Best Crypto to Buy Now – JasmyCoin Price Prediction For 2026

The crypto market is heating up again as traders react to strong technical signals and sharp price movements across key altcoins. One project drawing increasing attention is JasmyCoin, which has just delivered a powerful rebound after spending weeks in oversold territory.

Many investors are now re-evaluating their strategies as new patterns begin to form and momentum slowly returns to the market. JasmyCoin price prediction has become one of the most searched topics as traders look ahead to where this recovery could lead.

At the same time, uncertainty across the broader market has sparked fresh conversations about the best crypto to buy now. With fear still present and opportunity building, the coming months could prove decisive for those positioned early.

JasmyCoin Price Prediction

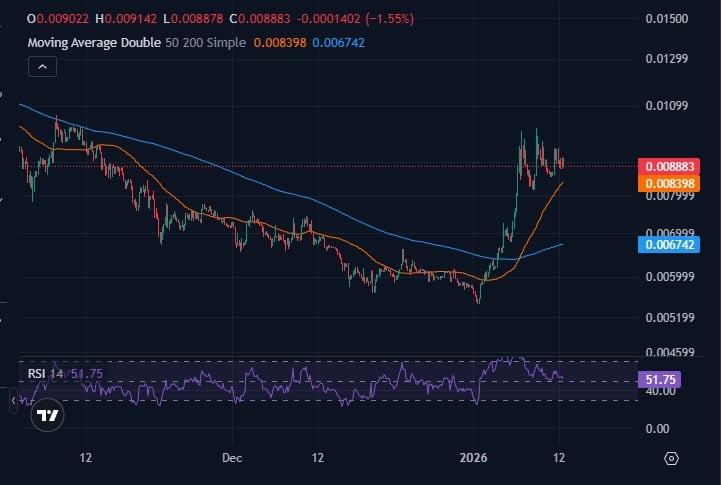

JasmyCoin has recently shown strong bullish momentum after rebounding from deeply oversold levels on the weekly relative strength index. The token surged nearly 30% in the past week and has climbed roughly 76% from its recent bottom, signaling renewed market confidence.

Technical structure now suggests the formation of an ascending triangle, a pattern that often precedes continued upward movement. Short-term resistance remains near the $0.009 region, while a breakout above that level could open the path toward $0.01 and beyond.

Although pullbacks toward the $0.008 zone remain possible during periods of volatility, the broader trend continues to favor buyers. Over the long term, if adoption and market conditions align, $JASMY could potentially revisit significantly higher valuation levels.

Market Structure Holds Firm as Leverage and Demand Remain Restrained

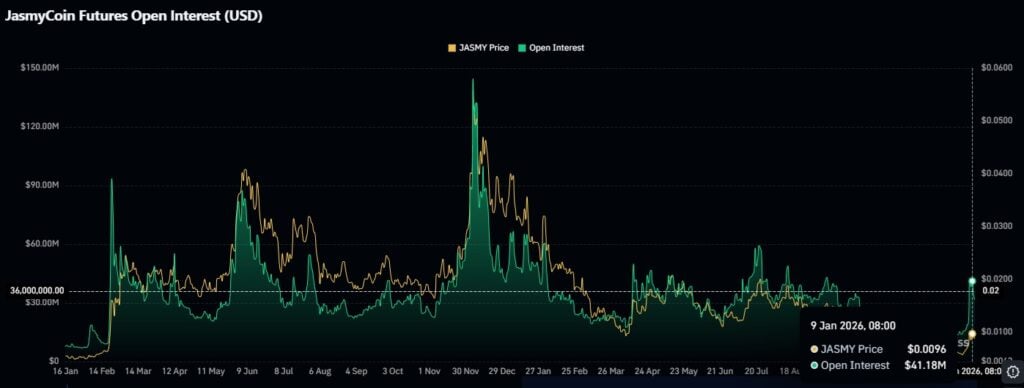

Futures metrics paint a more balanced outlook. Open interest previously surged during strong rallies before unwinding sharply during market pullbacks. More recently, it has risen again toward the $41 million level while price action continues to consolidate lower.

This behavior points to new positions being established rather than widespread liquidations. At the same time, overall leverage remains well below earlier highs, reflecting a more cautious risk environment.

Source – Coinglass

Spot market activity reinforces that caution. Selling pressure has persisted across recent sessions, with participants using short-term rebounds to trim positions.

The latest net outflow of roughly $430,000 also indicates limited accumulation, meaning current price stability is being supported more by technical structure than by aggressive demand.

Top Crypto to Buy Now: Why JasmyCoin Alone Isn’t Enough for the Next Cycle

While JasmyCoin offers attractive technical setups and long-term upside, it is important to acknowledge its limitations, particularly its large token supply and the historical effects of token emissions, which have previously suppressed price performance.

These structural factors suggest that although $JASMY can deliver solid gains, it may not always provide the strongest risk-to-reward profile in the market. This is why many experienced investors are increasingly turning their attention to early-stage crypto presales.

Below are new crypto projects currently in presale; as the next market phase approaches, balancing established assets like JasmyCoin with these high-potential presale opportunities may offer a more optimized strategy for those seeking the best crypto to buy now.

Maxi Doge (MAXI)

Maxi Doge is positioned as an intensified evolution of the original Dogecoin concept. The project builds on the proven dominance of dog-themed tokens, arguing that this category remains the core driver of meme coin market capitalization and cultural impact.

Rather than copying Dogecoin, Maxi Doge presents itself as a full escalation, combining exaggerated branding, an oversized mascot, and an intentionally loud visual identity for instant recognition.

Source – JRCRYPTEX YouTube Channel

Its strategy centers on attention as the primary asset, allocating roughly two-thirds of presale funds toward marketing partnerships and broad exposure across the crypto ecosystem.

The presale has already raised nearly $4.5 million, and the structure includes immediate staking with 70% APY. Maxi Doge frames itself as a calculated attempt to translate classic Doge momentum into a modern, high-impact meme coin model.

Visit Maxi Doge

Bitcoin Hyper (HYPER)

Bitcoin Hyper is positioned as one of the best crypto to buy now because it transforms Bitcoin into a fast, low-cost, and highly usable blockchain environment without abandoning its core principles.

Built as a Bitcoin Layer-2, the network allows users to access a parallel version of Bitcoin. This structure unlocks entire ecosystems on Bitcoin itself, enabling payments, DeFi applications, staking, borrowing, lending, decentralized apps, and even meme coin activity.

Users simply send Bitcoin to a designated address, receive the same amount on the Layer-2, and immediately gain full functionality without leaving the Bitcoin network. The system operates trustlessly, remains fully decentralized, and aligns closely with Bitcoin’s original philosophy.

With nearly $30.4 million already raised in its presale, confidence in its long-term utility continues to strengthen. As adoption grows, Bitcoin Hyper could reshape how Bitcoin holders interact with the broader crypto economy.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Why Is Crypto Up Today? – January 13, 2026