins—Is $1000 Next? appeared first on Coinpedia Fintech News

Privacy tokens are back in focus, and Monero is leading the charge. The XMR price decisively broke above a crucial resistance zone to reach fresh all-time highs near $596.87. The move was backed by a sharp expansion in trading volume, highlighting strong buyer conviction. As market sentiment turns risk-on within the privacy coin segment, Monero’s breakout signals a shift into a stronger bullish phase.

Monero is rising today as privacy coins regain market attention and capital rotates into anonymity-focused assets. The move into new all-time high territory has attracted momentum traders, pushing prices closer to the key $600 psychological level. At the same time, uncertainty surrounding rival privacy projects, like Zcash, has strengthened demand for XMR. With bullish technical structure and sustained volume inflows, Monero’s rally appears primed to maintain an upside trajectory.

What’s Next for the XMR Price Rally?

The XMR price has decisively broken out of a multi-year structure that had remained intact since the 2021 market top. Monero surged above the neckline of a large cup-and-handle pattern, a classic bullish formation that typically signals trend continuation. Based on this setup, the projected breakout target is measured by the depth of the cup, pointing to levels well above $1,000. With the broader structure suggesting a long-term objective near $1,600.

After posting a strong and consistent advance throughout 2024 and 2025, Monero now enters 2026 at a critical juncture. This raises the key question of whether bullish momentum can be sustained at higher price zones.

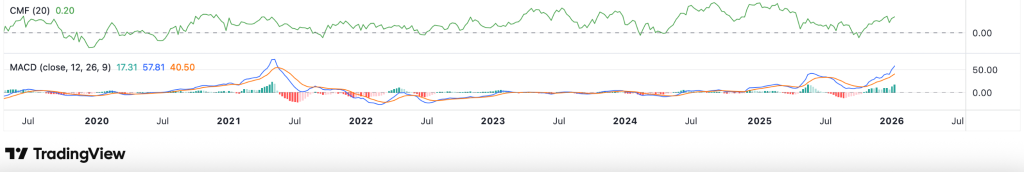

The liquidity flow indicator, CMF, displays a consistent inflow of capital since the 2021 bull run, as the levels have never dropped below 0 in the weekly chart. Besides, the MACD is replicating a similar move observed during the bull run period, where it soared high after a prolonged consolidation. This suggests buying pressure has been mounted to a large extent, which could help the bulls to maintain a strong upswing.

When a positive CMF aligns with expanding MACD momentum, it usually hints at a healthy bull trend with follow-through potential. For Monero, this suggests buyers remain in control and that pullbacks, if any, are more likely to be consolidations than trend reversals. This setup could weaken only if CMF drops back to 0 and MACD flattens and rolls over while price stalls near resistance. Until then, indicators favor a continued upside trajectory, but not a cycle top.

Will Monero (XMR) Price Reach $1000?

With Monero breaking into price discovery and holding above its former multi-year resistance, the broader structure remains decisively bullish. In the near term, the next logical upside zone lies between $650 and $720, where minor historical extensions and psychological resistance may trigger consolidation. A sustained move above this range would strengthen the case for a medium-term advance toward $850–$1,000.

While a direct rally to $1,000 may not be immediate, current momentum, strong volume inflows, and bullish indicators suggest the level is realistic in the coming months. Provided broader market conditions remain supportive and Monero (XMR) price maintains its breakout structure.

You May Also Like

XRP Whales Accumulate as Retail Pulls Back — Bullish Signal Ahead

Vitalik Buterin to Deliver Keynote After Shanghai Upgrade at ETHTaipei