Grant Cardone Bets on Bitcoin Real Estate as Trump Plots Housing Shakeup — What To Expect

Grant Cardone is expanding his push into a strategy that links Bitcoin with income-generating real estate, positioning the approach as the U.S. housing market faces growing political and regulatory uncertainty amid President Donald Trump’s renewed emphasis on affordability.

The real estate investor and entrepreneur laid out the strategy in a recent Fox Business interview, describing plans to combine large apartment complexes with Bitcoin holdings, tokenize ownership, and ultimately take the structure public as a single tradable vehicle.

How Cardone Is Turning Apartment Cash Flow Into Bitcoin Exposure

Cardone said the strategy combines two contrasting assets to balance risk and return.

On one side is multifamily housing, which provides steady cash flow through rental income and is viewed by lenders as low risk, while Bitcoin offers liquidity but comes with price volatility.

By linking the two, Cardone said rental proceeds are gradually used to buy Bitcoin, creating a structure that generates predictable income while steadily building exposure to the digital asset over time.

In the interview, Cardone said his firm is already executing the model at scale. He cited a $366 million multifamily project acquired out of bankruptcy from Blackstone, explaining that such assets could be tokenized into hundreds of millions of units, allowing investors to participate with as little as one dollar.

Cardone noted that tokenization removes geographic and capital barriers that typically limit access to large real estate deals, opening participation to investors outside the United States or those without six-figure minimums.

The strategy is not theoretical, as Cardone Capital already manages more than 14,000 apartment units across the U.S. and roughly $5.1 billion in assets and has been steadily adding Bitcoin to its balance sheet.

In June 2025, the firm disclosed the purchase of 1,000 BTC worth just over $100 million at the time.

By August, it added another 130 BTC as part of a refinancing deal tied to its Miami River property, opting to raise equity and secure debt at a 4.89% rate rather than buy interest rate caps.

The firm has said it is targeting up to 4,000 BTC, which would place it among the largest non-mining corporate holders.

Cardone’s Bitcoin-Property Model Emerges Amid U.S. Housing Policy Changes

Cardone has framed the approach as different from pure Bitcoin treasury companies, which typically rely on issuing debt or equity to accumulate crypto without an operating business underneath.

In contrast, he argues that housing generates recurring cash flow regardless of market cycles.

In November, Cardone said one newly launched 366-unit property paired with $100 million in Bitcoin could produce roughly $10 million in annual net operating income, funds he plans to reinvest into additional BTC purchases.

The timing of Cardone’s push comes as housing policy moves back to the center of U.S. politics.

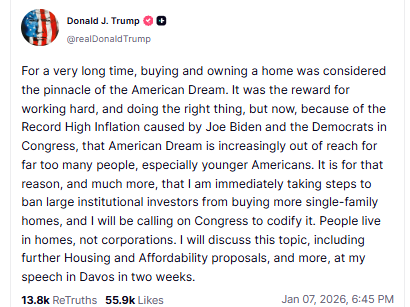

On January 7, President Trump said he would move to block large institutional investors from buying more single-family homes, arguing that corporate ownership has priced Americans out of homeownership.

Source: Truth Socials

Source: Truth Socials

Trump also said more details would be unveiled at the World Economic Forum in Davos.

The administration has pushed to lower borrowing costs, with mortgage rates falling to about 6% in early January after Trump said Fannie Mae and Freddie Mac were directed to buy $200 billion in mortgage bonds.

Rates are at their lowest since late 2022, helping lift existing home sales for a fourth straight month, even as prices remain high.

Cardone told Fox Business that his team has been in discussions with policymakers about loosening housing constraints, including expanding capital gains exemptions on home sales and extending bonus depreciation rules.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Unleashing A New Era Of Seller Empowerment