Tom Lee’s Bitmine Acquires 4.17M ETH, Eyes 5% of Total Supply

TLDR

- Bitmine currently holds over 4.17 million ETH which represents about 3.45% of the total Ethereum supply.

- The company has staked 1.25 million ETH valued at approximately $3.9 billion as of January 11.

- Bitmine acquired 24,266 ETH and increased its cash reserves by $73 million within one week.

- The company plans to launch its MAVAN staking network in early 2026 to become the largest staking provider.

- Bitmine will hold a shareholder meeting on January 15 to vote on increasing authorized shares.

Bitmine has disclosed its crypto holdings now stand at $14.0 billion, comprising over 4.17 million ETH, 193 BTC, and $988 million in cash, as of January 11. The company confirmed that it acquired 24,266 ETH during the past week while increasing its cash reserves by $73 million, moving closer to its stated target of holding 5% of all Ethereum. Chairman Tom Lee reaffirmed Bitmine’s strategy to prioritize ETH per share growth and maintain capital flexibility.

Ethereum Holdings Reach 4.17 Million as Bitmine Moves Closer to 5% Supply Goal

Bitmine holds approximately 3.45% of Ethereum’s total supply, positioning the company among the largest single holders of ETH globally. With this increase, the firm has now reached nearly 70% of its goal to acquire 5% of the total supply. “We remain the largest ‘fresh money’ buyer of ETH in the world,” said Tom Lee on Monday.

The firm confirmed that it only issues equity at a premium to its net asset value and does so selectively. Bitmine describes this capital approach as essential to expanding its Ethereum-focused treasury while safeguarding shareholder value. The company continues to add ETH consistently, supported by its institutional backers.

Bitmine’s daily average trading volume for BMNR stock stands at $1.3 billion, ranking 67th among U.S.-listed equities. Its investors include ARK’s Cathie Wood, Bill Miller III, Founders Fund, Kraken, Pantera, DCG, and Galaxy Digital. These backers have helped solidify confidence in Bitmine’s asset management approach and crypto strategy.

$3.9 Billion in ETH Staked as MAVAN Launch Nears

Bitmine has now staked 1,256,083 ETH, with an estimated value of $3.9 billion based on current pricing as of January 11. The company reported that staking activity rose by 597,000 ETH in just one week, signaling rapid deployment. It confirmed partnerships with multiple staking providers to optimize performance.

The company plans to launch its Made in America Validator Network (MAVAN) in early 2026. Bitmine said MAVAN would become the largest Ethereum staking provider globally once operations begin. Lee stated, “When MAVAN launches its commercial operations, we will be the largest staking provider in the entire crypto ecosystem.”

The company estimates staking rewards could reach $374 million annually based on Ethereum’s current composite staking rate of 2.81%. Bitmine aims to stake its entire ETH treasury over time to support long-term returns. The move aligns with the company’s broader strategy to generate yield while maintaining liquidity.

Shareholder Meeting Set as Company Plans to Expand Equity Base

Bitmine will hold its annual shareholder meeting in Las Vegas on January 15. The agenda includes a vote on increasing authorized shares to support further ETH accumulation. The company stated that this step is required to continue expanding its treasury strategy.

Tom Lee emphasized that Bitmine only issues new equity at a premium to its modified net asset value (mNAV). This approach allows the company to scale while protecting shareholder equity dilution. Bitmine’s equity model remains central to funding its Ethereum acquisition plan.

The shareholder vote will decide whether the company can proceed with its next phase of asset expansion. Bitmine confirmed that its long-term vision includes growing ETH per share while maximizing staking revenue. The company continues to build its Ethereum holdings week by week.

As of the latest report, Bitmine holds over 4.17 million ETH, has staked over 1.2 million, and remains active in weekly ETH purchases.

The post Tom Lee’s Bitmine Acquires 4.17M ETH, Eyes 5% of Total Supply appeared first on CoinCentral.

You May Also Like

Wall Street’s Pivotal Shift To Digital Asset Leadership

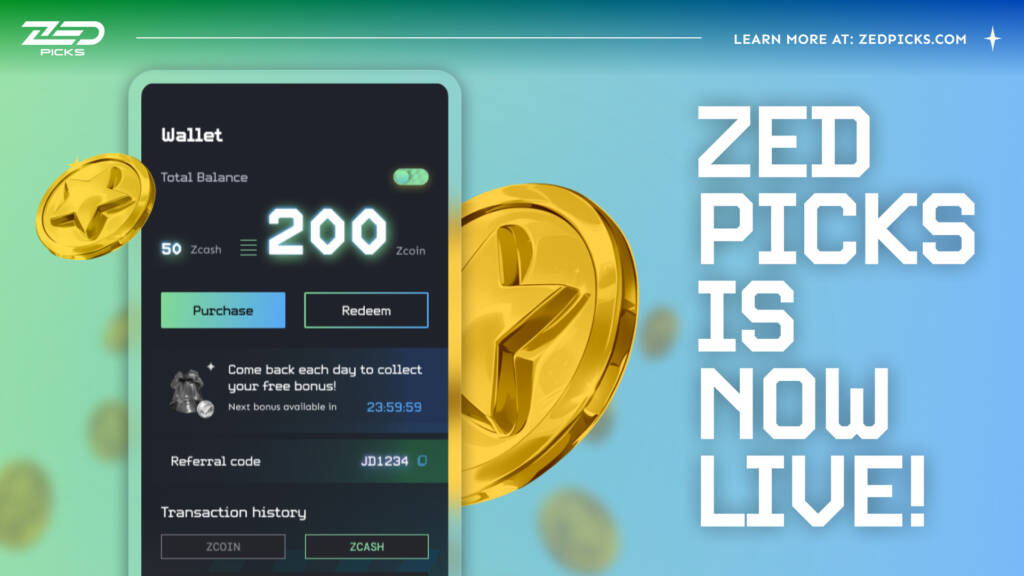

Introducing ZED Picks: A First-of-its-Kind Pick-and-Play Digital Horse Racing Game