Ethereum and XRP charts trigger rare buy signals as Remittix captures market interest

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Ethereum and XRP flash rare buy signals as Remittix gains traction and investors rotate toward real utility in 2026.

- Remittix gains traction as its PayFi platform nears launch, offering real crypto-to-bank payments beyond chart signals.

- With $28.8m raised and a live iOS wallet, Remittix moves from promise to product ahead of Feb 9 PayFi launch.

- Remittix targets crypto’s usability gap, enabling fast crypto-to-fiat transfers as investors seek real-world utility.

The crypto market is entering a critical moment. Ethereum and XRP charts are flashing rare technical buy signals, drawing attention from traders watching for the next major move. At the same time, Remittix is gaining serious traction as investors look beyond price charts and toward real-world payment utility.

With market sentiment shifting, capital is starting to rotate toward projects with clearer long-term value. This mix of technical signals and growing interest in PayFi solutions is reshaping how crypto investors view opportunity heading into 2026.

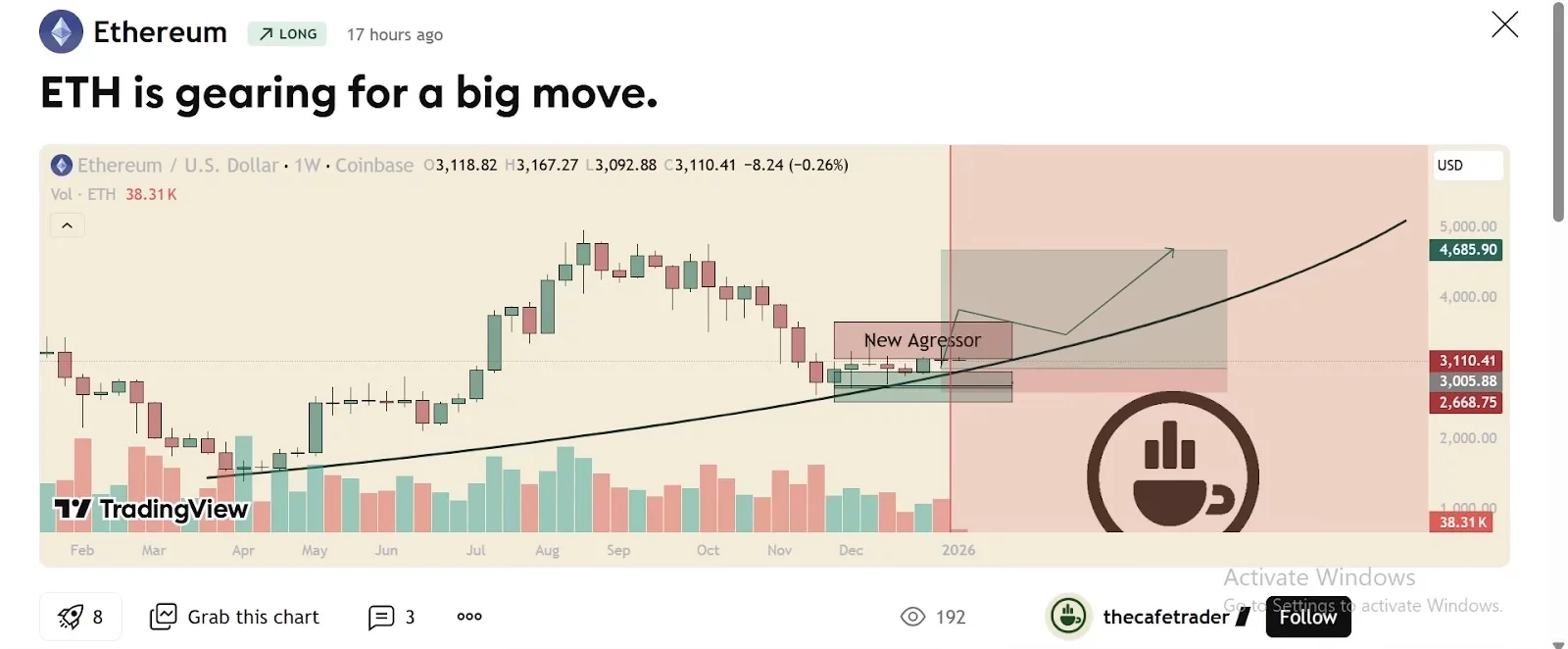

Ethereum gives early signs of a breakout

Over the past two months, Ethereum has been trading flat with a range of approximately between $2600 and $3350. This extended period of consolidation has been frustrating to the traders; however, it has established a strong base. Ethereum is presently priced at around $3,140, and it is well above the major psychological support levels.

Daan Crypto on X tracking Ethereum, notes that the price remains trapped below major resistance near $3,350 and the daily 200 EMA. Until Ethereum clears those levels, the broader trend stays uncertain. Still, some signals are turning constructive. Ether is also moving on an upward trend since its December lows and is still making higher lows on shorter timeframes. The entire interest in Ethereum futures has completely regained its strength since the crash in October, but the price is nowhere near its previous highs. Such a gap implies that traders are placing ahead as opposed to momentum chasing.

Ethereum accumulating positions that are not accompanied by price growth is likely to be followed by a good movement. Once Ethereum breaks above the $3,350 mark and maintains, it may be driven to the $3,800 price. A confirmed move beyond $4,000 would signal a major trend shift and potentially open the door to much higher levels later in the cycle.

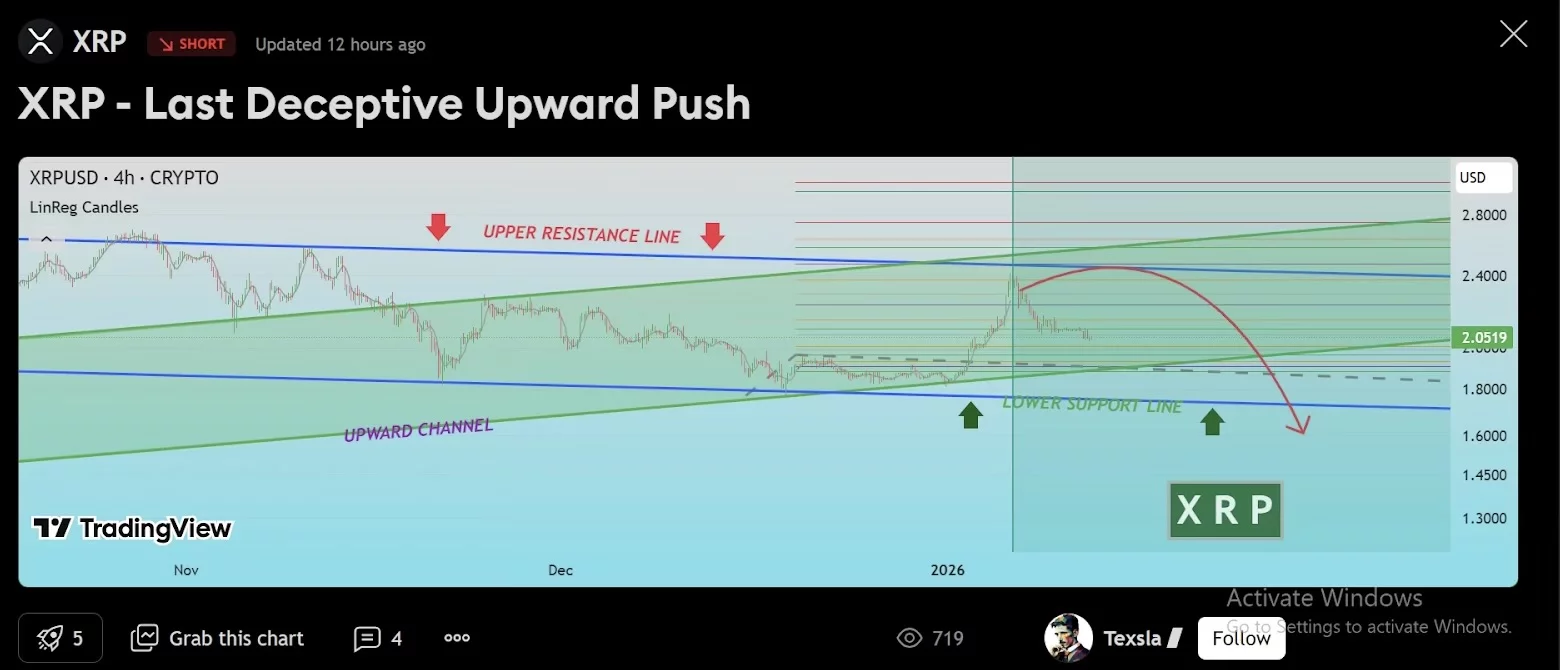

XRP price action signals a possible trend shift

XRP price action has also caught trader attention. After defending the critical $2.00 demand zone, XRP has broken above a long-standing descending trendline. XRP now trades near $2.04 and is consolidating, which is often how strong moves begin. Market analysts describe this structure as an early-stage bullish reversal. Buyers continue to absorb selling pressure near support, while downside attempts have failed to push the price lower. This behavior points to accumulation rather than distribution.

The resistance level at which the XRP price will have the next significant test is 2.41. Breakout of this level would be valid to continue and may change the market mood towards buyers. In case XRP could not regain that point, the crucial zone to hold is $2.00. The bullish argument is backed by momentum indicators. XRP has removed a major technical barrier, and volume behavior suggests traders are positioning rather than exiting. While risks remain, the chart structure has improved meaningfully compared to earlier months.

Remittix gains ground as investors look beyond chart signals

While Ethereum and XRP charts are triggering rare buy signals, many investors are also paying attention to what happens after the charts. This is where Remittix is capturing growing market interest. Instead of relying only on technical setups, Remittix is positioning itself around real-world payments, usability, and timing.

The project has already raised over $28.8 million, showing steady demand even before its main product launch. Its wallet is live on the Apple App Store, with Android support coming soon, giving users a working product today rather than promises. But the key reason attention is building is the confirmed launch of its crypto-to-fiat PayFi platform on February 9, 2026. That launch is expected to move Remittix from a growing ecosystem into an active payment network.

Users will be able to convert crypto into local currency and send funds directly to bank accounts, without needing multiple centralized exchanges or long settlement times. This directly targets one of crypto’s biggest pain points: turning digital assets into something usable in daily life. Only a few tokens are remaining to grab the 200% bonus, using the promo code RTX2026 to secure yours before the phase closes. With this, investors can position early in a project that bridges traditional and digital finance.

Beyond utility, the project has also built strong credibility. It has completed CertiK verification, earned the #1 Pre-Launch ranking on CertiK Skynet, and secured its first centralized exchange listings, with more already confirmed. These steps matter to investors who are becoming more selective as the market matures. As Ethereum and XRP traders watch resistance levels and breakout zones, Remittix is attracting a different type of buyer. These are investors looking for exposure to payments, PayFi, and long-term adoption rather than short-term price moves.

Remittix is focused on solving problems that still slow crypto adoption:

- Slow and expensive cross-border payments that block everyday users

- Confusing off-ramps that force people through multiple platforms

- Limited real-world spending options for crypto holders and small businesses

- Trust gaps that come from weak security and unclear teams

- Low accessibility in regions where banking is limited or costly

Why Ethereum and XRP signals are coinciding with rising interest in Remittix

Ethereum and XRP charts are showing early signs of trend shifts, but confirmation is still needed. During these consolidation phases, capital often rotates toward projects with clearer near-term catalysts and practical use cases. That rotation helps explain why Remittix is gaining attention alongside these technical signals. Ethereum may break higher if resistance gives way. XRP price could continue its recovery if demand holds.

Yet Remittix offers something different: a defined launch date, a live wallet, and a payment platform designed for real users. As the market weighs charts against fundamentals, interest is building around projects that can grow even while majors consolidate.

To learn more about Remittix, visit the website and socials.

FAQs

1. What is the top project on the presale crypto calendar right now?

Many crypto investors point to Remittix as a top presale project due to its live wallet, upcoming PayFi platform, and strong fundraising momentum. Unlike many early-stage tokens, it already shows real product progress ahead of its February 2026 launch.

2. Which trending new ICOs offer real utility in 2026?

Payments and real-world finance projects are drawing interest in payments and real-world finance. Remittix is unique in that it focuses on crypto-to-fiat transfers, cross-border remittances, and everyday usefulness, which are some of the major factors behind long-term crypto adoption outside of hype cycles.

3. Which are the most promising early crypto investor opportunities?

The early chances generally seem at the point of utility and timing. Investors seek projects that have working products, a roadmap, and future launches. Remittix fits this profile as it prepares to roll out its PayFi platform while market interest continues to grow.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push