Internet Computer (ICP) Surges 17% as Trading Volume Triples Ahead of Major Tokenomics Update

Internet Computer posted a 17% gain over 24 hours, climbing to $3.70 as trading volume nearly tripled compared to the previous day.

The token’s daily trading volume reached $186.21 million, up 190% from the prior session, according to data from CoinGecko. ICP ICP $3.53 24h volatility: 12.4% Market cap: $1.93 B Vol. 24h: $220.51 M touched a seven-day high of $3.71 after trading as low as $3.09 earlier in the week. The project, developed by the Swiss nonprofit Dfinity Foundation, currently holds a $2.02 billion market cap.

ICP price 1H | Source: TradingView

Upcoming Tokenomics Announcement

The price movement comes ahead of an anticipated ecosystem announcement. Dfinity founder Dominic Williams confirmed on Jan. 12 that a white paper detailing the Mission70 initiative would be published on Jan. 14. The proposal aims to reduce the rate at which new ICP tokens enter circulation by 70% during 2026.

Technical analysts also pointed to chart patterns as a contributing factor. Analyst @brain2jene observed that the token’s five-day chart displayed a reversal pattern that erased approximately 20 days of prior losses.

On-chain data tracker @icterminal noted that the weekly burn rate, which measures tokens permanently removed from supply, reached 18,728 ICP. This marked the second-highest weekly burn figure since September 2024.

Broader Market Conditions

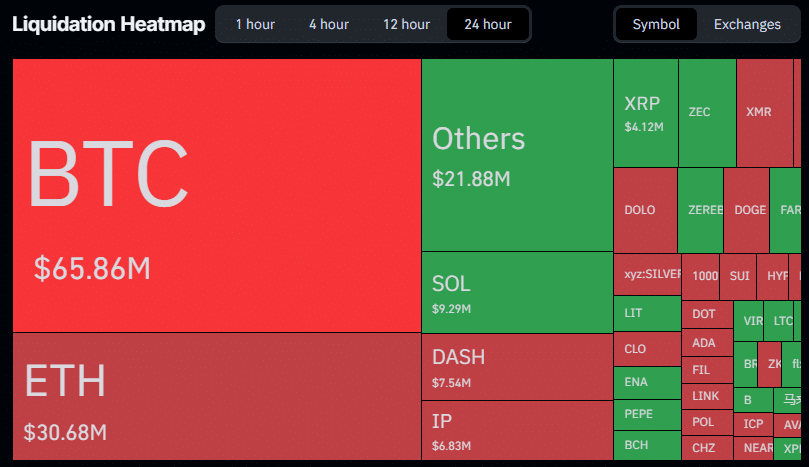

Market-wide data from Coinglass showed $176.55 million in forced position closures over 24 hours, with bearish bets accounting for $104.61 million of that total.

Liquidation Heatmap | Source: Coinglass

The Fear & Greed Index registered 26, indicating fear, down one point from the previous day. The broader crypto market added 1.41% to its total market capitalization, which reached $3.25 trillion. As previously reported by Coinspeaker, the index has remained in fearful territory for an extended period following late December volatility.

ICP falls within the AI and infrastructure categories on CoinGecko. The Dfinity Foundation previously expanded its AI capabilities with the November 2025 launch of its Caffeine application.

nextThe post Internet Computer (ICP) Surges 17% as Trading Volume Triples Ahead of Major Tokenomics Update appeared first on Coinspeaker.

You May Also Like

FCA, crackdown on crypto

Stablecoin rewards provisions face industry test in Senate crypto bill