Dubai Regulator Freezes Privacy Tokens as AML Requirements Quicken throughout DIFC

Scope of the Restriction

Importantly, the ban applies to trading, promotion, fund management, and derivatives related to privacy tokens. The action concerns all companies based in or out of the DIFC. Moreover, the companies should now make sure that crypto assets comply with international standards. According to the regulators, more responsibility was put on the firms to evaluate the suitability of tokens, since they hide the transaction history and the owner of the wallet. As such, these characteristics make firms unable to comply with Financial Action Task Force transparency requirements.

According to Elizabeth Wallace, the DFSA associate director of policy, anonymity functions render compliance almost impossible. Therefore, the authority decided to ban it formally. Nonetheless, the move comes at a time when the privacy-oriented tokens have lately piqued more trading interest around the world. Dubai officials realized that there was activity in the market, but focused on regulatory alignment.

In addition, the transfer is in contrast to the debates in the United States. The DFSA also streamlined its stablecoin framework in addition to the privacy tokens that the US Securities and Exchange Commission probed recently regarding the balance of privacy and surveillance in digital finance. The update presented a more explicit definition of fiat-backed crypto tokens. According to the regulations, fiat crypto tokens need to hold substantial liquid reserves of high quality. Such reserves have to cater to redemptions made in times of market stress.

The reclassification of Algorithmic Tokens

The new definition fails to apply to algorithmic stablecoins. In turn, the DIFC will treat them as general crypto tokens but not stablecoins. Nonetheless, the UAE still promotes licensed blockchain development. Also in November, Abu Dhabi digital bank Zand introduced the first dirham stablecoin in the country, and the DFSA started working towards an industry-driven approval model. Thus, companies have decided on which crypto assets comply with the regulatory and risk requirements. Dubai has, therefore, strengthened its compliance system without realizing unregulated innovation. The regulator indicated further monitoring as world crypto standards change.

This article was originally published as Dubai Regulator Freezes Privacy Tokens as AML Requirements Quicken throughout DIFC on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Wall Street’s Pivotal Shift To Digital Asset Leadership

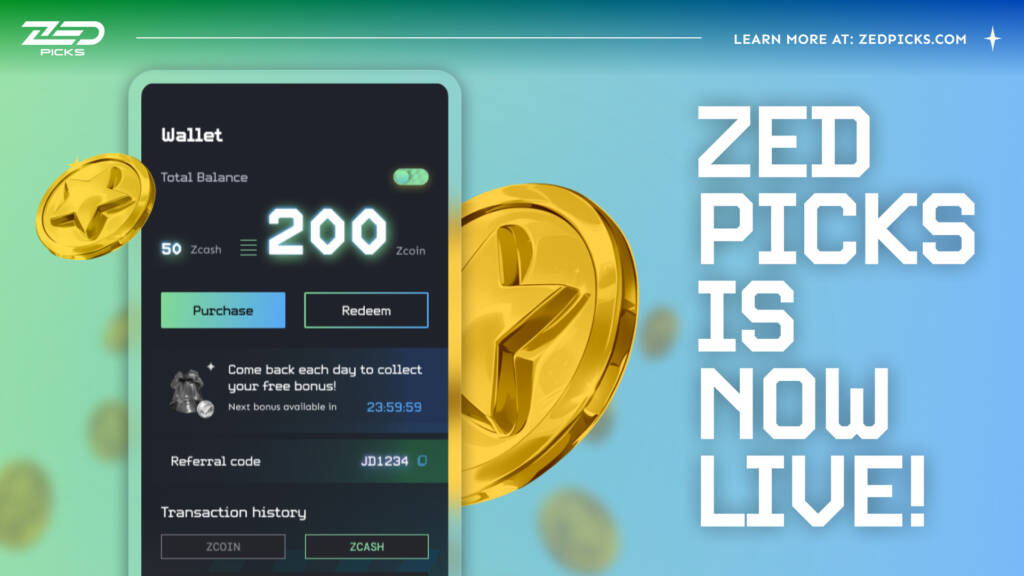

Introducing ZED Picks: A First-of-its-Kind Pick-and-Play Digital Horse Racing Game