21Shares Secures Approval to Launch Spot Dogecoin ETF on Nasdaq

- 21Shares has secured approval to launch a spot Dogecoin ETF

- DOGE price shows mixed signals, despite rising trading activity

21Shares has officially entered the spot Dogecoin ETF race, announcing its product with the US Securities and Exchange Commission. As it follows an automatic approval to list on the Nasdaq stock market under the ticker TDOG.

As per the 21Shares filing to the U.S. SEC, it has submitted its final prospectus to launch its Dogecoin ETF, which clearly shows the progress toward its launch this week.

This ETF joins the expanding list of Dogecoin-focused investment instruments, which secures the third spot Dogecoin ETF to launch after Grayscale Dogecoin ETF (GDOG) and Bitwise Dogecoin ETF (BWOW) launched in November. With that, the broadening ETF market could boost market interest and support price gains for DOGE.

As the Exchange-Traded Funds are passive funds designed to track the price of Dogecoin alongside other cryptocurrencies, gaining mainstream investment exposure, while the 21Shares spot Dogecoin ETF is designed to track the CF Dogecoin–Dollar US Settlement Price Index, where the custody services are provided by Coinbase Custody, Anchorage Digital Bank, and BitGo Bank & Trust.

DOGE Price Shows Mixed Signals

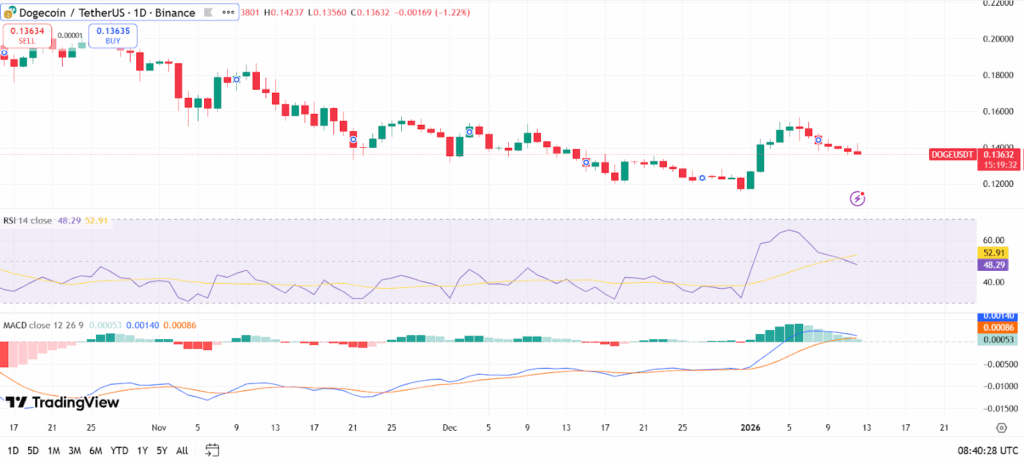

Source: TradingView

Source: TradingView

While the article is being written, Dogecoin price is trading at $0.136, down about 2.06% from its intraday high, which was around $0.14237. But the market interest was raised, as the daily trading volume increased by more than 150% to $1.23 billion, despite the increased trading activity surges, DOGE’s price movement is mixed.

With that, analysing the 1-day chart of (DOGE/USDT), the Relative Strength Index (RSI) sits near 48, sitting in the neutral territory, neither overbought nor oversold region, which puts it right in the middle ground, not showing any extreme buying or selling pressure.

Meanwhile, the Moving Average Divergence and Convergence (MACD) is still in positive territory but has started to settle down. So, the immediate support is located between $0.13 and $0.125, while resistance remains near the $0.145–$0.15 range; a strong break above this is needed to confirm the next direction.

Highlighted Crypto News:

South Korea Plans to End Corporate Crypto Ban With 5% Equity Cap

You May Also Like

WIF price reclaims 200-day moving average

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise