Sell Pressure Fades as Bitcoin Price Consolidates Above $91,000—Is $100K Next?

The post Sell Pressure Fades as Bitcoin Price Consolidates Above $91,000—Is $100K Next? appeared first on Coinpedia Fintech News

Bitcoin price is holding steady after a brief rebound, but the market still lacks a decisive trigger. BTC is consolidating above $91,000, while traders keep a close watch on whether the range turns into a breakout or another rejection. Volatility remains compressed, suggesting a larger move could be building as liquidity clusters around key levels. With risk sentiment turning highly reactive and positioning tightening, the big question is whether Bitcoin can build enough momentum to retest the $100,000 zone in the near term.

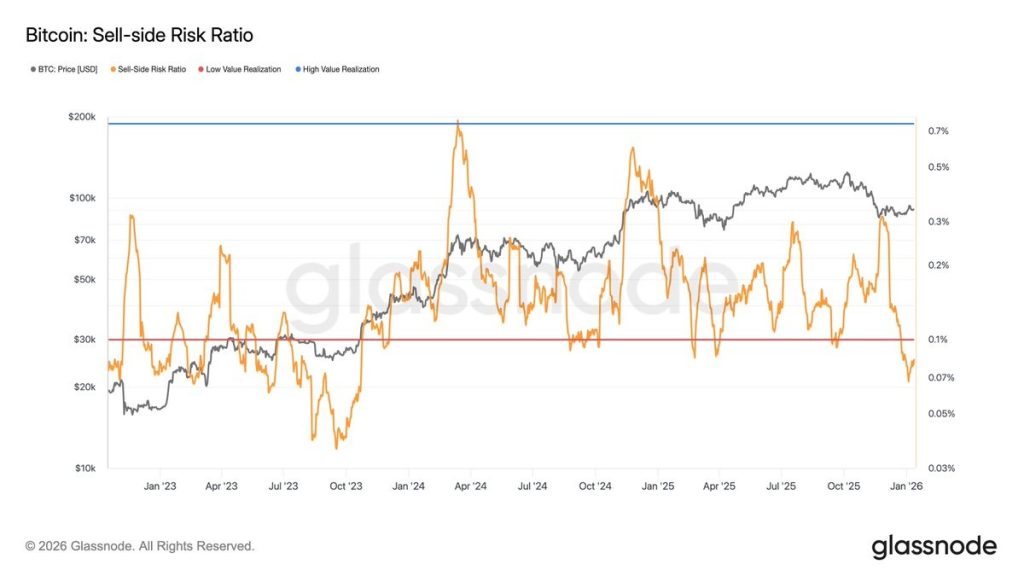

Sell-side Risk Ratio Cools as Holders Slow Down Profit-Taking

The next clue comes from Glassnode’s Sell-side Risk Ratio, which tracks how much profit or loss investors are realising relative to Bitcoin’s market cap. In simple terms, it shows whether the market is seeing heavy distribution (aggressive selling into strength) or lighter selling (holders choosing to sit tight).

On the chart, the Sell-side Risk Ratio has dropped toward the lower band after spending much of 2024–2025 oscillating at higher levels. Historically, the bigger spikes in this metric have aligned with periods of strong profit realization and overheated moves, while dips toward the lower zone have appeared during cool-down phases where sell pressure eases and the market builds a base.

This supports a constructive consolidation thesis: if holders aren’t rushing to realize profits, BTC often needs a fresh demand catalyst to push higher—but it also reduces the odds of an immediate, seller-driven collapse. The risk is that low selling pressure can still mean low urgency from buyers, which keeps BTC choppy until the price breaks key resistance with volume.

Will Bitcoin Price Reach $100K This Month?

The Bitcoin price has been closely consolidating within a tight range for the past weeks following a recovery from the interim lows around $80,000. The price is struggling to clear the resistance zone between $91,600 and $93,500 as it is facing constant bearish pressure. Despite this, the volume remains within the average, suggesting considerable trader participation, regardless of the sluggish behavior of the BTC price.

The weekly price action of BTC reflects the growing momentum of bulls as the rally continues to trade along the rising trend line. This line has been acting as a strong support since 2024, and a rebound from this zone suggests the upcoming rally could be more explosive than before. The weekly MACD is preparing for a bullish crossover, and the weekly RSI has just begun to rise. This indicates there is more room for the bulls to thrive, and hence the upper target for the Bitcoin (BTC) price rally is much ahead than $100,000.

Is Bitcoin (BTC) Price Heading Towards a New ATH?

As seen in the above chart, the price is consolidating within the rising expanding channel and has rebounded from the support. In the previous rebounds, the price has surged towards the resistance. Therefore, the Bitcoin price is believed to rise, but to mark a new ATH, the token is required to clear 2 important resistance zones. After the current one, it needs to surge above the price range between $106,800 and $109,600. A rise above this range may push the levels above $110,000 and later the ATH price levels.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Why Is Crypto Up Today? – January 13, 2026