Bitwise CIO Blasts “Ridiculous” Bitcoin 401(k) Fears: “Less Volatile Than Nvidia”

Bitwise Chief Investment Officer Matt Hougan has pushed back sharply against renewed concerns that Bitcoin is too volatile to be considered for retirement accounts.

He called efforts to block the asset from 401(k) plans “ridiculous” and out of step with how risk is treated elsewhere in financial markets.

Hougan’s comments came during an interview with Investopedia Express Live, on the same day US Senator Elizabeth Warren pressed the Securities and Exchange Commission for clarity on how it plans to protect retirement savers if cryptocurrencies are allowed into defined-contribution plans.

The timing shows a growing divide between crypto industry leaders and policymakers over whether Bitcoin’s price swings make it unsuitable for long-term retirement investing.

Bitcoin Was Less Volatile Than Nvidia, Hougan Says

At the center of Hougan’s argument is a comparison he says regulators and plan administrators often avoid.

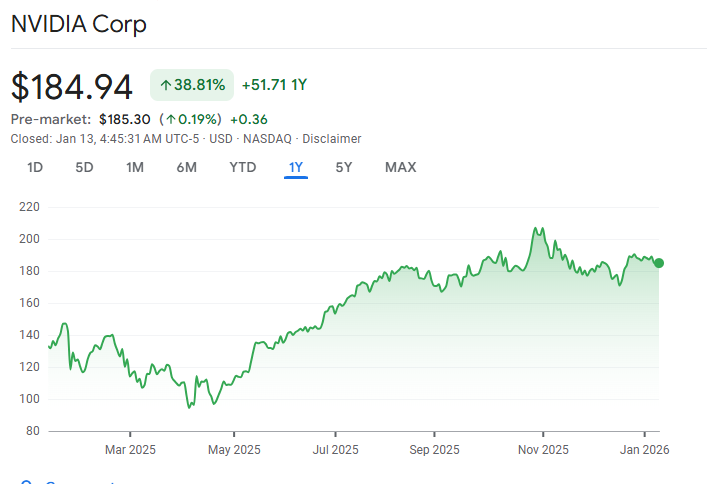

Over the past year, Bitcoin has been less volatile than Nvidia, one of the most widely held stocks in US retirement portfolios.

Nvidia shares fell to around $94 in April 2025 before surging past $207 by October, a move of roughly 120%. Bitcoin, by contrast, traded between about $76,000 and $126,080 over the same period, a swing of around 65%.

Source: Google Finance

Source: Google Finance

Despite that difference, Hougan noted, there are no calls to ban 401(k) providers from offering Nvidia stock.

“This is just another asset,” Hougan said during the interview, adding that while Bitcoin clearly carries risk, that risk is often overstated relative to familiar equities.

His remarks directly challenge a long-standing narrative that crypto volatility alone should disqualify it from retirement plans. The debate has gained urgency following a series of regulatory shifts in the United States.

Last August, President Trump issued an executive order directing the Department of Labor to reconsider limiting the inclusion of alternative assets in defined-contribution plans, which has again made cryptocurrencies a possibility in 401(k)s.

The Employee Benefits Security Administration of the Labor Department had previously canceled 2022 guidance encouraging plan fiduciaries to be extremely cautious with crypto and adopted a more neutral position on it, neither approving nor discouraging its inclusion.

Bitcoin Access in Retirement Plans Remains Limited

Despite those changes, access to Bitcoin in retirement accounts remains limited. For most workers, exposure is only possible through self-directed brokerage accounts, where the investment decision fall squarely on the individual.

Only a small number of providers, including Fidelity and ForUsAll, currently offer pathways to Bitcoin exposure, often through spot Bitcoin ETFs. Large firms such as Vanguard have stayed on the sidelines.

Warren has been one of the most vocal critics of expanding crypto’s role in retirement savings.

In an open letter published Monday, she warned that allowing crypto into 401(k)s could expose workers to higher fees, market manipulation, and sharp price swings that undermine retirement security.

She argued that for many Americans, retirement accounts are a financial lifeline rather than a place for speculative bets.

Warren has asked SEC Chair Paul Atkins to explain how the agency accounts for crypto volatility in valuations and whether it is studying manipulative practices in digital asset markets, with responses requested by Jan. 27.

Hougan acknowledged that widespread adoption will not happen overnight.

He said 401(k) providers are slow-moving institutions constrained by fiduciary risk and regulatory uncertainty, but he expects Bitcoin exposure to become normalized over time.

He pointed to increased institutional participation, particularly through spot Bitcoin ETFs, as a stabilizing force that has already reduced Bitcoin’s extreme volatility compared with earlier cycles.

Bitcoin’s price history still shows larger drawdowns than broad market indices like the S&P 500, which typically sees annualized volatility of around 15% to 20%.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Why Is Crypto Up Today? – January 13, 2026