Spot ETF Flows Fuel Bitcoin Rally as Price Targets $100K

This article was first published by The Bit Journal.

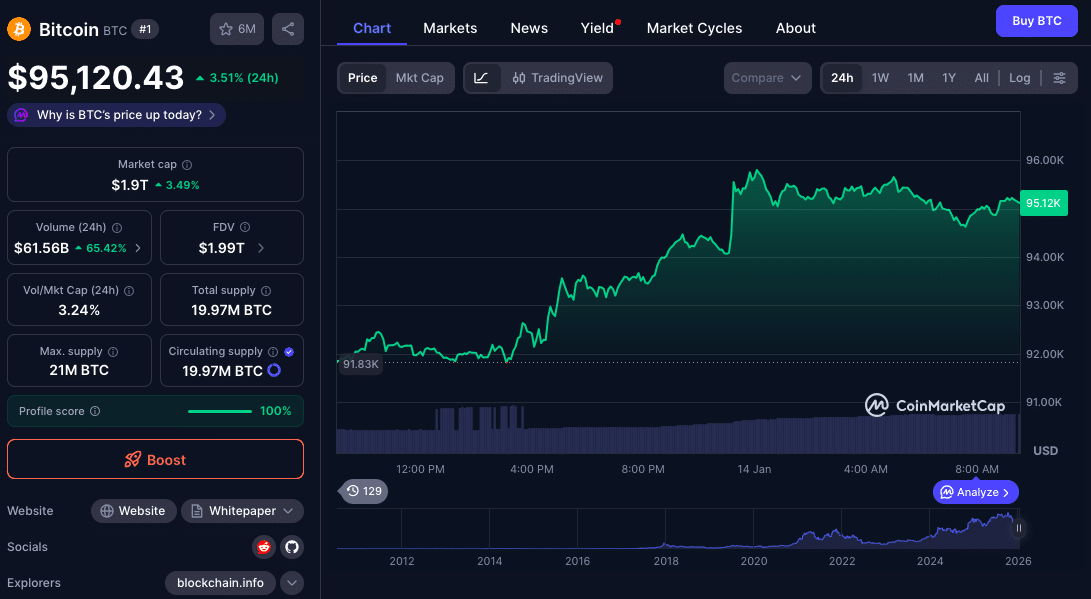

Bitcoin has surged above the $95,000 price level, driven by spot flows rather than derivatives gearing for a potential sprint toward the $100,000 level.

Data from CoinGlass shows more than $269.21 million in BTC short positions were liquidated as the asset overcame resistance, with sentiment measures sitting firmly bearish despite rising price levels.

Analysts have attributed the surge to real demand in the spot market where investors buy the asset itself, creating renewed optimism throughout trading desks and prediction markets.

Spot Flows Power BTC’s Move Above Key Levels

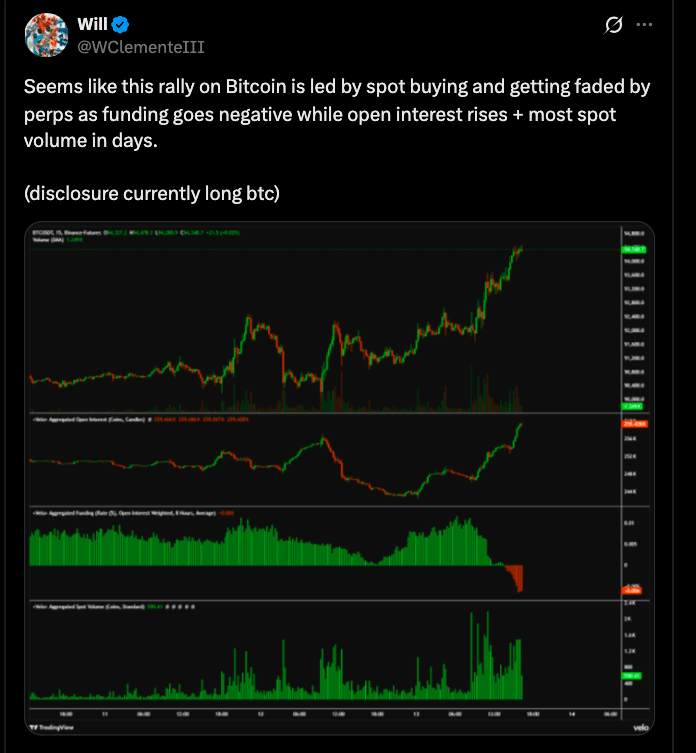

Bitcoin price rally above $95,000 is important because it suggests that fundamental demand and not leveraged bets are driving prices higher. Speaking on the rally, crypto analyst Will Clemente pointed out that it “seems like this rally on Bitcoin is led by spot buying,” suggesting that capital is coming in through direct purchases of Bitcoin on spot markets rather than futures or options.

Bitcoin Price Rally Led by Spot Flows Puts $100K in Sight

Bitcoin Price Rally Led by Spot Flows Puts $100K in Sight

This is important because spot buying implies real accumulation, unlike derivative-led moves that boost prices without generating demand.

Short sellers have been caught offside with a reported $269.21 million worth of Bitcoin shorts being liquidated within 24 hours.

Liquidations happen when leveraged positions get forcefully closed out as prices move higher, and can fuel upside moves. This has helped Bitcoin push above a few resistances in the $94,500-$95,000 region.

Analysts Predict Move Toward $100,000

Market observers have noted how strong the current positioning is.

According to Michaël van de Poppe of MN Trading Capital, he shared in a public post that it is “quite clear that this is going to run to $100K in the coming week and that dips are for buying”, framing recent price action as structurally supportive of more upside. Bitcoin last failed to sustain a break above $100,000 in November 2025.

Crypto prediction markets have also shown short-term optimism. Looking at Polymarket’s pricing, Bitcoin has a 51% chance of exceeding $100,000 by February 1, 2026 and slightly smaller odds of trading higher to as high as $105,000.

This bet balance indicates that traders believe the current momentum will sustain long enough to retest six-figure territory once again.

Some historical seasonal trends help anchor this analysis. In general, January is a lackluster month for Bitcoin returns with an average return of about 4.18%, whereas February has typically offered better average monthly returns. This seasonal bias is one more added dimension to participants’ outlook for the extension of price movement.

Bitcoin Price Rally Led by Spot Flows Puts $100K in Sight

Bitcoin Price Rally Led by Spot Flows Puts $100K in Sight

Sentiment Muted As Price Pumps Out

Although prices are up, broader sentiment measures remain tentative. The Crypto Fear & Greed Index, which is closely watched as an indicator of investor sentiment, has bounced between “fear” and “extreme fear” in recent weeks, and readings remain below-average based on a longer-term outlook.

Santiment noted that if Bitcoin starts to “tease $100K,” it could cause a “retail FOMO” could be triggered, indicating that market involvement may occur only when the asset gets close to this level.

Santiment’s report encapsulates an ongoing tension in the market as price rallies amid underwhelming investor sentiment.

This trend has existed since last year’s market-led liquidation event in October 2025, when over $19 billion in leveraged positions were destroyed.

The fear reading at 27 shows traders remain cautious even as spot flows see prices higher.

Interest and Market Structure in 2026

Unlike futures-driven rallies that can snap back quickly when leverage is unwound, spot-led movements are driven by investors who end up owning the investment. Recent reports also show fresh inflows into Bitcoin investment products, including exchange-traded products (ETPs), which have absorbed a lot of capital following seasonal liquidity patterns being relieved.

The drive is more institutional and as yet not fully formed but can be seen through these vehicles and demand dynamics writ large. Trading volumes surged in January following some of the lowest seasonal levels on record, suggesting a more widespread appetite beyond short-term speculation.

Conclusion

Bitcoin’s recent ascent above $95,000 tells of a switch in market behavior

The accumulation in spot markets, a large number of strong short squeezes, as well as increasing odds in prediction markets suggest that the market might experience further upwards momentum soon.

Although sentiment indicators are in the cautious territory, analysts and traders now draw attention to spot demand as a more durable source of price action than leveraged moves.

Whether Bitcoin goes to the six figures and beyond will be determined by continued spot buying and participation across investor segments.

Glossary

Spot flows: Money flowing into the actual, physical or underlying Bitcoin purchase rather than through vehicles like futures or options.

Short liquidation: The forced closure of short positions as prices increase, leading to additional upward price pressure.

Prediction markets: sites where traders bet on future prices, which generally represent market sentiment and probabilities.

Crypto Fear & Greed Index: A sentiment indicator that calculates an index from 0 to 100 based on investors’ emotions and market trends, with 0 representing “extreme fear” and 100 representing “extreme greed.”

Frequently Asked Questions About Bitcoin Price Rally

What’s behind latest Bitcoin price rally?

Bitcoin’s recent break toward $95,000 has been led by spot buying, suggesting direct accumulation of the asset rather than price moves purely derivative-driven.

Which analysts support this Bitcoin price rally?

Analysts such as Will Clemente and Michaël van de Poppe have noted that the current rally seems to be driven by spot flows; arguing that dips could turn into buying opportunities.

Has Bitcoin surpassed $100,000 yet?

As of mid-January 2026; Bitcoin has not reclaimed $100,000 after breaking below it in November 2025, though recent price action has raised the odds of doing so.

Why are short liquidations relevant to this?

Big short liquidations topping $269 million suggest that bears were forced to cut loose as prices climbed, amplifying the upward thrust of the rally.

Are sentiment indicators bullish?

Sentiment remains cautious. According to the Crypto Fear & Greed Index, market still has not completely transformed into optimistic territory.

References

Coinglass

Santiment

PolyMarket

Will Clemente

Read More: Spot ETF Flows Fuel Bitcoin Rally as Price Targets $100K">Spot ETF Flows Fuel Bitcoin Rally as Price Targets $100K

You May Also Like

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058

‘Primal’ Creator Genndy Tartakovsky Talks Zombified Season 3