Elizabeth Warren Urges Regulator to Freeze World Liberty Bank Bid Until Trump Cuts Crypto Ties

US Senator Elizabeth Warren has called on federal banking regulators to pause their review of World Liberty Financial’s application for a national bank charter, arguing that the process should not move forward while President Donald Trump maintains direct financial ties to the crypto platform.

The request raises fresh questions about conflicts of interest at a moment when stablecoins are moving deeper into the US financial system and Washington is debating how far to go in regulating the sector.

Stablecoin Charter Puts OCC in Political Crosshairs, Warren Says

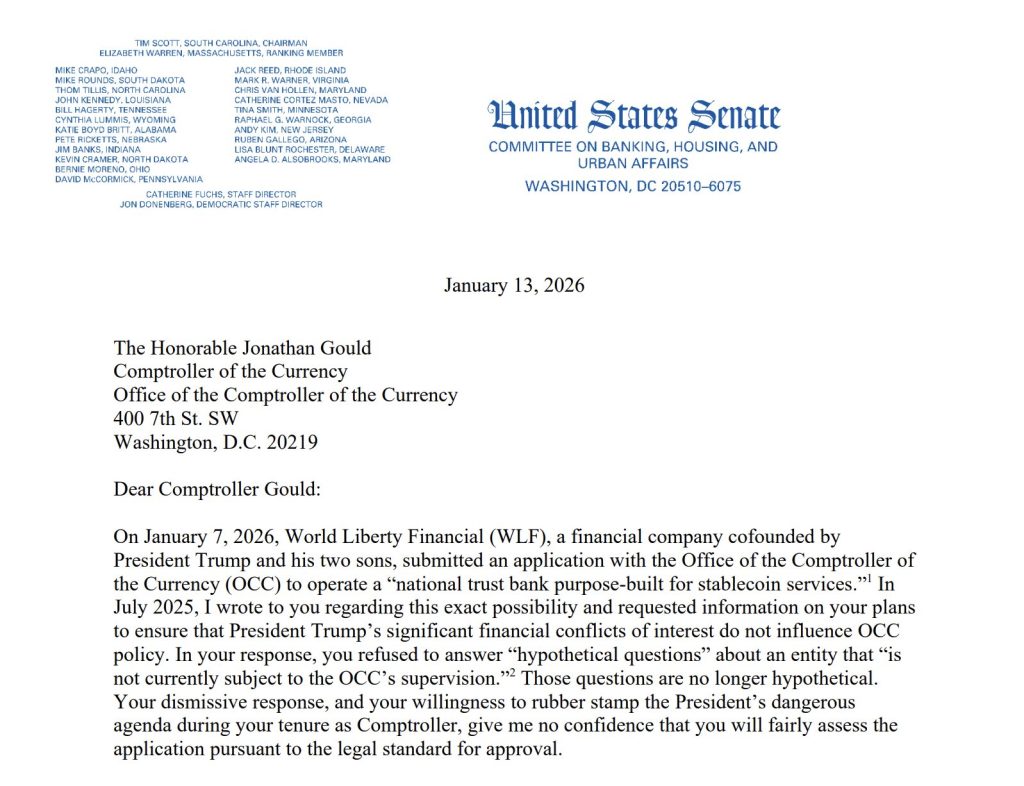

In a letter sent Tuesday to Jonathan Gould, the Comptroller of the Currency, Warren urged the Office of the Comptroller of the Currency to delay consideration of World Liberty Financial’s bid until Trump divests from the company and removes what she described as “real and serious” financial conflicts involving himself and his family.

Source: Banking, Housing, and Urban Affairs

Source: Banking, Housing, and Urban Affairs

Warren, the ranking Democrat on the Senate Banking Committee, said the situation was no longer hypothetical after a World Liberty subsidiary formally applied on January 7, 2026, to operate a national trust bank designed to support stablecoin services.

World Liberty Financial was launched in 2024 and lists Trump and his sons Barron, Eric, and Donald Trump Jr. as co-founders.

The platform has grown quickly, raising more than $550 million through token sales and launching a dollar-backed stablecoin, USD1, in March 2025.

USD1 has since expanded to an estimated $3.4 billion in market value and has been used in high-profile transactions, including a $2 billion Binance investment by a third-party firm using the token.

A World Liberty subsidiary, WLTC Holdings, filed for the charter that would allow it to issue, custody, and convert USD1 directly under federal supervision.

Warren argued that the application places the OCC in an unprecedented position.

Under the National Innovation for US Stablecoins Act, or GENIUS Act, signed into law by Trump in July 2025, the OCC became the primary regulator for federally licensed stablecoin issuers.

That role includes approving charters, writing rules, supervising issuers, and enforcing violations.

Warren said that approving World Liberty’s application would effectively make the president responsible for overseeing a financial company from which he and his family benefit, while the regulator itself serves at the president’s pleasure.

Crypto Policy Debate Intensifies as Trump Family Ventures Expand

In a public report cited in Warren’s letter, Trump and his family have earned more than $1 billion from World Liberty Financial and other crypto ventures.

Beyond World Liberty, the Trump family controls entities tied to an official Trump-branded meme coin launched on Solana in early 2025, several NFT collections that have generated millions in licensing revenue, and a Bitcoin mining company established by Trump’s sons last year.

These ventures mark a sharp shift from Trump’s earlier skepticism of digital assets and have been accompanied by a policy agenda that has rolled back enforcement actions and positioned the US as a global crypto hub.

The charter filing comes as regulators have shown greater willingness to bring crypto firms under bank-style oversight.

In December, the OCC approved national trust bank charters for several digital asset companies, including BitGo, Circle, Paxos, Ripple, and others.

Trust banks cannot take deposits or make loans, but they can provide custody and settlement services, making them an attractive structure for stablecoin issuers seeking tighter integration with the traditional financial system.

Warren’s push also lands amid broader legislative friction. There are many efforts going on in Congress, including the Stop TRUMP in Crypto Act and the End Crypto Corruption Act, that aim to restrict elected officials and their families from owning or profiting from digital assets, but none have advanced into law.

You May Also Like

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future

SEC approves new listing standards paving way for crypto ETFs on Nasdaq, Cboe, and NYSE