Meta Platforms, Inc. (META) Stock: Slips as Zuckerberg Unveils Meta Compute AI Push

TLDR

- META stock trades near $647.75 during market hours

- Zuckerberg launches Meta Compute as a top-level AI initiative

- Meta targets tens of gigawatts of AI infrastructure this decade

- New unit reports directly to Zuckerberg for tighter oversight

- Analysts track infrastructure scale as a long-term advantage

Meta Platforms, Inc. (META) stock traded at $647.75, down 0.81% during market hours, as investors reacted to a major strategic announcement from CEO Mark Zuckerberg.

Meta Platforms, Inc., META

The Meta chief said the company is establishing a new top-level initiative called Meta Compute, focused on building massive artificial intelligence infrastructure that could shape Meta’s competitive position for years.

The announcement signals a sharper focus on AI capacity as a core pillar of Meta’s future. Zuckerberg framed infrastructure scale as a strategic differentiator, placing Meta in direct competition with other Big Tech firms racing to secure compute power, energy access, and long-term partnerships.

Meta Compute Sets Ambitious Infrastructure Targets

In a statement shared on his social media accounts, Zuckerberg said Meta plans to build “tens of gigawatts” of AI infrastructure this decade, with ambitions to reach “hundreds of gigawatts or more over time.” He emphasized that how Meta engineers, invests, and partners to build this infrastructure will define its long-term advantage.

Meta Compute will operate as a dedicated unit with leaders reporting directly to Zuckerberg. This structure suggests tighter executive oversight and a more hands-on approach as the company scales its AI ambitions across data centers and related systems.

Leadership Team Blends Technical and Strategic Roles

The new initiative will be led by Santosh Janardhan, Meta’s head of global infrastructure and co-head of engineering, alongside Daniel Gross, who joined Meta last year from Safe Superintelligence, where he served as CEO and co-founder.

Janardhan will oversee technical architecture and data center operations, ensuring Meta’s infrastructure can support increasingly complex AI workloads. Gross will lead capacity strategy, supplier partnerships, and business planning, focusing on how Meta sources hardware, power, and long-term capacity.

Both executives will work closely with Dina Powell McCormick, Meta’s recently named president. Zuckerberg said Powell McCormick will focus on partnerships with governments and sovereign entities to build, deploy, invest in, and finance Meta’s infrastructure projects.

Infrastructure Push Aligns With Long-term Investment Plans

Meta has previously stated plans to invest up to $600 billion in American infrastructure and jobs by 2028, including large-scale AI data centers. Until now, the company had shared limited detail on how that capital fits into a broader strategic roadmap.

The creation of Meta Compute clarifies that vision. By formalizing AI infrastructure as a standalone initiative, Meta signals that compute capacity is no longer just a support function but a core growth driver. The move positions Meta to better coordinate capital deployment, supplier relationships, and regulatory engagement.

Managing Scrutiny Around data Centers and Energy use

Large data center projects often draw political and community scrutiny, especially around electricity demand, water usage, and local economic impact. The Meta Compute structure could help Meta manage these challenges more effectively by centralizing planning and external engagement.

Zuckerberg’s emphasis on partnerships with governments suggests Meta aims to address these concerns early, aligning infrastructure development with public-sector priorities and long-term energy planning.

META Stock Performance in Focus

Meta’s stock performance reflects both recent caution and long-term strength. Year to date, META is down 1.86%, trailing the S&P 500’s 1.88% gain. Over the past year, the stock is up 5.52%, compared with the index’s 19.69% return.

Longer-term performance remains strong. META has delivered a 377.17% return over three years and a 159.80% gain over five years, both well ahead of the broader market. Investors now weigh near-term infrastructure spending against the potential for AI-driven growth.

With Meta Compute reporting directly to Zuckerberg and targeting unprecedented scale, Meta is signaling that AI infrastructure sits at the center of its next growth phase. How effectively the company executes this vision will shape investor sentiment in the years ahead.

The post Meta Platforms, Inc. (META) Stock: Slips as Zuckerberg Unveils Meta Compute AI Push appeared first on CoinCentral.

You May Also Like

Wall Street’s Pivotal Shift To Digital Asset Leadership

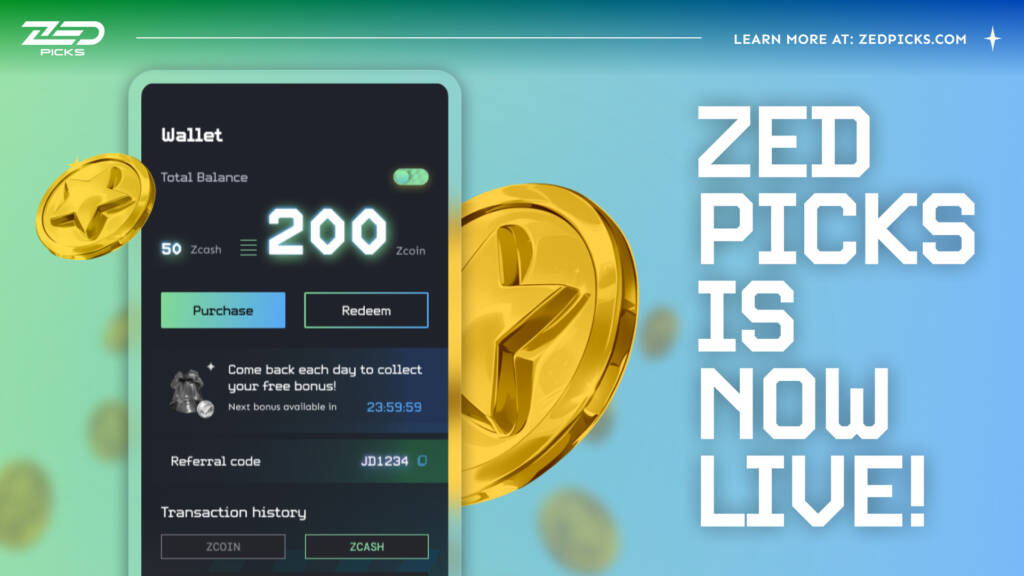

Introducing ZED Picks: A First-of-its-Kind Pick-and-Play Digital Horse Racing Game