Crypto ETPs Lose $454M in Outflows as Bitcoin Bears Dominate

Cryptocurrency Investment Products Face Significant Outflows Amid Shifting Investor Sentiment

Recent data reveals a notable decline in crypto investment products, with a four-day series of withdrawals erasing gains from early 2026. Despite a solid start to the year, investor confidence has waned, primarily due to macroeconomic concerns and expectations around Federal Reserve policies.

Key Takeaways

- Crypto exchange-traded products experienced $454 million in outflows last week, according to CoinShares.

- Bitcoin led the retreat, with outflows totaling $405 million, sparking concerns over market sentiment.

- Altcoin funds rallied, with inflows into assets like XRP, Solana, and Sui totaling over $87 million.

- The United States was the sole region showing significant withdrawals, while Europe and other markets saw inflows.

Tickers mentioned: $BTC, $ETH

Sentiment: Bearish

Price impact: Negative, as widespread outflows indicate increased risk aversion among investors.

Trading idea (Not Financial Advice): Hold, monitoring macroeconomic cues for potential market rebounds.

Market context: The shift reflects broader caution amid uncertain monetary policy outlooks and macroeconomic data.

Market Analysis

Last week, crypto investment products endured a steep decline, with weekly outflows totaling $454 million. CoinShares attributes this to investor concerns over the Federal Reserve’s potential delay in interest rate cuts, influenced by recent macroeconomic indicators. Despite the outflows, the overall monthly flows remain positive at $229 million, balancing the initial inflows of $582 million at the year’s onset.

Bitcoin’s Volatility

Bitcoin was the primary driver of the negative sentiment, with outflows of $405 million. Short-Bitcoin funds saw minor outflows of $9 million, suggesting a mixed outlook on the asset’s near-term direction. Meanwhile, alternative cryptocurrencies like XRP, Solana, and Sui continued to see inflows, with combined gains of approximately $87 million, signaling sustained interest in altcoins despite Bitcoin’s pullback.

Weekly crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinSharesSectoral and Geographic Breakdown

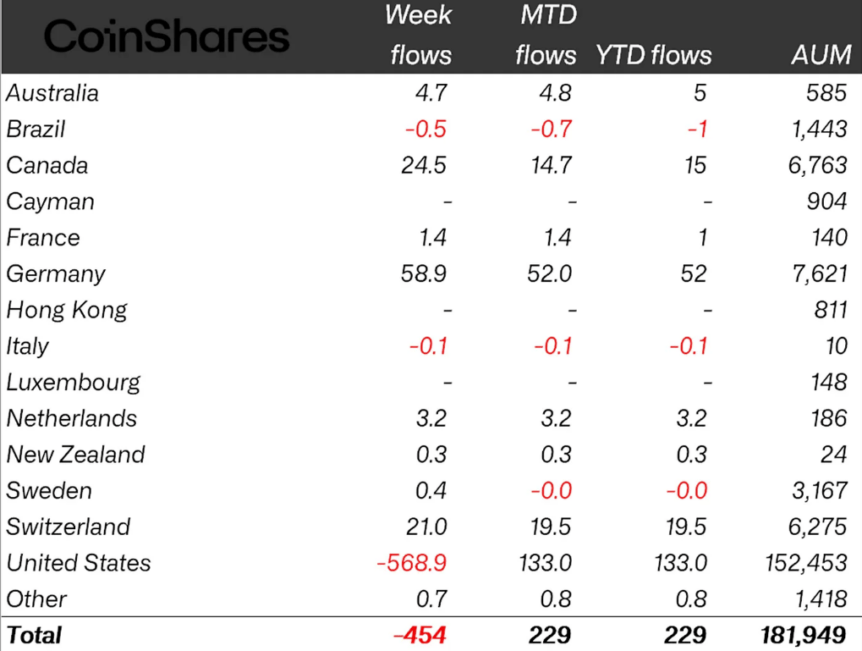

Regionally, the United States was the only major market to exhibit significant outflows, totaling $569 million. Conversely, Germany, Canada, and Switzerland registered inflows of $59 million, $25 million, and $21 million, respectively. Despite these shifts, total assets under management across crypto ETPs slightly increased week-over-week to $181.9 billion from $181.3 billion.

Weekly crypto ETP flows by country as of Friday (in millions of US dollars). Source: CoinShares

Weekly crypto ETP flows by country as of Friday (in millions of US dollars). Source: CoinShares

Despite the recent negative trends, institutional interest remains considerable. Major players like BlackRock’s iShares and Profunds Group led inflows, while Fidelity and Grayscale experienced notable outflows. The continued fluctuation underscores the evolving landscape of crypto investments amid macroeconomic uncertainties and shifting risk appetite.

This article was originally published as Crypto ETPs Lose $454M in Outflows as Bitcoin Bears Dominate on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Top Crypto to Buy with $500: Why Mutuum Finance (MUTM) Could Be a Smarter Bet Than Shiba Inu (SHIB)

The United States and Greenland: Trump’s Strategy Amid Direct Payments and Diplomatic Tensions